Reebok 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

adidas Group

/

2013 Annual Report

To Our Shareholders

58

2013

/

01.10

/

Our Share

Our Share

In 2013, international stock markets and the adidas AG share continued their bullish run from the prior

year and increased considerably. Global central banks’ promise to keep key rates low for an extended

period of time (Forward Guidance), the recovery of the US economy as well as the stabilisation of

the euro area economy were key catalysts for strong market developments throughout the year.

Discussions about a possible tapering by the Fed, the lacklustre earnings seasons, the looming US

government shutdown as well as geopolitical risk factors in certain regions only temporarily weighed

on equity markets. This resulted in an increase of 25% in 2013 for both the DAX-30 and the MSCI World

Textiles, Apparel & Luxury Goods Index. The adidas AG share outperformed both indices, supported

by ongoing strong performance in emerging markets and market participants’ rising confidence in the

adidas Group’s Route 2015 strategic business plan. This more than offset a temporary weakness in the

share price following the amendment of the adidas Group’s full year guidance during the third quarter.

As a result, at year-end the adidas AG share reached a new all-time high of € 92.64, representing an

increase of 38% compared to the prior year. With the increase in the Group’s net income attributable to

shareholders excluding impairment losses, we intend to propose an 11% higher dividend compared to

2012 at our 2014 Annual General Meeting.

International stock markets maintain positive momentum

In 2013, international stock markets maintained the positive momentum

from the previous year, which resulted in new all-time highs for the

DAX-30 and the Dow Jones. At the beginning of 2013, US equity markets

improved considerably, supported by the last-minute US fiscal cliff deal,

strong US economic data and a better than expected US earnings season.

European benchmark indices, however, underperformed international

equity markets due to setbacks in the euro debt crisis, in particular the

bailout package for Cyprus as well as the impending political deadlock

in Italy. In the second quarter of 2013, equity markets continued their

bullish run, supported by the ongoing accommodative monetary policy

of the major central banks. This, combined with improving US economic

indicators, as well as the ECB’s decision to further cut its key interest

rate by 25 basis points to 0.5%, drove the DAX-30 and US equity markets

to new all-time highs at the beginning of May. However, signals that the

Fed could reduce its monetary stimulus, together with disappointing

economic data in China, resulted in a consolidation of equity markets

towards the end of the second quarter. In the third quarter of 2013,

international stock markets improved significantly. The key catalyst of

the uptrend was the recovery of leading economic indicators as well as

ongoing accommodative monetary policies of the ECB and the Fed. This

more than offset the negative impact of a lacklustre Q2 earnings season,

the looming US government shutdown as well as geopolitical risk factors

01

/

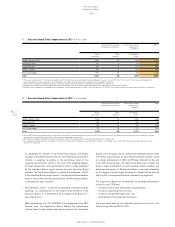

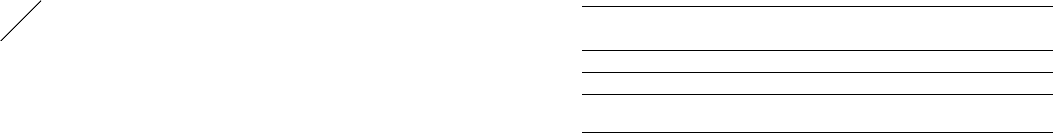

Historical performance of the adidas AG share and

important indices at year-end 2013 (in %)

1 year 3 years 5 years 10 years Since IPO

adidas AG 38 89 241 310 858

DAX-30 25 38 99 141 335

MSCI World Textiles,

Apparel & Luxury Goods 25 50 230 259 415

Source: Bloomberg.

in certain regions. Despite the reduction in the Fed’s asset purchases

and disappointing third quarter GDP data for the euro area, international

stock markets enjoyed a strong fourth quarter. This was attributable to

the Fed’s reconfirmation of its Forward Guidance, rising global leading

indicators and the surprising rate cut by the ECB. Furthermore, robust

US economic data and the steady flow of new money into European

equity funds provided additional tailwinds for stock markets. As a result,

both the DAX-30 and the MSCI World Textiles, Apparel & Luxury Goods

Index increased 25% in 2013

/

TABLE 01. The Dow Jones Index gained

26% during the period.

1)

1) This section is part of the audited Group Management Report.