Reebok 2013 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

181

2013

Management Assessment of Performance, Risks and Opportunities, and Outlook

/

03.6

/

Assessment of overall risks and opportunities

The Group’s Risk Management team aggregates all risks and

opportunities reported by different business units and functions through

the quarterly risk and opportunity assessment process. In addition,

the Group’s Executive Board discusses and assesses Group risks and

opportunities on a regular basis. Taking into account the potential

financial impact as well as the likelihood of materialising of the risks

explained within this report, and considering the strong balance

sheet as well as the current business outlook, we do not foresee any

material jeopardy to the viability of the Group as a going concern. This

assessment is also supported by the historical response to our financing

demands

/

SEE TREASURY, P. 135. The adidas Group therefore has not

sought an official rating by any of the leading rating agencies. We remain

confident that the Group’s earnings strength forms a solid basis for our

future business development and provides the resources necessary

to pursue the opportunities available to the Group. Compared to the

prior year, our assessment of certain risks has changed in terms of

likelihood of occurrence and/or potential financial impact

/

SEE RISK AND

OPPORTUNITY REPORT, P. 158. The partial changes in risk evaluation have

no substantial impact on the overall adidas Group risk profile; however,

we believe that the current development of major currencies since the

beginning of 2014 will make the achievement of our financial targets for

2014 and 2015 significantly more challenging to meet.

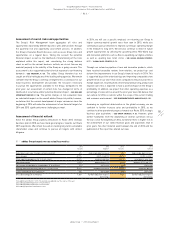

Assessment of financial outlook

Since the adidas Group publicly announced its Route 2015 strategic

business plan in 2010, we have made good progress towards our Route

2015 aspirations. We remain focused on creating long-term sustainable

shareholder value and continue to pursue all targets with utmost

diligence.

In 2014, we will see a specific emphasis on returning our Group to

higher currency-neutral growth rates than seen in 2013, while also

continuing to pursue initiatives to improve our Group’s operating margin

in the medium to long term. We will also continue to invest in future

growth opportunities by utilising the upcoming 2014 FIFA World Cup

and innovation platforms such as Boost, expanding our digital activities

as well as opening new retail stores

/

SEE GLOBAL BRANDS STRATEGY,

P. 77

/

GLOBAL SALES STRATEGY, P. 72.

Through our extensive pipeline of new and innovative products, which

have received favourable reviews from retailers, we project top- and

bottom-line improvements in our Group’s financial results in 2014. This

is supported by positive order backlogs and improving comparable store

growth trends in our own-retail stores compared to the prior year. Gross

margin expansion, resulting from a more favourable pricing, product and

regional sales mix, is expected to have a positive impact on the Group’s

profitability. In addition, we project that other operating expenses as a

percentage of sales will be around the prior year level. We believe that

our outlook for 2014 is realistic within the scope of the current trading

and economic environment

/

SEE SUBSEQUENT EVENTS AND OUTLOOK, P. 151.

Assuming no significant deterioration in the global economy, we are

confident to further increase sales and profitability in 2015, as we

continue to drive operational progress towards our Route 2015 strategic

business plan aspirations

/

SEE GROUP STRATEGY, P. 68. However, given

further headwinds from the weakening of several currencies versus

the euro since the beginning of 2014, we believe there is higher risk to

the achievement of our stated financial goals and aspirations than in

prior years. No other material event between the end of 2013 and the

publication of this report has altered our view.

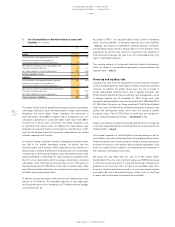

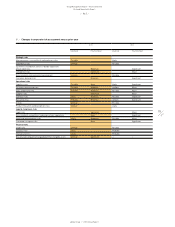

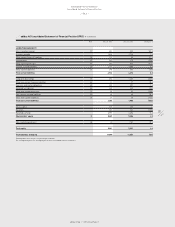

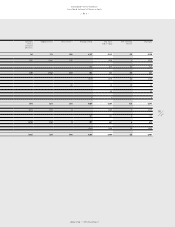

01

/

adidas Group targets versus actual key metrics

2012

Results

2013

Targets 1)

2013

Results

2014

Outlook

Sales (year-over-year change, currency-neutral) 6% mid-single-digit increase 3% high-single-digit increase

Gross margin 47.7% 48.0% to 48.5% 49.3% 49.5% to 49.8%

Other operating expenses (in % of net sales) 41.3% moderate decline 42.3% around prior year level

Operating margin 8.0% 2) approaching 9.0% 8.7% 3) between 8.5% and 9.0%

Net income attributable to shareholders (€ in millions) 791 2) 890 to 920 839 3) 830 to 930

Average operating working capital (in % of net sales) 20.0% moderate increase 20.9% moderate decline

Capital expenditure (€ in millions) 4) 434 500 to 550 479 500 to 550

Gross borrowings (€ in millions) 1,487 further reduction of gross

borrowings

1,334 further reduction of gross

borrowings

1) As published on March 7, 2013. The outlook was updated over the course of the year.

2) Excluding goodwill impairment of € 265 million.

3) Excluding goodwill impairment of € 52 million.

4) Excluding acquisitions and finance leases.