Reebok 2013 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

130

2013

/

03.2

/

Group Business Performance

/

Income Statement

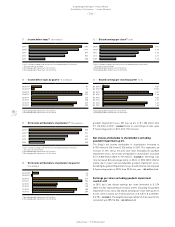

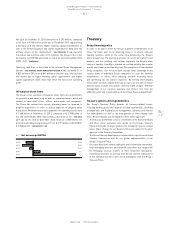

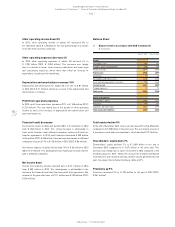

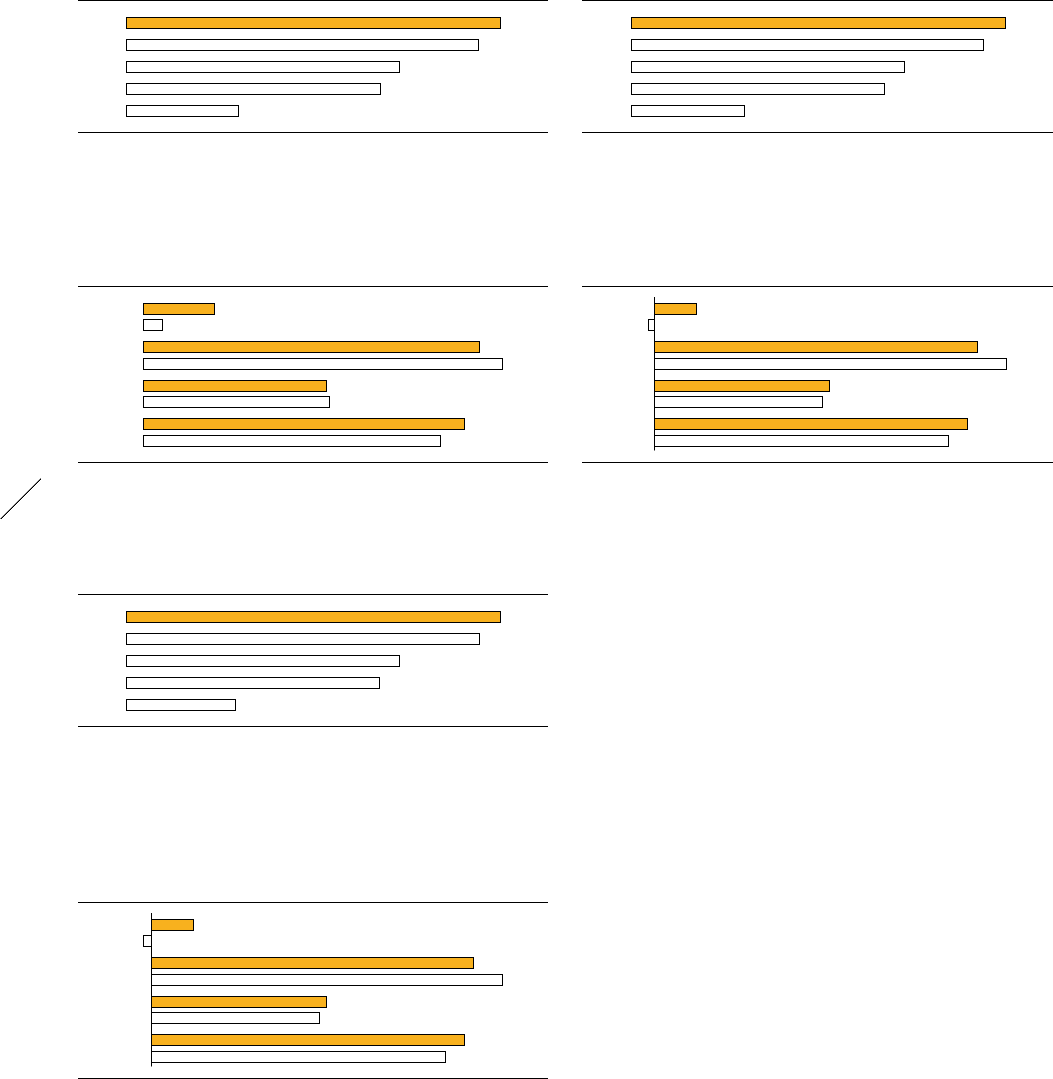

30

/

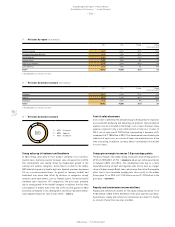

Net income attributable to shareholders by quarter

(€ in millions)

Q4 2013 1) 42

Q4 2012 2) (7)

Q3 2013 316

Q3 2012 344

Q2 2013 172

Q2 2012 165

Q1 2013 308

Q1 2012 289

1) Excluding goodwill impairment of € 52 million.

2) Excluding goodwill impairment of € 265 million.

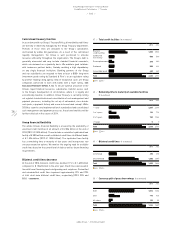

32

/

Diluted earnings per share by quarter (in €)

Q4 2013 1) 0.20

Q4 2012 2) (0.03)

Q3 2013 1.51

Q3 2012 1.64

Q2 2013 0.82

Q2 2012 0.79

Q1 2013 1.47

Q1 2012 1.38

1) Excluding goodwill impairment of € 52 million.

2) Excluding goodwill impairment of € 265 million.

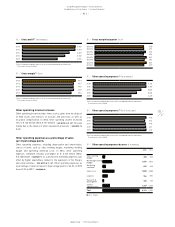

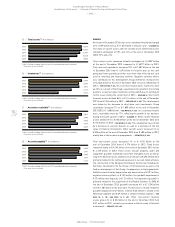

goodwill impairment losses, IBT was up 6% to € 1.186 billion from

€ 1.116 billion in 2012

/

DIAGRAM 27 and, as a percentage of sales, grew

0.7 percentage points to 8.2% from 7.5% last year.

Net income attributable to shareholders excluding

goodwill impairment up 6%

The Group’s net income attributable to shareholders increased to

€ 787 million in 2013 from € 526 million in 2012. This represents an

increase of 49% versus the prior year level. Excluding the goodwill

impairment losses, net income attributable to shareholders increased

6% to € 839 million (2012: € 791 million)

/

DIAGRAM 29. The Group’s tax

rate decreased 8.0 percentage points to 30.4% in 2013 (2012: 38.4%),

mainly due to lower non-tax-deductible goodwill impairment losses.

Excluding the goodwill impairment losses, the effective tax rate improved

0.3 percentage points to 29.0% from 29.3% last year

/

SEE NOTE 33, P. 229.

Earnings per share excluding goodwill impairment

reach € 4.01

In 2013, basic and diluted earnings per share amounted to € 3.76

(2012: € 2.52), representing an increase of 49%. Excluding the goodwill

impairment losses, basic and diluted earnings per share were up 6% to

€ 4.01, which is below our initial projections of € 4.25 to € 4.40 (2012:

€ 3.78)

/

DIAGRAM 31. The weighted average number of shares used in the

calculation was 209,216,186

/

SEE NOTE 34, P. 231.

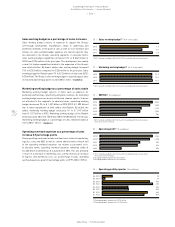

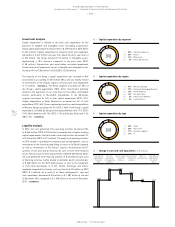

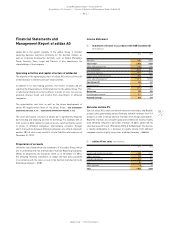

27

/

Income before taxes 1) (€ in millions)

2013 2) 1,186

2012 3) 1,116

2011 869

2010 806

2009 358

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

2) Excluding goodwill impairment of € 52 million.

3) Excluding goodwill impairment of € 265 million.

29

/

Net income attributable to shareholders 1) (€ in millions)

2013 2) 839

2012 3) 791

2011 613

2010 567

2009 245

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

2) Excluding goodwill impairment of € 52 million.

3) Excluding goodwill impairment of € 265 million.

31

/

Diluted earnings per share 1) (in €)

2013 2) 4.01

2012 3) 3.78

2011 2.93

2010 2.71

2009 1.22

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

2) Excluding goodwill impairment of € 52 million.

3) Excluding goodwill impairment of € 265 million.

28

/

Income before taxes by quarter (€ in millions)

Q4 2013 1) 81

Q4 2012 2) 12

Q3 2013 442

Q3 2012 479

Q2 2013 236

Q2 2012 235

Q1 2013 427

Q1 2012 389

1) Excluding goodwill impairment of € 52 million.

2) Excluding goodwill impairment of € 265 million.