Reebok 2013 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

217

2013

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

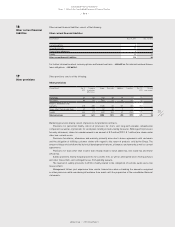

All equities and bonds are traded freely and have a quoted market price in an active market. The other assets

consist predominantly of foreign insurance products.

At each balance sheet date, the company analyses the over- or underfunding and, where appropriate, adjusts

the composition of plan assets.

In the next financial year, the adidas Group intends to transfer assets to a trustee via a Contractual Trust

Arrangement (CTA) for the purpose of fiduciary management and insolvency insurance with regard to part of

the pension obligations of adidas AG. In this respect, the registered association “adidas Pension Trust e.V.” was

established in December 2013.

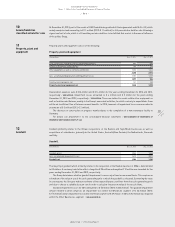

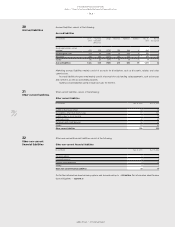

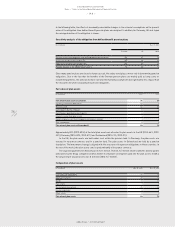

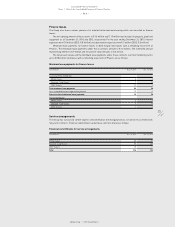

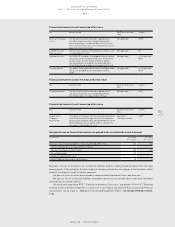

Other non-current liabilities consist of the following:

Other non-current liabilities

(€ in millions) Dec. 31, 2013 Dec. 31, 2012

Liabilities due to personnel 7 9

Deferred income 22 23

Sundry 0 2

Other non-current liabilities 29 34

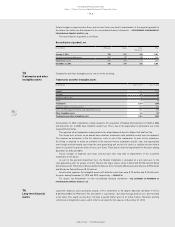

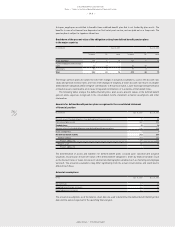

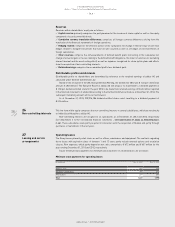

The nominal capital of adidas AG (“the company”) has remained unchanged since December 31, 2012. As at the

balance sheet date, and in the period beyond, up to and including February 14, 2014, it amounted to € 209,216,186

divided into 209,216,186 registered no-par-value shares (“registered shares”) and is fully paid in.

Each share grants one vote and is entitled to dividends starting from the beginning of the year it was issued.

Treasury shares held directly or indirectly are not entitled to dividend payment in accordance with § 71b German

Stock Corporation Act (Aktiengesetz – AktG). Neither at the balance sheet date nor at February 14, 2014 does the

company hold any treasury shares.

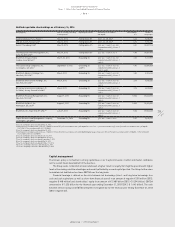

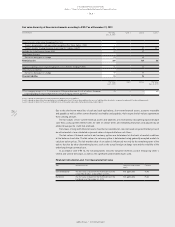

Authorised Capital

The Executive Board of adidas AG did not utilise the existing amounts of authorised capital of up to € 95 million

in the 2013 financial year or in the period beyond the balance sheet date up to and including February 14, 2014.

The following overview of the existing amounts of authorised capital does not contain the cancellation of the

Authorised Capital 2009/I, 2010 and 2011, resolved by the Annual General Meeting on May 8, 2013, which had also

not been made use of up to May 8, 2013.

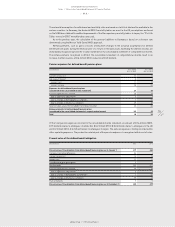

The authorised capital of the company, which is set out in § 4 sections 2, 3 and 4 of the Articles of Association

as at the balance sheet date, entitles the Executive Board, subject to Supervisory Board approval, to increase the

nominal capital

until June 30, 2018

/

by issuing new shares against contributions in cash once or several times by no more than € 50 million and,

subject to Supervisory Board approval, to exclude residual amounts from shareholders’ subscription rights

(Authorised Capital 2013/I);

until June 30, 2016

/

by issuing new shares against contributions in kind once or several times by no more than € 25 million and,

subject to Supervisory Board approval, to exclude shareholders’ subscription rights (Authorised Capital 2013/II);

until June 30, 2018

/

by issuing new shares against contributions in cash once or several times by no more than € 20 million and,

subject to Supervisory Board approval, to exclude residual amounts from shareholders’ subscription rights and to

exclude shareholders’ subscription rights when issuing the new shares at a value not essentially below the stock

market price of shares with the same features; this exclusion of subscription rights can also be associated with

the listing of the company’s shares on a foreign stock exchange (Authorised Capital 2013/III). The authorisation to

exclude subscription rights pursuant to the previous sentence may, however, only be used to the extent that the

pro-rata amount of the new shares in the nominal capital together with the pro-rata amount in the nominal capital

of other shares which have been issued by the company since May 8, 2013, subject to the exclusion of subscription

rights pursuant to or in accordance with § 186 section 3 sentence 4 AktG on the basis of an authorised capital or

following a repurchase, or for which conversion or subscription rights or conversion or subscription obligations

were granted after May 8, 2013, through the issuance of convertible bonds and/or bonds with warrants, with

24

Other non-current

liabilities

25

Shareholders’ equity