Reebok 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

126

2013

/

03.2

/

Group Business Performance

/

Income Statement

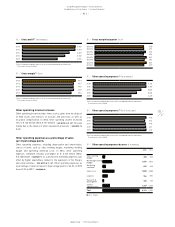

Group sales up in footwear and hardware

In 2013, Group sales grew in most product categories on a currency-

neutral basis. Currency-neutral footwear sales increased 4% in 2013.

This development was mainly driven by double-digit growth in the

running and outdoor categories. Action Sports as well as the adidas

NEO label also grew at a double-digit rate. Apparel revenues decreased

3% on a currency-neutral basis, as growth in running, football and

basketball was more than offset by declines in categories closely

related to prior year events, such as Olympic sports. Currency-neutral

hardware sales increased 15% compared to the prior year, primarily

due to strong growth in the football category. In addition, the first-time

consolidation of Adams Golf at the end of the second quarter of 2012

positively contributed to this development. Currency translation effects

had a negative impact on sales in euro terms

/

TABLE 12.

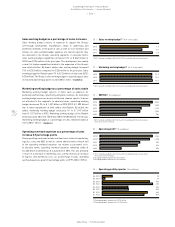

Cost of sales decreases

Cost of sales is defined as the amount we pay to third parties for expenses

associated with producing and delivering our products. Own-production

expenses are also included in the Group’s cost of sales. However, these

expenses represent only a very small portion of total cost of sales. In

2013, cost of sales was € 7.352 billion, representing a decrease of 5%

compared to € 7.780 billion in 2012. This development was driven by the

reduction of input costs as a result of lower raw material prices at the

time of sourcing. In addition, currency effects contributed to the decline

in cost of sales.

Group gross margin increases 1.5 percentage points

The gross margin of the adidas Group increased 1.5 percentage points to

49.3% in 2013 (2012: 47.7%)

/

DIAGRAM 15, above our initial expectations

of between 48.0% and 48.5%. This development was due to a more

favourable pricing, product and regional sales mix as well as a larger

share of higher-margin Retail sales, which more than offset the negative

effect from a less favourable hedging rate. Gross profit for the adidas

Group grew 1% in 2013 to € 7.140 billion versus € 7.103 billion in the

prior year

/

DIAGRAM 14.

Royalty and commission income declines

Royalty and commission income for the adidas Group decreased 1% to

€ 104 million in 2013 from € 105 million in the prior year. On a currency-

neutral basis, royalty and commission income was also down 1%, mainly

as a result of lower licensee sales at adidas.

11

/

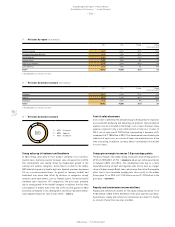

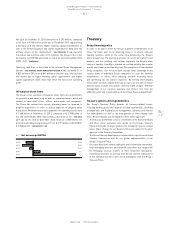

Net sales by region (€ in millions)

2013 2012 Change Change

(currency-neutral)

Western Europe 3,800 4,076 (7%) (6%)

European Emerging Markets 1,894 1,947 (3%) 4%

North America 3,362 3,410 (1%) 2%

Greater China 1,655 1,562 6% 7%

Other Asian Markets 2,206 2,407 (8%) 5%

Latin America 1,575 1,481 6% 19%

Total 1) 14,492 14,883 (3%) 3%

1) Rounding differences may arise in totals.

12

/

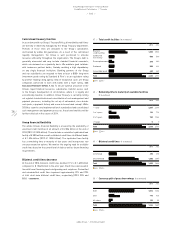

Net sales by product category (€ in millions)

2013 2012 Change Change

(currency-neutral)

Footwear 6,873 6,922 (1%) 4%

Apparel 5,813 6,290 (8%) (3%)

Hardware 1,806 1,671 8% 15%

Total 1) 14,492 14,883 (3%) 3%

1) Rounding differences may arise in totals.

13

/

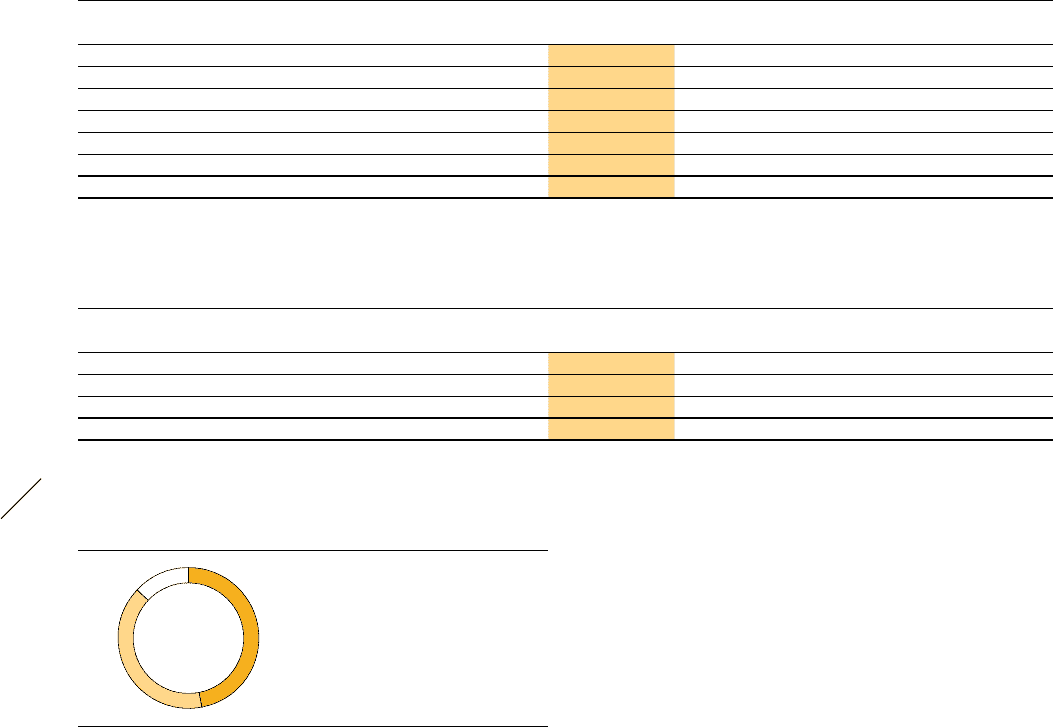

Net sales by product category

2013 1

/

47% Footwear

2

/

40% Apparel

3

/

13% Hardware

1

2

3