Reebok 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

133

2013

/

03.2

/

Group Business Performance

/

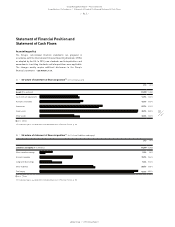

Statement of Financial Position and Statement of Cash Flows

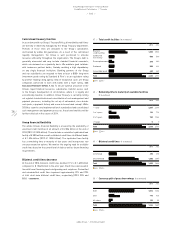

Operating working capital

Operating working capital increased 10% to € 2.618 billion at the end of

December 2013 compared to € 2.384 billion in 2012

/

DIAGRAM 40. This

was due to the increase in inventories related to the Group’s expectations

for growth in the coming quarters as well as higher inventories in

Russia/CIS following distribution centre issues during the second

half of 2013. Higher receivables reflecting the growth of our business

during the fourth quarter of 2013 also contributed to the increase in

operating working capital. As a result, average operating working

capital as a percentage of sales increased 0.9 percentage points to

20.9% (2012: 20.0%), above our initial guidance of a moderate increase

/

DIAGRAM 41.

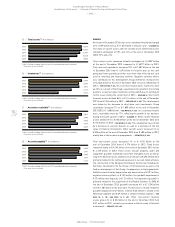

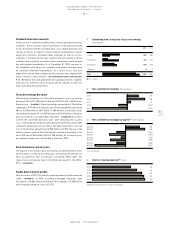

Liabilities and equity

Total current liabilities increased 8% to € 4.732 billion at the end of

December 2013 from € 4.374 billion at the end of December 2012.

Accounts payable were up 2% to € 1.825 billion at the end of December

2013 versus € 1.790 billion at the end of 2012

/

DIAGRAM 38. On a currency-

neutral basis, accounts payable increased 5%, which is in line with the

increase in inventories. At the end of December 2013, other current

financial liabilities increased 37% to € 113 million from € 83 million

in 2012, primarily as a result of the increase in the negative fair value

of financial instruments

/

SEE NOTE 18, P. 211. Short-term borrowings

more than doubled to € 681 million at the end of December 2013

(2012: € 280 million). The increase was mainly due to a reclassification

of long-term borrowings to short-term borrowings, as a result of the

Group’s Eurobond, which will mature in July 2014. Other current

provisions were down 20% to € 450 million at the end of 2013 versus

€ 563 million at the end of 2012. This primarily relates to a decrease in

provisions for returns and allowances, provisions for personnel as well

as other operational provisions. In addition, currency effects contributed

to the decline in other current provisions

/

SEE NOTE 19, P. 211. Current

accrued liabilities increased 6% to € 1.147 billion at the end of 2013

from € 1.084 billion in 2012, mainly due to an increase in accruals for

customer discounts as well as for outstanding invoices

/

SEE NOTE 20,

P. 212. Other current liabilities were down 8% to € 276 million at the

end of 2013 from € 299 million in 2012, mainly due to a decrease in tax

liabilities other than income taxes

/

SEE NOTE 21, P. 212.

Total non-current liabilities decreased 30% to € 1.386 billion at the end

of December 2013 from € 1.986 billion in the prior year. Long-term

borrowings declined 46% to € 653 million at the end of December 2013

from € 1.207 billion in the prior year. This development was mainly due

to a reclassification of long-term borrowings to short-term borrowings,

as a result of the Group’s Eurobond, which will mature in July 2014

/

SEE

NOTE 17, P. 209.

Shareholders’ equity increased 3% to € 5.489 billion at the end of

December 2013 versus € 5.304 billion in 2012

/

DIAGRAM 39. The

net income generated during the last twelve months was the main

contributor to this development, partially offset by negative currency

translation effects of € 312 million, the dividend paid to shareholders of

€ 282 million for the 2012 financial year as well as a decrease in hedging

reserves of € 13 million

/

SEE NOTE 25, P. 217. The Group’s equity ratio at

the end of December 2013 improved to 47.3% compared to 45.5% in the

prior year.

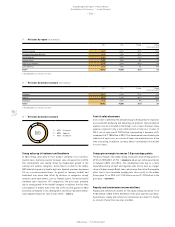

39

/

Shareholders’ equity 1) (€ in millions)

2013 5,489

2012 5,304

2011 5,137

2010 4,616

2009 3,771

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

41

/

Average operating working capital 1) (in % of net sales)

2013 20.9

2012 20.0

2011 20.4

2010 20.8

2009 24.3

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

40

/

Operating working capital (€ in millions)

Q4 2013 2,618

Q4 2012 2,384

Q3 2013 3,273

Q3 2012 3,337

Q2 2013 2,895

Q2 2012 2,966

Q1 2013 3,324

Q1 2012 3,201