Reebok 2013 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

199

2013

Notes

/

04.8

/

Impairment losses

If facts and circumstances indicate that non-current assets (e.g. property, plant and equipment, intangible assets

including goodwill and certain financial assets) might be impaired, the recoverable amount is determined. It is

measured at the higher of its fair value less costs to sell and value in use. An impairment loss is recognised

in other operating expenses or reported separately if the carrying amount exceeds the recoverable amount. If

there is an impairment loss for a cash-generating unit, first the carrying amount of any goodwill allocated to

the cash-generating unit is reduced, and subsequently, provided that the recoverable amount is lower than the

carrying amount, the other non-current assets of the unit are reduced pro rata on the basis of the carrying amount

of each asset in the unit.

Irrespective of whether there is an impairment indication, intangible assets with an indefinite useful life and

goodwill acquired in business combinations are tested annually for impairment.

An impairment loss recognised in goodwill is not reversible. With respect to all other impaired assets, an

impairment loss recognised in prior periods is reversed affecting the income statement if there has been a change

in the estimates used to determine the recoverable amount. An impairment loss is reversed only to the extent

that the asset’s carrying amount does not exceed the carrying amount that would have been determined (net of

depreciation or amortisation) if no impairment loss had been recognised.

Leases

Under finance lease arrangements, the substantial risks and rewards associated with an asset are transferred

to the lessee. At the beginning of the lease arrangement, the respective asset and a corresponding liability are

recognised at the fair value of the asset or, if lower, the net present value of the minimum lease payments.

For subsequent measurement, minimum lease payments are apportioned between the finance expense and the

reduction of the outstanding liability. The finance expense is allocated to each period during the lease term so as

to produce a constant periodic interest rate on the remaining balance of the liability. In addition, depreciation and

any impairment losses for the associated assets are recognised. Depreciation is performed over the lease term

or, if shorter, over the useful life of the asset.

Under operating lease agreements, rent expenses are recognised on a straight-line basis over the term of

the lease.

Intangible assets (except goodwill)

Intangible assets are valued at amortised cost less accumulated amortisation (except for assets with indefinite

useful lives) and impairment losses. Amortisation is calculated on a straight-line basis taking into account any

potential residual value.

Expenditures during the development phase of internally generated intangible assets are capitalised as

incurred if they qualify for recognition under IAS 38 “Intangible Assets”.

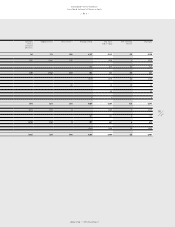

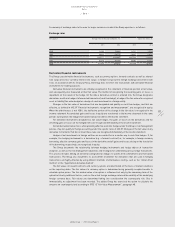

Estimated useful lives are as follows:

Estimated useful lives of intangible assets

Years

Trademarks indefinite

Software 5 – 7

Patents, trademarks and concessions 5 – 15

The adidas Group determined that there was no impairment necessary for any of its trademarks with indefinite

useful lives in the years ending December 31, 2013 and 2012. In addition, an increase in the discount rate of up to

approximately 1.5% or a reduction of cash inflows of up to approximately 20% would not result in any impairment

requirement.