Reebok 2013 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

132

2013

/

03.2

/

Group Business Performance

/

Statement of Financial Position and Statement of Cash Flows

35

/

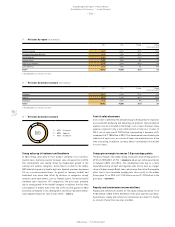

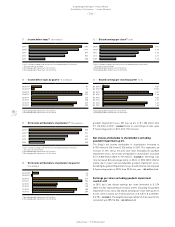

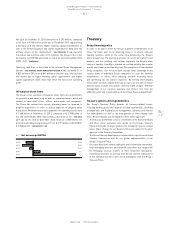

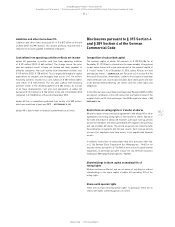

Total assets 1) (€ in millions)

2013 11,599

2012 11,651

2011 11,237

2010 10,618

2009 8,875

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

36

/

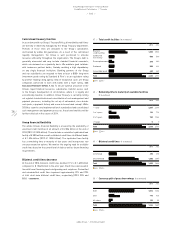

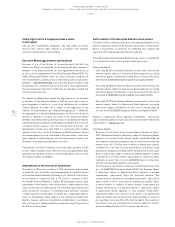

Inventories 1) (€ in millions)

2013 2,634

2012 2,486

2011 2,502

2010 2,119

2009 1,471

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

37

/

Accounts receivable 1) (€ in millions)

2013 1,809

2012 1,688

2011 1,595

2010 1,667

2009 1,429

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

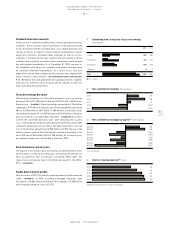

38

/

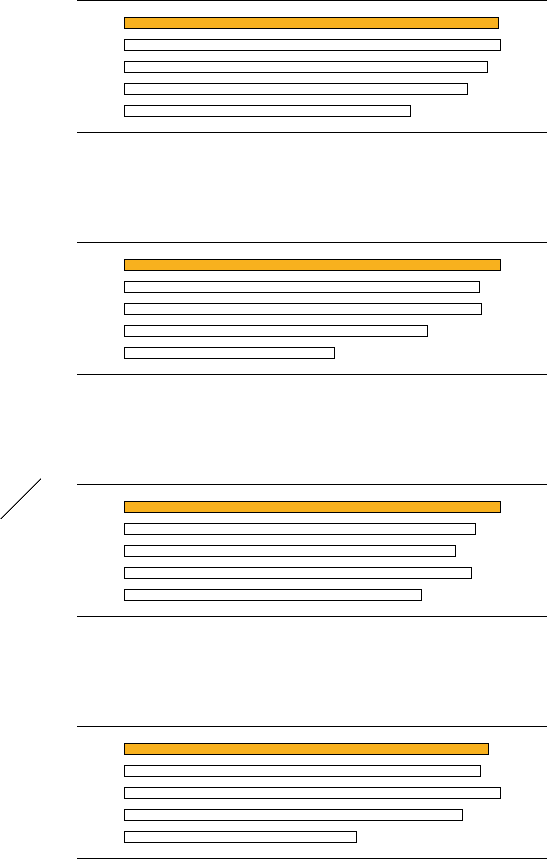

Accounts payable 1) (€ in millions)

2013 1,825

2012 1,790

2011 1,887

2010 1,694

2009 1,166

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

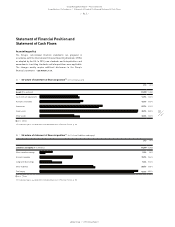

Assets

At the end of December 2013, total assets remained virtually unchanged

at € 11.599 billion versus € 11.651 billion in the prior year

/

DIAGRAM 35.

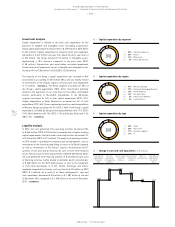

The share of current assets and non-current assets within total assets

remained unchanged at 59% and 41% at the end of December 2013

(2012: 59% and 41%).

Total current assets remained virtually unchanged at € 6.857 billion

at the end of December 2013 compared to € 6.877 billion in 2012.

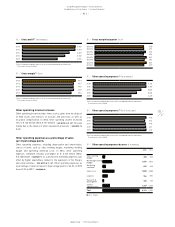

Cash and cash equivalents decreased 5% to € 1.587 billion at the end

of December 2013 from € 1.670 billion in the prior year, as net cash

generated from operating activities was more than offset by net cash

used in investing and financing activities. Negative currency effects

also contributed to this development. Group inventories increased 6%

to € 2.634 billion at the end of December 2013 versus € 2.486 billion in

2012

/

SEE NOTE 08, P. 206. On a currency-neutral basis, inventories were

up 13% as a result of the Group’s expectations for growth in the coming

quarters as well as higher inventories in Russia/CIS due to distribution

centre issues during the second half of 2013

/

DIAGRAM 36. Short-term

financial assets declined 84% to € 41 million at the end of December

2013 from € 265 million in 2012

/

SEE NOTE 05, P. 205. This development

was driven by the decrease in short-term cash investments. Group

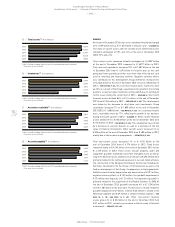

receivables increased 7% to € 1.809 billion at the end of December

2013 (2012: € 1.688 billion)

/

SEE NOTE 06, P. 205. On a currency-neutral

basis, receivables were up 17%, reflecting the growth of our business

during the fourth quarter of 2013

/

DIAGRAM 37. Other current financial

assets declined 5% to € 183 million at the end of December 2013 from

€ 192 million in 2012

/

SEE NOTE 07, P. 206. This development was driven

by a decrease in security deposits as well as a decrease in the fair

value of financial instruments. Other current assets increased 4% to

€ 506 million at the end of December 2013 from € 489 million in 2012,

mainly due to the increase in prepayments

/

SEE NOTE 09, P. 206.

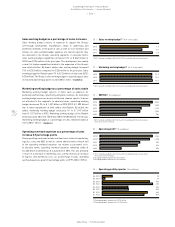

Total non-current assets decreased 1% to € 4.742 billion at the

end of December 2013 from € 4.774 billion in 2012. Fixed assets

remained stable at € 4.144 billion at the end of December 2013 versus

€ 4.139 billion in 2012. Fixed assets include property, plant and

equipment, goodwill, trademarks and other intangible assets as well as

long-term financial assets. Additions in an amount of € 492 million were

primarily related to the continued expansion of our own-retail activities,

the construction of the European Distribution Centre near Osnabrueck,

Germany, investments into the Group’s IT infrastructure as well as the

further development of the Group’s headquarters in Herzogenaurach.

Additions were offset by depreciation and amortisation of € 291 million,

negative currency effects of € 132 million, the goodwill impairment of

€ 52 million and disposals of € 12 million. The majority of goodwill is

primarily related to the acquisition of the Reebok business in 2006. At

the end of December 2013, goodwill decreased 6% to € 1.204 billion

from € 1.281 billion in the prior year. The decrease is mainly related to

goodwill impaired of € 52 million, of which € 23 million is related to the

Wholesale segment and € 29 million is related to Retail segment

/

SEE

NOTE 02, P. 195

/

SEE NOTE 12, P. 207. Other non-current financial

assets grew 41% to € 30 million at the end of December 2013 from

€ 21 million in 2012, driven by an increase in the fair value of financial

instruments

/

SEE NOTE 15, P. 209.