Reebok 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

To Our Shareholders

61

2013

/

01.10

/

Our Share

Level 1 ADR performs in line with common stock

Since its launch on December 30, 2004, our Level 1 American Depositary

Receipt (ADR) facility has enjoyed great popularity among American

investors. Deutsche Bank Trust Company Americas runs our Level 1 ADR

Programme. Our Level 1 ADR closed 2013 at US $ 64.23, representing

an increase of 43% versus the prior year level (2012: US $ 44.80). The

more pronounced increase of the Level 1 ADR price compared to the

ordinary share price was due to the depreciation of the US dollar versus

the euro at the end of 2013 compared to year-end 2012. While the

number of Level 1 ADRs outstanding reached a new high in July 2013

with 12.8 million Level 1 ADRs outstanding, the number decreased

to 9.2 million at year-end 2013. This compares to 11.8 million Level 1

ADRs outstanding at the end of 2012. The average daily trading volume

decreased 14% to 35,800 ADRs in 2013 (2012: 41,500). Since November

2007, the adidas AG ADR is quoted on the OTCQX International Premier

market, the highest over-the-counter market tier. This electronic

trading forum includes leading international companies with substantial

operating businesses and credible disclosure policies. Further

information on our ADR Programme can be found on our website at

:

//

WWW.ADIDAS-GROUP.COM/ADR.

adidas AG share historically outperforms

benchmark indices

The adidas Group is committed to continuously enhancing shareholder

value. The long-term development of our share price reflects investor

confidence and the growth potential of our Group. Over the last ten years,

our share has gained 310%. This represents a clear outperformance of

the DAX-30, which increased 141% during the period

/

TABLE 01.

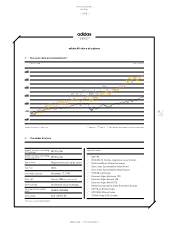

adidas AG share member of important indices

The adidas AG share is included in a variety of high-quality indices

around the world, most importantly the DAX-30 and the MSCI World

Textiles, Apparel & Luxury Goods Index

/

TABLE 03. The DAX-30 is

a blue chip stock market index consisting of the 30 major German

companies trading on the Frankfurt Stock Exchange. The MSCI World

Textiles, Apparel & Luxury Goods Index comprises our Group’s major

competitors. At December 31, 2013, our weighting in the DAX-30, which

is calculated on the basis of free float market capitalisation and twelve-

month share turnover increased to 2.36% (2012: 2.13%). Our higher

weighting compared to the prior year was mainly a result of the increase

in share turnover and the market capitalisation of adidas AG. Within

the DAX-30, we ranked 16 on market capitalisation (2012: 16) and 17 on

turnover (2012: 19) at year-end 2013.

Strong sustainability track record reflected in

index memberships

In recognition of our social and environmental efforts, adidas AG is

listed in several sustainability indices. For the 14th consecutive time,

adidas AG has been selected to join the Dow Jones Sustainability Indices

(DJSI), the world’s first global sustainability index family tracking the

performance of more than 300 leading sustainability-driven companies

worldwide. In the category “Textiles, Apparel & Luxury Goods”,

adidas AG was rated as industry leader in sustainability issues and

corporate responsibility for the tenth time. In addition, adidas AG was

again included in the FTSE4Good Europe Index and the Vigeo Group’s

Ethibel Sustainability Index Excellence Europe and Excellence Global.

Also, adidas AG was included in three of the newly created Euronext

Vigeo indices. In addition, adidas AG remains a component of the

STOXX Global ESG Leaders indices for the third consecutive year. The

index family is made up of three specialised indices for the categories

environmental, social and governance, and one broad index which

sums up the specialised indices. In detail, these are the STOXX Global

ESG Environmental Leaders, STOXX Global ESG Social Leaders, STOXX

Global ESG Governance Leaders and STOXX Global ESG Leaders indices.

The index family is based on relevant key performance indicators (KPIs)

provided by the index partner Sustainalytics, a leading provider of ESG

research and analysis

/

TABLE 03.

Convertible bond significantly above prior year level

In March 2012, adidas AG successfully issued a convertible bond, due on

June 14, 2019, for an aggregate nominal amount of € 500 million

/

SEE

NOTE 17, P. 209. The bonds are not callable by the issuer or putable by

the bondholders until June 2017. The bonds are convertible into up to

6.02 million new or existing adidas AG shares. Proceeds from the offering

have allowed the Group to further optimise its debt structure. The bonds

were priced with a 0.25% annual coupon and a conversion premium of

40% above the reference price of € 59.61, resulting in an initial conversion

price of € 83.46 per share. As a consequence of contractual provisions

relating to dividend protection, the conversion price was adjusted to

€ 83.10 per share. This adjustment became effective on May 9, 2013. The

convertible bond closed the year at € 129.96, significantly above the prior

year value level of € 114.30.