Reebok 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

123

2013

/

03.2

/

Group Business Performance

/

Economic and Sector Development

02

/

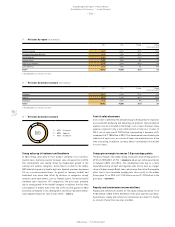

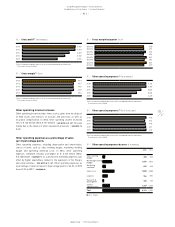

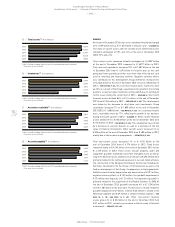

Quarterly unemployment rate by region

(in % of total active population)

Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013

USA 1) 7.8 7.7 7.5 7.3 7.0

Euro area 2) 11.9 12.0 12.1 12.1 12.0

Japan 3) 4.3 4.1 3.9 4.0 3.7

China 4) 4.1 4.1 4.1 4.0 4.0

Russia 5) 5.1 5.7 5.4 5.3 5.6

Brazil 6) 4.6 5.7 6.0 5.4 4.3

1) Source: US Bureau of Labor Statistics.

2) Source: Eurostat.

3) Source: Japan Ministry of Internal Affairs and Communications.

4) Source: China National Bureau of Statistics.

5) Source: Russia Federal Service of State Statistics.

6) Source: Brazil Institute of Geography and Statistics.

03

/

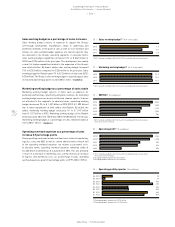

Quarterly development of Consumer Price Index 1)

(by region)

Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013

USA 2) 1.7 1.5 1.8 1.2 1.5

Euro area 3) 2.2 1.7 1.6 1.1 0.8

Japan 4) (0.1) (0.9) 0.2 1.1 1.6

China 5) 2.5 2.1 2.7 3.1 2.5

Russia 6) 6.6 7.0 6.9 6.1 6.5

Brazil 7) 5.8 6.6 6.7 5.9 5.9

1) Quarter-end figures.

2) Source: US Bureau of Labor Statistics.

3) Source: Eurostat.

4) Source: Japan Ministry of Internal Affairs and Communications.

5) Source: China National Bureau of Statistics.

6) Source: Russia Federal Service of State Statistics.

7) Source: Brazil Institute of Geography and Statistics.

04

/

Quarterly consumer confidence development 1)

(by region)

Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013

USA 2) 66.7 61.9 82.1 80.2 77.5

Euro area 3) (26.0) (23.3) (18.7) (14.8) (13.6)

Japan 4) 39.1 45.0 44.3 45.1 40.0

China 5) 103.7 102.6 97.0 99.8 102.3

Russia 6) (8.0) (7.0) (6.0) (7.0) (11.0)

Brazil 7) 115.2 114.3 110.1 110.1 111.2

1) Quarter-end figures.

2) Source: Conference Board.

3) Source: European Commission.

4) Source: Economic and Social Research Institute, Government of Japan.

5) Source: China National Bureau of Statistics.

6) Source: Russia Federal Service of State Statistics.

7) Source: Brazil National Confederation of Industry.

The US economy grew modestly in 2013, with GDP, according to the

Federal Reserve, expanding 2.3% compared to 1.8% in 2012. Low

inflation and a recovery in the real estate market helped drive consumer

confidence and spending, particularly in the second half of the year.

Additionally, robust export and industrial activity contributed positively

to economic growth. However, sizeable austerity measures, higher

federal taxes and disruptions from the partial shutdown of many federal

agencies adversely impacted growth.

Asia recorded positive GDP growth of around 4.3% (2012: 4.2%). Excluding

Japan, most Asian markets continued to post the highest global GDP

growth rates, increasing 6.0% (2012: 6.0%). China was the region’s

top-performing economy, expanding its GDP by 7.7% (2012: 7.7%),

with steady momentum in its manufacturing and service sectors. This

compared to growth of 1.7% in Japan, where, despite a slight slowdown

in the third quarter, the economy continued to rebound. This was fuelled

by a substantial government stimulus programme and the relatively low

value of the yen, which assisted a recovery in export activity. Most other

Asian economies also posted healthy GDP growth, with strong wage

increases across most of the region helping to drive domestic demand.

In Latin America, GDP increased 2.0% (2012: 2.5%), with growth

supported by low unemployment rates, credit incentives, a recovery

in industrial production and solid domestic consumption, albeit

weaker than in recent years. Investment in the urban infrastructure in

preparation for the 2014 FIFA World Cup also fuelled activity in Brazil.

However, increases in inflation, particularly in Argentina, negatively

impacted economic expansion.

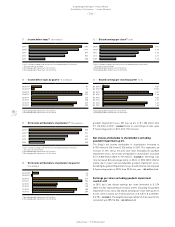

Positive momentum in the global sporting goods industry

In 2013, the global sporting goods industry recorded solid growth,

primarily driven by rising consumer spending in the emerging markets,

which more than offset subdued private spending in many Western

European markets. The e-commerce channel continued to see rapid

expansion across the industry, with a wide diversity of strategies being

implemented to leverage commercial opportunities through digital,

social media and, particularly, mobile technologies. The industry also

witnessed a large number of fitness-tracking devices and fitness mobile

apps coming to the market during the year. From a category perspective,

basketball remained strong, with both performance and lifestyle

performing well. Running posted a solid performance, with lightweight

and technical running continuing to record strong growth. However,

sales trends in the lifestyle running category were low. The build-up

to the 2014 FIFA World Cup supported the football category, especially

towards year-end. The outdoor category, in both footwear and apparel,

faced some headwinds at retail during the year.