Reebok 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

To Our Shareholders

62

2013

/

01.10

/

Our Share

07

/

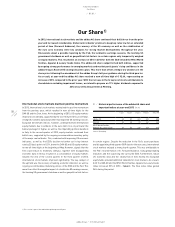

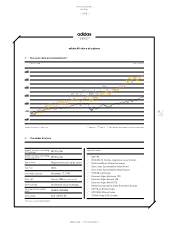

Recommendation split 1)

1) At year-end 2013. Source: Bloomberg.

2013 1

/

74% Buy

2

/

19% Hold

3

/

7% Sell

1

2

3

06

/

Shareholder structure 1)

1) As of February 2014.

2013

1

/

37% Rest of Europe

2

/

32% North America

3

/

14% Other, undisclosed holdings

4

/

10% Germany

5

/

5% Rest of the world

6

/

2% Management

6

5

1

2

3

4

Dividend proposal of € 1.50 per share

The adidas AG Executive and Supervisory Boards will recommend

paying a dividend of € 1.50 to shareholders at the Annual General

Meeting (AGM) on May 8, 2014 (2012: € 1.35). Subject to the meeting’s

approval, the dividend will be paid on May 9, 2014. This represents an

increase of 11% compared to an increase of net income attributable to

shareholders, excluding goodwill impairment losses, of 6%. The total

payout of € 314 million (2012: € 282 million) reflects a payout ratio of

37.4% of net income attributable to shareholders, excluding goodwill

impairment losses, versus 35.7% in the prior year

/

TABLE 08. This is in

line with our dividend policy, where we intend to pay out between 20%

and 40% of net income attributable to shareholders.

Strong international investor base

Based on our share register, we estimate that adidas AG currently has

around 60,000 shareholders. In our latest ownership analysis conducted

in February 2014, we identified around 94% of our shares outstanding.

Shareholdings in the North American market account for 32% of our total

shares outstanding. Identified German institutional investors hold 10%

of shares outstanding. The shareholdings in the rest of Europe excluding

Germany amount to 37%, while 5% of institutional shareholders were

identified in other regions of the world. adidas Group Management,

which comprises current members of the Executive and Supervisory

Boards, holds less than 2% in total

/

SEE CORPORATE GOVERNANCE REPORT

INCLUDING THE DECLARATION ON CORPORATE GOVERNANCE, P. 48. Undisclosed

holdings, which also include private investors, account for the remaining

14%

/

DIAGRAM 06.

Voting rights notifications published

In 2013, adidas AG published 31 voting rights notifications in accordance

with §§ 21 section 1, 25 section 1 and 25a of the German Securities Trading

Act (Wertpapierhandelsgesetz – WpHG). All voting rights notifications

received in 2013 and thereafter can be viewed on our corporate website

:

//

WWW.ADIDAS-GROUP.COM/VOTING_RIGHTS_NOTIFICATIONS. Information on

reportable shareholdings that currently exceed or fall below a certain

threshold can also be found in the Notes section of this Annual

Report

/

SEE NOTE 25, P. 217.

adidas AG share again receives strong analyst support

The adidas Group and the adidas AG share continued to receive strong

analyst support in 2013. Around 45 analysts from investment banks and

brokerage firms regularly published research reports on our Group. The

vast majority of analysts are confident about the medium- and long-term

potential of the Group. This is reflected in the recommendation split for

our share as at December 31, 2013. 74% of analysts recommended

investors to “buy” our share in their last publication during the

twelve-month period (2012: 60%). 19% advised to “hold” our share

(2012: 30%). 7% of the analysts recommended to “sell” our share

(2012: 10%)

/

DIAGRAM 07.

Successful Investor Relations activities

adidas AG strives to maintain close contact to institutional and private

shareholders as well as analysts. In 2013, Management and the

Investor Relations team spent around 28 days on roadshows and also

spent 19 days presenting at 13 national and international conferences.

Furthermore, in order to provide an update on our Route 2015 strategic

business plan, we hosted an Investor Field Trip in Herzogenaurach from

December 2 to 3, 2013. The event was attended by more than 50 investors

and representatives of the financial community. Our efforts to deliver

best-in-class services to our investors and analysts were again highly

acknowledged in 2013. In June, the adidas Group won the prestigious

IR Magazine Award in the Personal Care & Household/Luxury Goods

sector. In addition, in an investor relations survey conducted by Thomson

Reuters, the adidas Group was ranked second again by buy-side analysts

in the sector Consumer/Luxury Goods.

In August 2013, the adidas Group 2012 Annual Report “Pushing

Boundaries” ranked second among the German DAX-30 companies

for the prestigious “Best Annual Report 2013” award granted by the

German business magazine “manager magazin”. The prize is awarded

by a jury which reviews 160 annual reports from across Germany’s most

important stock indices, the DAX-30, MDAX, SDAX and TecDAX. After

winning this title in 2007 and 2012, and coming narrowly second in 2011,

this is the fourth time the adidas Group has ranked among the top two.