Reebok 2013 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

225

2013

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

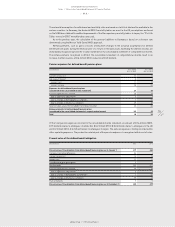

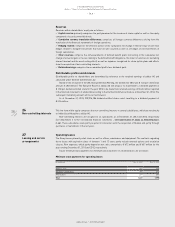

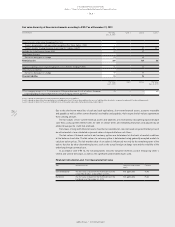

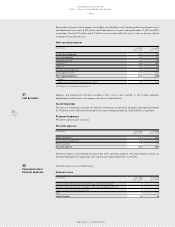

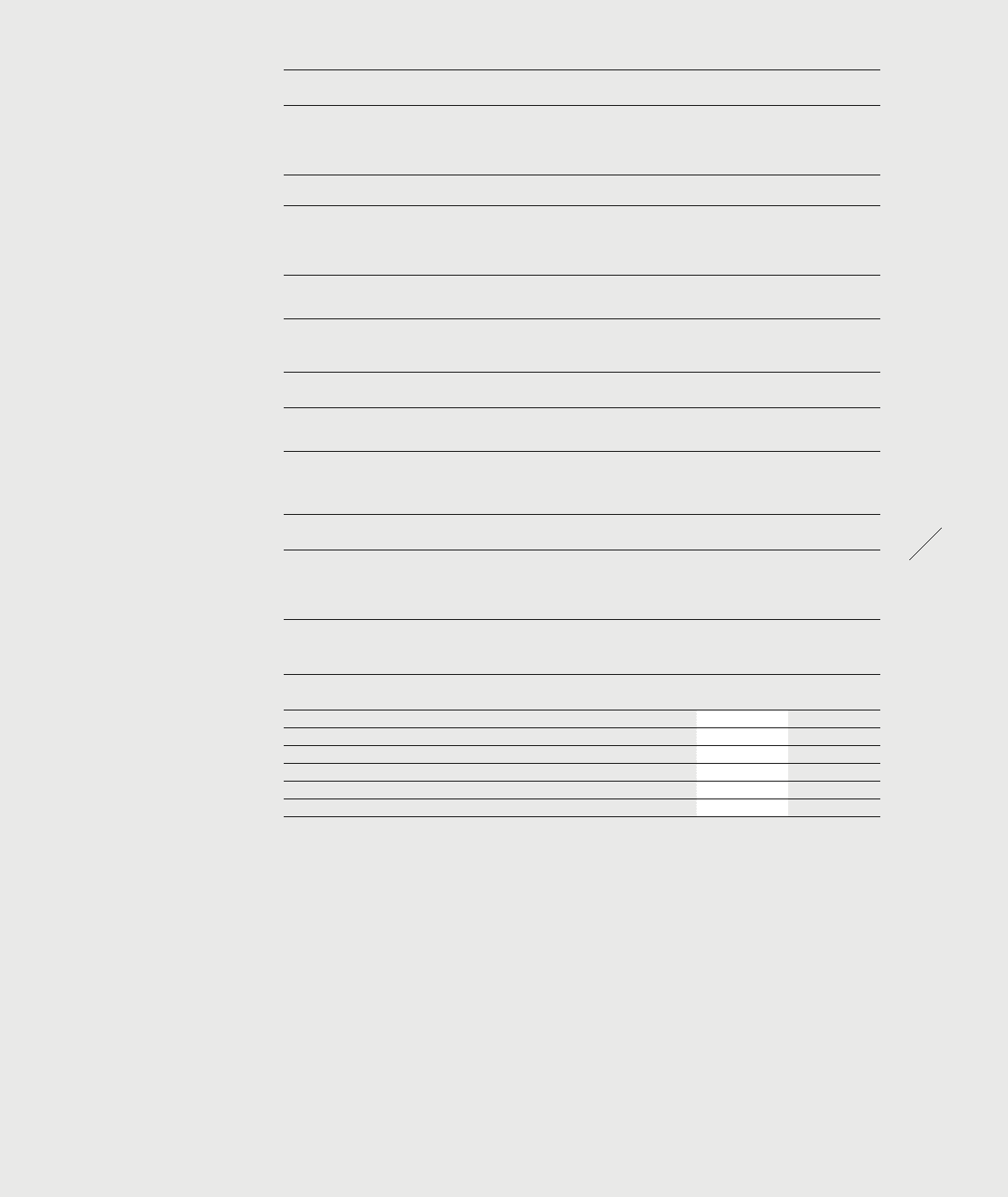

Financial instruments Level 2 measured at fair value

Type Valuation method Significant unobservable

inputs

Category

Short-term financial

assets

The discounted cash flow method is applied, which

considers the present value of expected payments,

discounted using a risk-adjusted discount rate. Due to

their short-term maturities, their respective fair value is

equal to the notional amount.

Not applicable FAHfT

Available-for-sale

financial assets

The fair value is based on the market price of the assets

as at December 31, 2013.

Not applicable AfS

Forward contracts For EUR/USD, the adidas Group applies the par method,

which uses actively traded forward rates. For the other

currency pairs, the zero coupon method is applied.

The zero method is a model for the determination of

forward rates based on deposit and swap interest rates.

Not applicable n.a. respectively

FAHfT

Currency options The adidas Group applies the Garman-Kohlhagen model,

which is an extended version of the Black-Scholes

model.

Not applicable n.a. respectively

FAHfT

Financial instruments Level 2 not measured at fair value

Type Valuation method Significant unobservable

inputs

Category

Private placements The discounted cash flow method is applied, which

considers the present value of expected payments,

discounted using a risk-adjusted discount rate.

Not applicable FLAC

Financial instruments Level 3 measured at fair value

Type Valuation method Significant unobservable

inputs

Category

Investment in

FC Bayern

München AG

This equity security does not have a quoted market price

in an active market. Existing contractual arrangements

(based on the externally observable dividend policy of the

Bayern München AG) are used in order to calculate the

fair value as at December 31, 2013.

See column

“Valuation method”

FAHfT

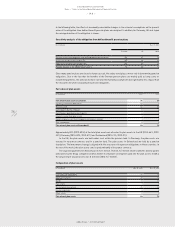

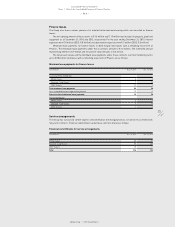

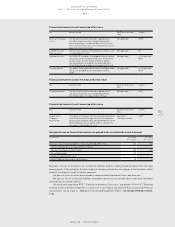

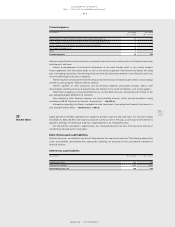

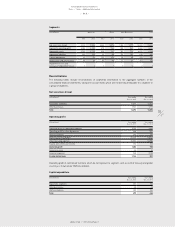

Net gains/losses on financial instruments recognised in the consolidated income statement

(€ in millions) Year ending

Dec. 31, 2013

Year ending

Dec. 31, 2012

Financial assets or financial liabilities at fair value through profit or loss (16) (20)

Thereof: designated as such upon initial recognition — —

Thereof: classified as held for trading (16) (20)

Loans and receivables (13) 1

Available-for-sale financial assets — —

Financial liabilities measured at amortised cost 15 14

Net gains or losses on financial assets or financial liabilities held for trading include the effects from fair value

measurements of the derivatives that are not part of a hedging relationship, and changes in the fair value of other

financial instruments as well as interest payments.

Net gains or losses on loans and receivables comprise mainly impairment losses and reversals.

Net gains or losses on financial liabilities measured at amortised cost include effects from early settlement

and reversals of accrued liabilities.

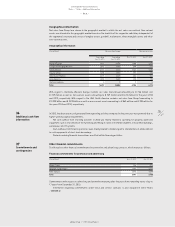

The disclosures required by IFRS 7 “Financial Instruments: Disclosures”, paragraphs 13 A to 13F (“Offsetting

financial assets and financial liabilities”) as well as 31 to 42 (“Nature and Extent of Risks arising from Financial

Instruments”) can be found in

/

NOTE 06 and the Group Management Report

/

SEE RISK AND OPPORTUNITY REPORT,

P. 158.