Reebok 2013 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

218

2013

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

subscription rights excluded in accordance with § 186 section 3 sentence 4 AktG, does not exceed 10% of the

nominal capital existing on the date of the entry of this authorisation into the commercial register or – if this

amount is lower – as of the respective date on which the authorisation is used.

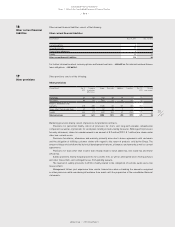

Contingent Capital

The following description of the Contingent Capital is based on § 4 section 5 of the Articles of Association of the

company as well as on the underlying resolutions of the Annual General Meeting held on May 6, 2010. Additional

contingent capital does not exist.

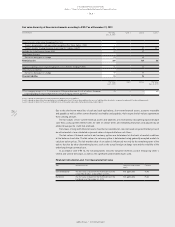

At the balance sheet date, the nominal capital is conditionally increased by up to € 36 million divided into

no more than 36,000,000 registered shares (Contingent Capital 2010). The contingent capital increase will be

implemented only to the extent that holders or creditors of option or conversion rights or the persons obligated

to exercise option or conversion duties on bonds issued by the company or a group company, pursuant to the

authorisation of the Executive Board granted by the resolution adopted by the Annual General Meeting of May 6,

2010, up to May 5, 2015 and guaranteed by the company, exercise their option or conversion rights or, if they are

obliged to exercise the option or conversion duties, meet their obligations to exercise the warrant or convert the

bond, or to the extent that the company exercises its rights to choose to deliver shares in the company for the

total amount or partially instead of a payment and insofar as no cash settlement, treasury shares or shares of

another public-listed company are used to serve these rights. The new shares shall be issued at the respective

option or conversion price to be established in accordance with the aforementioned authorisation resolution.

The new shares shall carry dividend rights from the commencement of the financial year in which the shares

are issued. The Executive Board is authorised, subject to Supervisory Board approval, to stipulate any additional

details concerning the implementation of the contingent capital increase.

The Executive Board of adidas AG did not issue shares from the Contingent Capital 2010 in the 2013 financial

year or in the period beyond the balance sheet date up to and including February 14, 2014.

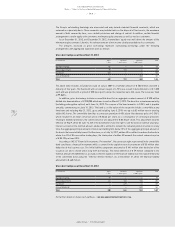

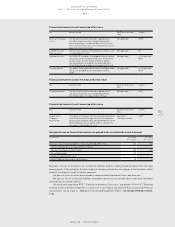

Convertible Bond

On March 14, 2012, the Executive Board, with the approval of the Supervisory Board, made partial use of the

authorisation of the Annual General Meeting from May 6, 2010, and on March 21, 2012 issued a convertible bond

due on June 14, 2019 in a nominal value of € 500 million via an offer to institutional investors outside the USA

excluding shareholders’ subscription rights. In principle, the conversion rights are exercisable between May 21,

2012 and June 5, 2019, subject to lapsed conversion rights as set out under § 6 section 3 or to the excluded periods

as defined by § 6 section 4 of the bond terms and conditions, and (subject to an adjustment to the conversion

rights resulting from the dilution adjustment regulations set out under § 10 or a change of control in accordance

with § 13 of the bond terms and conditions) are convertible into 6,016,954 shares of the company. The conversion

price currently amounts to € 83.10 per share. The convertible bond bears an interest rate of 0.25% per annum.

Bondholders are entitled to demand early redemption of the bonds as of June 14, 2017. As of July 14, 2017,

adidas AG may conduct an early redemption of the bond, if, on 20 of 30 consecutive trading days, the share price

of adidas AG exceeds the current conversion price of € 83.10 by at least 30%. The bonds are listed on the Open

Market segment of the Frankfurt Stock Exchange.

Repurchase of adidas AG shares

The Annual General Meeting on May 6, 2010, authorised the Executive Board to repurchase adidas AG shares

up to an amount totalling 10% of the nominal capital until May 5, 2015. The authorisation may be used by the

company but also by its subsidiaries or by third parties on account of the company or its subsidiaries or third

parties assigned by the company or one of its subsidiaries. For further information

/

SEE DISCLOSURES PURSUANT TO

§ 315 SECTION 4 AND § 289 SECTION 4 OF THE GERMAN COMMERCIAL CODE, P. 141.

The authorisation was not utilised in the year under review and up to and including February 14, 2014.

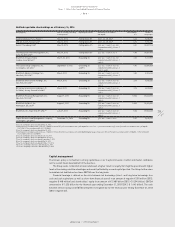

Changes in the percentage of voting rights

Pursuant to § 160 section 1 no. 8 AktG, existing shareholdings which have been notified to the company in

accordance with § 21 section 1 or section 1a of the German Securities Trading Act (Wertpapierhandelsgesetz –

WpHG) need to be disclosed.

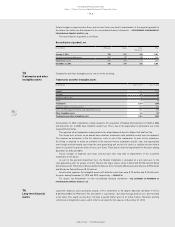

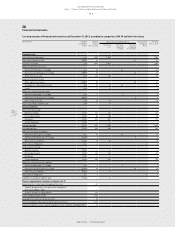

The following table reflects shareholdings reportable as at February 14, 2014 which have been notified

to the company. The respective details are taken from the most recent voting rights notification received by

the company. All voting rights notifications disclosed by the company in the year under review and up to and

including February 14, 2014 are available on the adidas Group website :

//

WWW.ADIDAS-GROUP.COM/VOTING_RIGHTS_

NOTIFICATIONS. The details on the percentage of shareholdings and voting rights may no longer be up to date.