Reebok 2013 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

207

2013

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

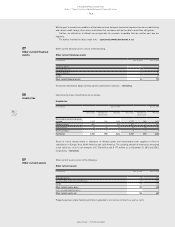

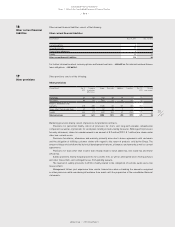

At December 31, 2013, part of the assets of GEV Grundstücksgesellschaft Herzogenaurach mbH & Co. KG, which

mainly comprise land amounting to € 11 million (2012: € 11 million), is still presented as held for sale following a

signed contract of sale, which is still awaiting certain conditions to be fulfilled that are not in the area of influence

of the adidas Group.

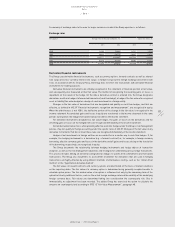

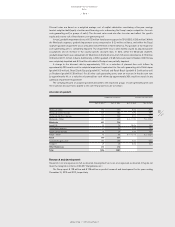

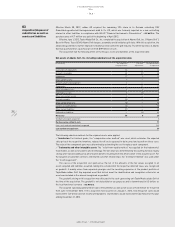

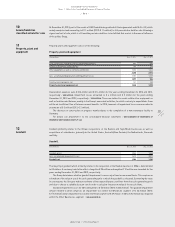

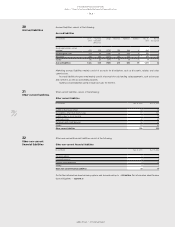

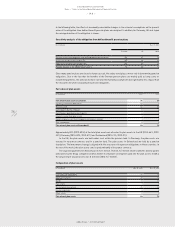

Property, plant and equipment consist of the following:

Property, plant and equipment

(€ in millions) Dec. 31, 2013 Dec. 31, 2012

Land, land leases, buildings and leasehold improvements 802 670

Technical equipment and machinery 254 199

Other equipment as well as furniture and fixtures 1,202 1,204

2,258 2,073

Less: accumulated depreciation and impairment losses 1,181 1,167

1,077 906

Construction in progress, net 161 189

Property, plant and equipment, net 1,238 1,095

Depreciation expenses were € 234 million and € 214 million for the years ending December 31, 2013 and 2012,

respectively

/

SEE NOTE 30. Impairment losses amounted to € 4 million and € 5 million for the years ending

December 31, 2013 and 2012, respectively

/

SEE NOTE 30. These are related to assets within other equipment as

well as furniture and fixtures, mainly in the Group’s own-retail activities, for which contrary to expectations there

will be an insufficient flow of future economic benefits. In 2013, reversals of impairment losses were recorded in

an amount of € 2 million (2012: € 2 million).

The decrease in construction in progress mainly relates to the completion of a new warehouse facility in

Germany.

For details see Attachment I to the consolidated financial statements

/

SEE STATEMENT OF MOVEMENTS OF

INTANGIBLE AND TANGIBLE ASSETS, P. 238.

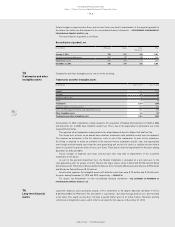

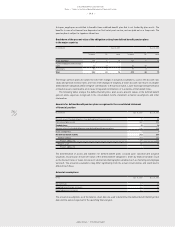

Goodwill primarily relates to the Group’s acquisitions of the Reebok and TaylorMade businesses as well as

acquisitions of subsidiaries, primarily in the United States, Australia/New Zealand, the Netherlands, Denmark

and Italy.

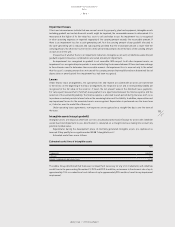

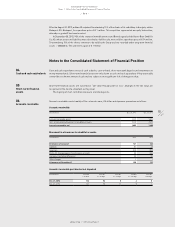

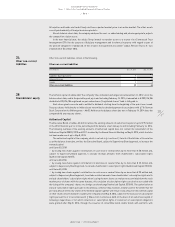

Goodwill

(€ in millions) Dec. 31, 2013 Dec. 31, 2012

Goodwill, gross 1,533 1,568

Less: accumulated impairment losses (329) (287)

Goodwill, net 1,204 1,281

The majority of goodwill which primarily relates to the acquisition of the Reebok business in 2006 is denominated

in US dollars. A currency translation effect of negative € 25 million and negative € 12 million was recorded for the

years ending December 31, 2013 and 2012, respectively.

The Group determines whether goodwill impairment is necessary at least on an annual basis. This requires an

estimation of the value in use of the cash-generating units to which the goodwill is allocated. Estimating the value

in use requires the Group to make an estimate of the expected future cash flows from the cash-generating units

and also to choose a suitable discount rate in order to calculate the present value of those cash flows.

Goodwill impairment losses for 2013 amounted to € 52 million (2012: € 265 million). The goodwill impairment

amount related to 2013 comprises an impairment loss within the Wholesale segment of € 23 million (2012:

€ 173 million) and an impairment loss within the Retail segment of € 29 million. In 2012, € 92 million was impaired

within the Other Businesses segment

/

SEE ALSO NOTE 02.

10

Assets/liabilities

classified as held for sale

11

Property, plant and

equipment

12

Goodwill