Reebok 2013 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

210

2013

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

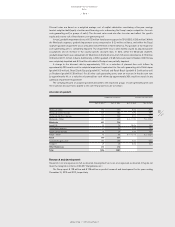

The Group’s outstanding financings are unsecured and may include standard financial covenants, which are

reviewed on a quarterly basis. These covenants may include limits on the disposal of fixed assets, the maximum

amount of debt secured by liens, cross default provisions and change of control. In addition, certain financial

arrangements contain equity ratio covenants, minimum equity covenants as well as net loss covenants.

As at December 31, 2013, and December 31, 2012, shareholders’ equity was well above the amount of the

minimum equity covenant. Likewise, the relevant amount of net income clearly exceeded net loss covenants.

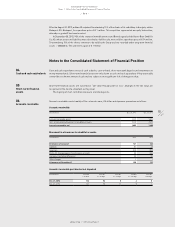

The amounts disclosed as gross borrowings represent outstanding borrowings under the following

arrangements with aggregated expiration dates as follows:

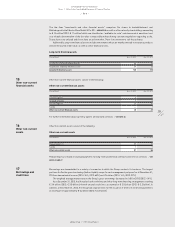

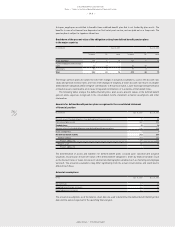

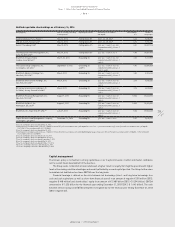

Gross borrowings as at December 31, 2013

(€ in millions) Up to

1 year

Between

1 and 3 years

Between

3 and 5 years

Total

Bank borrowings 126 — — 126

Private placements 55 193 — 248

Eurobond 500 — — 500

Convertible bond — — 460 460

Total 681 193 460 1,334

The above table includes a Eurobond issued on July 6, 2009 in a nominal amount of € 500 million and with a

maturity of five years. The Eurobond with an annual coupon of 4.75% was issued in denominations of € 1,000

each and was priced with a spread of 200 basis points above the respective euro mid-swap. The issue was fixed

at 99.865%.

In addition, gross borrowings include a convertible bond for an aggregate nominal amount of € 500 million

divided into denominations of € 200,000 which was issued on March 21, 2012. The bond has a maximum maturity

(including prolongation options) until June 14, 2019. The coupon of the bond amounts to 0.25% and is payable

annually, commencing on June 14, 2013. The bond is, at the option of the respective holder, convertible at any

time from and including May 21, 2012, up to and including June 5, 2019, into up to 6.02 million new or existing

adidas AG shares. The convertible bond has a conversion premium of 40% above the reference price of € 59.61,

which resulted in an initial conversion price of € 83.46 per share. As a consequence of contractual provisions

relating to dividend protection, the conversion price was adjusted to € 83.10 per share. This adjustment became

effective on May 9, 2013. On June 14, 2017, the bondholders have the right to call the bond at nominal value plus

interest accrued on the nominal amount. adidas AG is entitled to redeem the remaining bonds in whole if, at any

time, the aggregate principal amount of bonds outstanding falls below 15% of the aggregate principal amount of

the bonds that were initially issued. Furthermore, as of July 14, 2017, adidas AG is entitled to redeem the bonds in

whole if on 20 of 30 consecutive trading days, the share price of adidas AG exceeds the current conversion price

of € 83.10 by at least 30%.

According to IAS 32 “Financial Instruments: Presentation”, the conversion right represented in the convertible

bond constitutes a financial instrument which is covered in the capital reserve in an amount of € 55 million after

deduction of the issuance cost. The initial liability component amounted to € 441 million after deduction of the

issuance cost and is shown within long-term borrowings. The initial difference of € 59 million compared to the

nominal amount of € 500 million is accrued as interest expense of the financial liability over the expected maturity

of the convertible bond using the “effective interest method”. As at December 31, 2013, the financial liability

amounted to € 460 million.

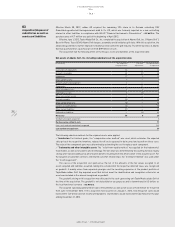

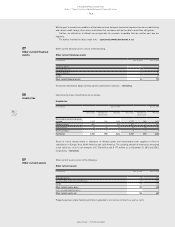

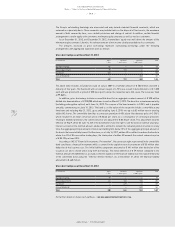

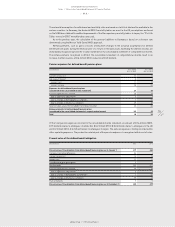

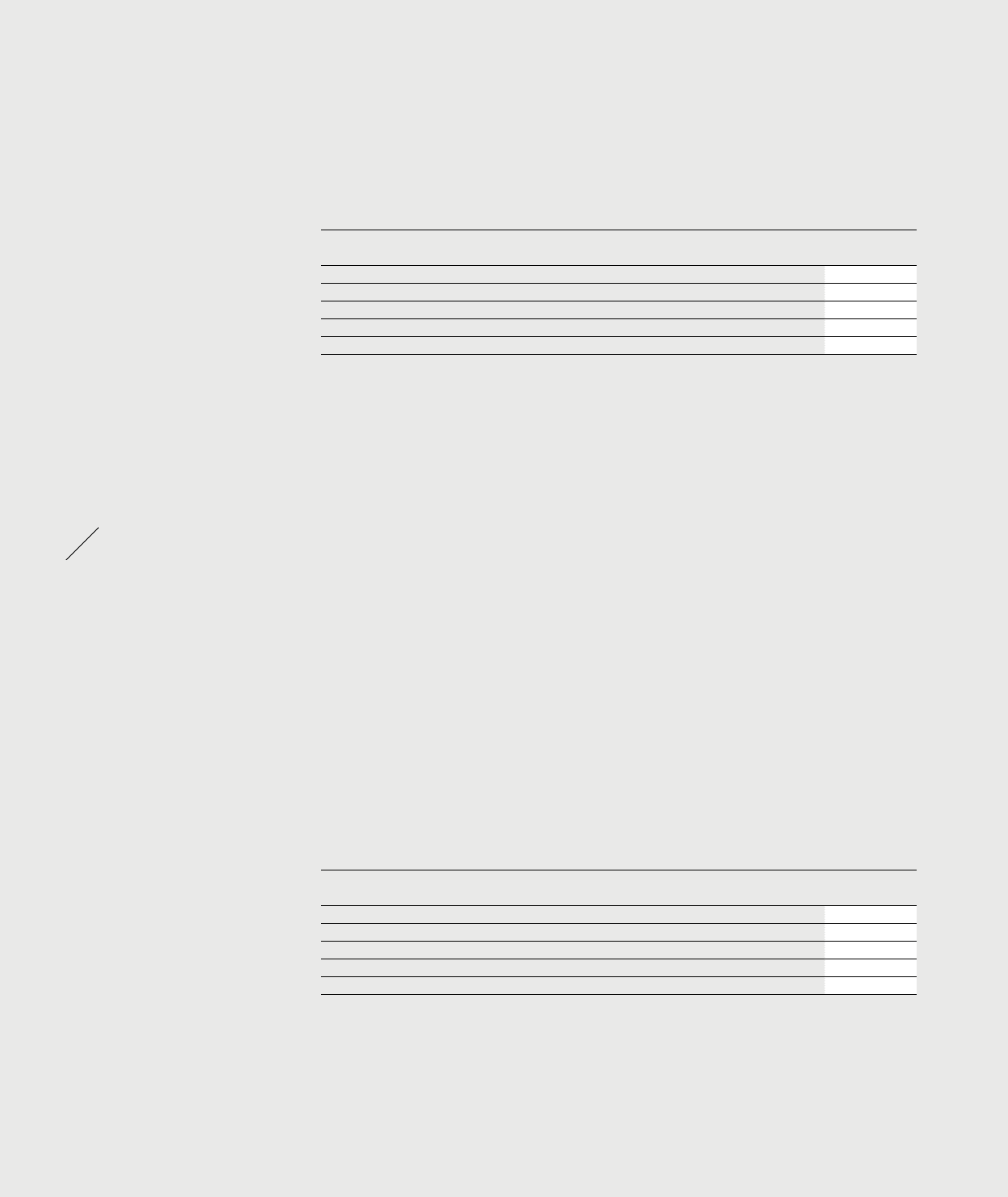

Gross borrowings as at December 31, 2012

(€ in millions) Up to

1 year

Between

1 and 3 years

Between

3 and 5 years

Total

Bank borrowings 59 — — 59

Private placements 221 145 114 480

Eurobond — 499 — 499

Convertible bond — — 449 449

Total 280 644 563 1,487

For further details on future cash outflows

/

SEE RISK AND OPPORTUNITY REPORT, P. 158.