Reebok 2013 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

213

2013

/

04.8

/

Notes

/

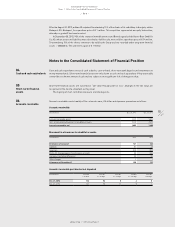

Notes to the Consolidated Statement of Financial Position

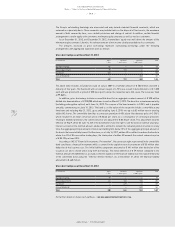

The Group has recognised post-employment benefit obligations arising from defined benefit plans. The benefits

are provided pursuant to the legal, fiscal and economic conditions in each respective country and mainly depend

on the employees’ years of service and remuneration.

The adidas Group is applying the revised standard IAS 19 Employee Benefits – Revised (2011), IAS 19R, as of

the beginning of the 2013 financial year. IAS 19R is retrospectively effective for annual periods beginning on or

after January 1, 2013. Changes due to IAS 19R which are relevant for the adidas Group are as follows: According

to the net interest approach, the net interest result to be reported within profit or loss of the period is determined

by multiplying the net pension liability with the discount rate which is used to measure the gross defined benefit

obligation. As the net pension liability is reduced by any plan assets, this calculation implicitly assumes a rate of

return on plan assets in the amount of the discount rate. In addition, the changes of IAS 19R comprise the effect

of the immediate recognition of unvested past service costs in the statement of income as incurred instead of

amortising them over the vesting period. The Group has analysed the effects of the above-mentioned changes of

IAS 19R on the current as well as prior consolidated financial statements and has come to the conclusion that

these changes do not have any material effect on the Group’s consolidated financial statements. Therefore, no

reclassification between other reserves and retained earnings within equity was carried out.

Under IAS 19R, early retirement schemes are no longer classified as termination benefits but as other

long-term employee benefits. Due to this reclassification, the valuation method has changed. The impact on the

obligations arising from early retirement schemes as a result of this change is not material in the Group’s view.

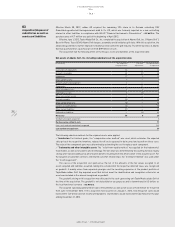

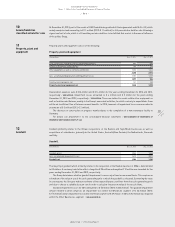

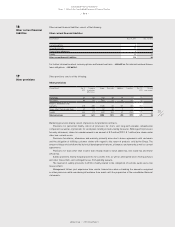

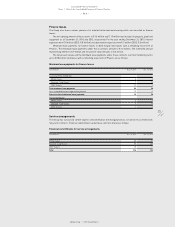

Pensions and similar obligations

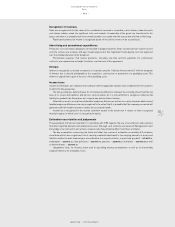

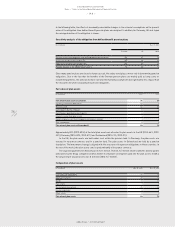

(€ in millions) Dec. 31, 2013 Dec. 31, 2012

Liability arising from defined benefit pension plans 243 241

Similar obligations 12 10

Pensions and similar obligations 255 251

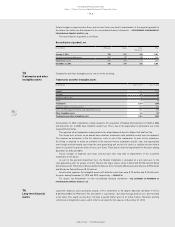

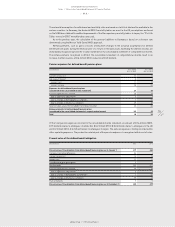

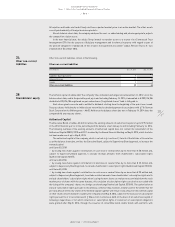

Defined contribution pension plans

The total expense for defined contribution plans amounted to € 47 million in 2013 (2012: € 46 million).

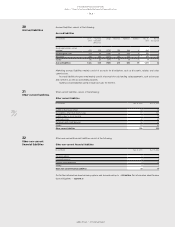

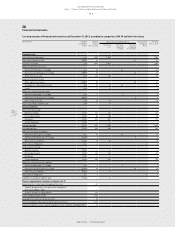

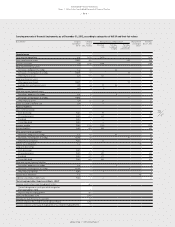

Defined benefit pension plans

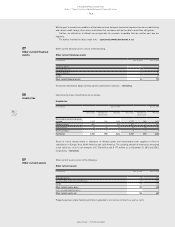

Given the diverse Group structure, different defined benefit pension plans exist, comprising a variety of

post-employment benefit arrangements. The Group’s major defined benefit pension plans relate to adidas AG

and its subsidiaries in the UK and Japan. The defined benefit pension plans generally provide payments in case

of death, disability or retirement to former employees and their survivors. The obligations arising from defined

benefit pension plans are partly covered by plan assets.

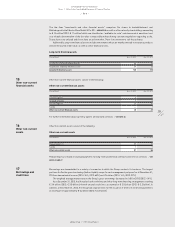

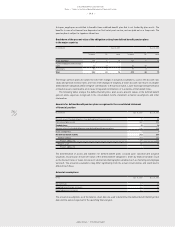

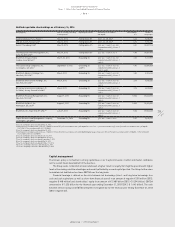

In Germany, the Group grants its employees contribution-based and final salary defined benefit pension

schemes, which provide employees with entitlements in the event of retirement, disability and death. In

general, German pension plans operate under the legal framework of the German Company Pension Act

(“Betriebsrentengesetz”) and under the German Labour Act. A large proportion of the pension plans are closed

to new entrants. New employees are entitled to benefits in accordance with the adidas Pension Plan or the adidas

Management Pension Plan. Both pension plans are so-called matching contribution plans; the contributions to

these pension plans are partly paid by the employee and partly paid by the employer. The pension plans in Germany

are financed using book reserves, a pension fund (“Pensionsfonds”) or a provident fund (“Unterstützungskasse”).

The benefits granted to members of the Executive Board are funded via a pension fund (“Pensionsfonds”) or

a provident fund (“Unterstützungskasse”). An insurance company is responsible for the determination and the

implementation of the investment strategy. Further details about the pension entitlements of members of the

Executive Board of adidas AG are contained in the Compensation Report

/

SEE COMPENSATION REPORT, P. 53.

The final salary defined benefit pension scheme in the UK is closed to new entrants and to future accrual.

The scheme operates under UK trust law and under the jurisdiction of the UK Pensions Regulator. The pension

scheme is subject to a minimum funding requirement. The Trustee Board is responsible for setting the scheme’s

funding objective, agreeing the contributions with the company and determining the investment strategy of the

scheme.

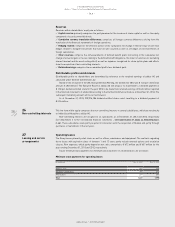

23

Pensions and similar

obligations