Reebok 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

120

2013

Internal Group Management System

/

03.1

/

02

/

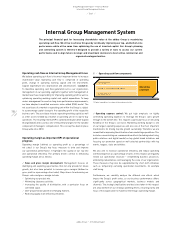

Key financial metrics

1) Excluding acquisitions and finance leases.

conducted its second global Employee Engagement Survey, gathering

responses from over 40,000 employees. This represents a participation

rate of 85%

/

SEE EMPLOYEES, P. 105.

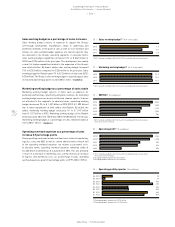

Sustainability performance: We have a strong commitment to enhance

the social and environmental performance of our Group. By doing so, we

firmly believe we will not only improve the Group’s overall reputation,

but also increase our economic value. We have therefore implemented

a comprehensive sustainability programme

/

SEE SUSTAINABILITY, P. 111

under which we regularly review our performance. We closely monitor

our 2015 sustainability targets and have set ourselves clear milestones

for each year. A key focus lies on monitoring and rating our factories

with regard to compliance with our Workplace Standards and rating

the effectiveness of compliance systems. A KPI rating tool helps

us evaluate six fundamental elements of social compliance. The

results of these ratings are an important non-financial KPI for our

Group

/

SEE SUSTAINABILITY, P. 111. We have a strong track record in

sustainability reporting, with our Sustainability Progress Report being

an integral part of this. All our social and environmental publications,

which include more details and additional data, are provided on our

corporate website at :

//

WWW.ADIDAS-GROUP.COM/EN/SUSTAINABILITY/

REPORTING-POLICIES-AND-DATA/SUSTAINABILITY-REPORTS.

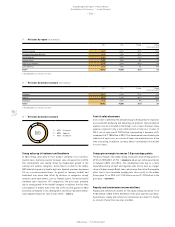

Gross margin Gross profit

= × 100

Net sales

Operating margin Operating profit

= × 100

Net sales

Average operating

working capital

Sum of operating working

capital at quarter-end

=

4

Operating working capital

in % of net sales

Average operating

working capital

= × 100

Net sales

Capital expenditure 1) = Additions of property, plant and

equipment plus intangible assets

Net cash/Net borrowings =

Cash and cash equivalents

+ short-term financial assets

– short-term borrowings

– long-term borrowings

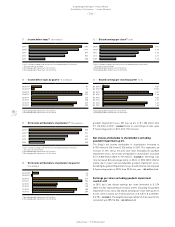

Non-financial key performance indicators (KPIs)

In addition to the Group’s financial KPIs to assess the current

performance and operational success of the adidas Group, we have

identified a set of non-financial KPIs that help us track our progress

in areas that are critical for our long-term success but are, however,

not directly reflected in the Group’s financial statements. These

non-financial KPIs are assessed on a regular basis and managed by the

respective Group functions. Key non-financial KPIs include market share

and consumer insight tracking, our customer delivery performance

(On-Time In-Full), our employee engagement and a set of KPIs in the

area of our sustainability performance.

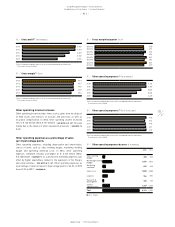

Market share: Maintaining and enhancing brand image and reputation

through the creation of strong brand identities is crucial for sustaining

and driving revenue and profit growth. It is also an important credential

as we extend our brands into new categories and regions. Therefore,

mainly on a market and category level, we invest in primary qualitative

and quantitative research such as trend scouting, consumer surveys and

market share data to determine brand and category strength. Measures

that are regularly tracked include market shares, brand awareness,

likeability and purchase intent. These efforts are supported by global

market research and consumer insight teams

/

SEE MANAGEMENT

ASSESSMENT OF PERFORMANCE, RISKS AND OPPORTUNITIES, AND OUTLOOK, P. 180.

Backlogs and sell-through data: To manage demand planning and

anticipate our future performance, backlogs comprising orders received

up to nine months in advance of the actual sale are used as a key

indicator. However, due to the growing share of own retail in our business

mix as well as fluctuating order patterns among our wholesale partners,

our order books are less indicative of anticipated revenues compared

to the past. Therefore, qualitative feedback from our retail partners on

the sell-through success of our collections at the point of sale as well

as data received from our own-retail activities are becoming even more

important

/

SEE SUBSEQUENT EVENTS AND OUTLOOK, P. 151.

On-Time In-Full (OTIF): “On-Time In-Full” (OTIF) measures the adidas

Group delivery performance towards customers (Wholesale) and our

own-retail stores. Managed by our Global Operations function, OTIF

assesses to what degree customers received what they ordered and if

they received it on time. It helps our Group to investigate improvement

potential in the area of order book management and logistics processes.

It therefore also helps us to improve our delivery performance, which

is a major aspect when it comes to customer satisfaction. The OTIF

assessment covers both the adidas and Reebok brands for our two

biggest channels, Wholesale and Retail, in most of our key markets

/

SEE

GLOBAL OPERATIONS, P. 94.

Employee engagement: The adidas Group regularly carries out

employee engagement surveys to measure the level of engagement and

motivation of all our employees. The survey aims to provide key insight

into how well as a company and as leaders we are doing in engaging

our employees. It thus enables us to develop the right focus and future

people strategies across our organisation. In 2013, the adidas Group