Reebok 2013 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

197

2013

Notes

/

04.8

/

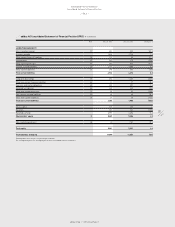

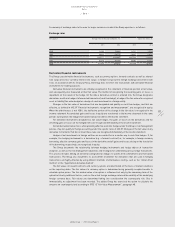

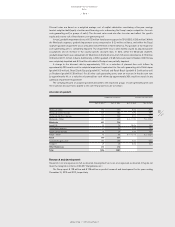

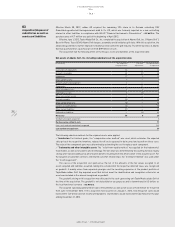

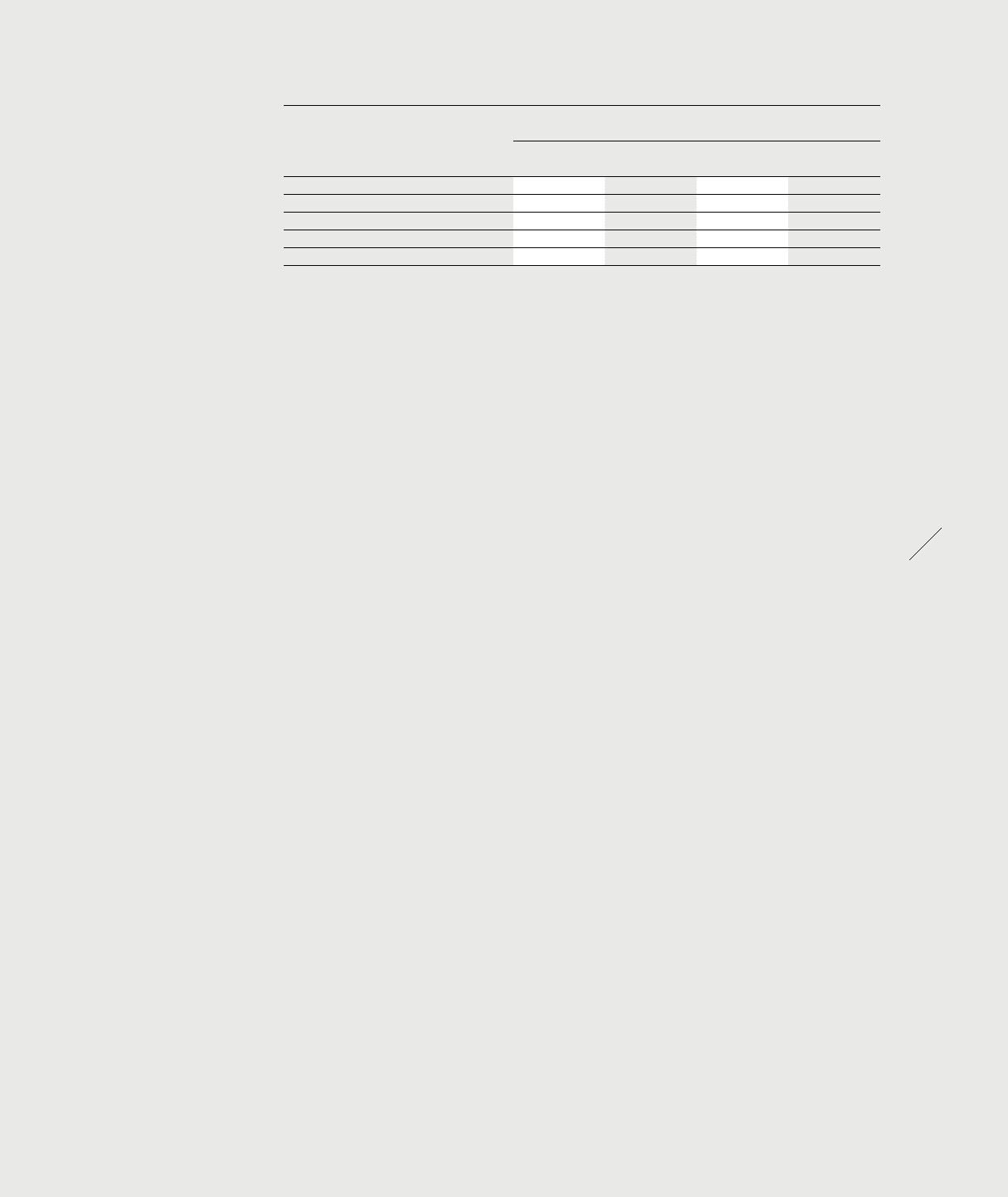

A summary of exchange rates to the euro for major currencies in which the Group operates is as follows:

Exchange rates

(€ 1 equals) Average rates for the year ending Dec. 31, Spot rates at Dec. 31,

2013 2012 2013 2012

USD 1.3283 1.2862 1.3791 1.3194

GBP 0.8492 0.8115 0.8337 0.8161

JPY 129.5777 102.6451 144.7200 113.6100

CNY 8.1674 8.1137 8.4082 8.2931

RUB 42.2979 39.9512 45.1368 40.0737

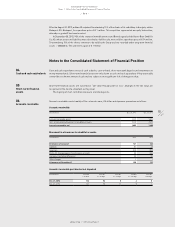

Derivative financial instruments

The Group uses derivative financial instruments, such as currency options, forward contracts as well as interest

rate swaps and cross-currency interest rate swaps, to hedge its exposure to foreign exchange and interest rate

risks. In accordance with its Treasury Policy, the Group does not enter into transactions with derivative financial

instruments for trading purposes.

Derivative financial instruments are initially recognised in the statement of financial position at fair value,

and subsequently also measured at their fair value. The method of recognising the resulting gains or losses is

dependent on the nature of the hedge. On the date a derivative contract is entered into, the Group designates

derivatives as either a hedge of a forecasted transaction (cash flow hedge), a hedge of the fair value of a recognised

asset or liability (fair value hedge) or a hedge of a net investment in a foreign entity.

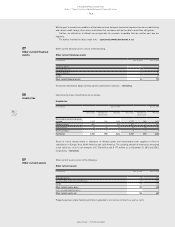

Changes in the fair value of derivatives that are designated and qualify as cash flow hedges, and that are

effective, as defined in IAS 39 “Financial instruments: recognition and measurement”, are recognised in equity.

When the effectiveness is not 100%, the ineffective portion of the change in the fair value is recognised in the

income statement. Accumulated gains and losses in equity are transferred to the income statement in the same

periods during which the hedged forecasted transaction affects the income statement.

For derivative instruments designated as fair value hedges, the gains or losses on the derivatives and the

offsetting gains or losses on the hedged items are recognised immediately in the income statement.

Certain derivative transactions, while providing effective economic hedges under the Group’s risk management

policies, may not qualify for hedge accounting under the specific rules of IAS 39. Changes in the fair value of any

derivative instruments that do not meet these rules are recognised immediately in the income statement.

Hedges of net investments in foreign entities are accounted for in a similar way to cash flow hedges. If, for

example, the hedging instrument is a derivative (e.g. a forward contract) or, for example, a foreign currency

borrowing, effective currency gains and losses in the derivative and all gains and losses arising on the translation

of the borrowing, respectively, are recognised in equity.

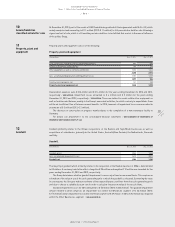

The Group documents the relationship between hedging instruments and hedge objects at transaction

inception, as well as the risk management objectives and strategies for undertaking various hedge transactions.

This process includes linking all derivatives designated as hedges to specific firm commitments and forecasted

transactions. The Group also documents its assessment of whether the derivatives that are used in hedging

transactions are highly effective by using different methods of effectiveness testing, such as the “dollar offset

method” or the “hypothetical derivative method”.

The fair values of forward contracts and currency options are determined on the basis of market conditions

on the reporting dates. The fair value of a currency option is determined using generally accepted models to

calculate option prices. The fair market value of an option is influenced not only by the remaining term of the

option but also by additional factors, such as the actual foreign exchange rate and the volatility of the underlying

foreign currency base. Fair values are determined taking into consideration the counterparty risk. Due to

immateriality, no adjustment has been recorded. The adidas Group has exercised the option to calculate the

amounts on counterparty level according to IFRS 13 “Fair Value Measurement”, paragraph 48.