Reebok 2013 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

204

2013

Notes

/

04.8

/

Effective March 30, 2012, adidas AG acquired the remaining 10% share in its German subsidiary GEV

Grundstücksgesellschaft Herzogenaurach mbH & Co. KG, which was formerly reported as a non-controlling

interest in other liabilities in compliance with IAS 32 “Financial Instruments: Presentation”

/

SEE NOTE 26. The

purchase price of € 7 million was paid at the beginning of April 2012.

Effective June 1, 2012, Taylor Made Golf Co., Inc. completed the acquisition of Adams Golf, Inc. (“Adams Golf”).

Based in Plano, Texas (USA), Adams Golf designs, assembles and distributes golf clubs. With this acquisition, the

adidas Group intends to further improve its market position within the golf industry. The entire business of Adams

Golf was purchased for a purchase price of US $ 89 million in cash.

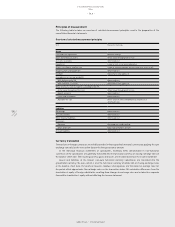

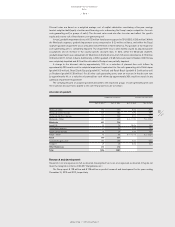

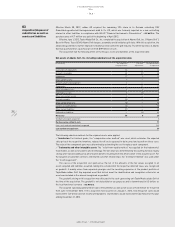

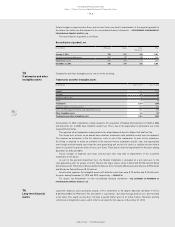

The acquisition had the following effect on the Group’s assets and liabilities at the acquisition date:

Net assets of Adams Golf, Inc. including subsidiaries at the acquisition date

(€ in millions) Pre-acquisition

carrying amounts

Fair value

adjustments

Recognised values

on acquisition

Cash and cash equivalents 14 — 14

Accounts receivable 28 (0) 28

Inventories 17 2 19

Other current assets 0 — 0

Property, plant and equipment 1 — 1

Trademarks — 11 11

Other intangible assets 1 3 4

Deferred tax assets 9 (2) 7

Other non-current assets 0 — 0

Accounts payable (5) — (5)

Other current provisions (4) — (4)

Current accrued liabilities (3) — (3)

Other current liabilities (0) — (0)

Deferred tax liabilities — (6) (6)

Net assets 58 8 66

Goodwill arising on acquisition 5

Purchase price settled in cash 71

Less: cash and cash equivalents acquired (14)

Cash outflow on acquisition 57

The following valuation methods for the acquired assets were applied:

/

Inventories: For finished goods, the “comparative sales method” was used, which estimates the expected

sales price of the respective inventory, reduced for all costs expected to be incurred and a profit on those costs.

The value of the component parts was determined by estimating the cost to replace each component.

/

Trademarks and other intangible assets: The “relief-from-royalty method” was applied for the trademarks/

trade names as well as for patents and technology. The fair value was determined by discounting notional royalty

savings after tax and adding a tax amortisation benefit, resulting from the amortisation of the acquired asset. For

the valuation of customer contracts and related customer relationships, the “distributor method” was used under

the “income approach”.

The excess of the acquisition cost paid versus the net of the amounts of the fair values assigned to all

assets acquired and liabilities assumed, taking into consideration the respective deferred taxes, was recognised

as goodwill. It mainly arises from expected synergies and the resulting expansion of the product portfolio of

TaylorMade-adidas Golf. Any acquired asset that did not meet the identification and recognition criteria for an

asset was included in the amount recognised as goodwill.

The goodwill arising on this acquisition was allocated to the cash-generating unit TaylorMade-adidas Golf at

the time of the acquisition. The goodwill is not deductible for tax purposes and is denominated in US dollars as

the local functional currency

/

SEE NOTE 02.

The acquired subsidiary generated net sales of € 33 million as well as net losses of € 22 million for the period

from June to December 2012. If this acquisition had occurred on January 1, 2012, total Group net sales would

have been € 14.9 billion and net income attributable to shareholders would have been € 534 million for the year

ending December 31, 2012.

03

Acquisition/disposal of

subsidiaries as well as

assets and liabilities