MetLife 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

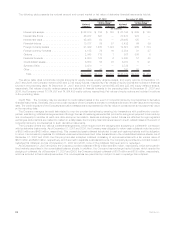

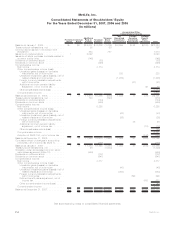

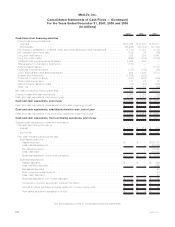

MetLife, Inc.

Consolidated Balance Sheets

December 31, 2007 and 2006

(In millions, except share and per share data)

2007 2006

Assets

Investments:

Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $238,761 and

$236,768, respectively) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $242,242 $241,928

Equity securities available-for-sale, at estimated fair value (cost: $5,891 and $4,549, respectively) . . . . . . . . 6,050 5,094

Trading securities, at estimated fair value (cost: $768 and $727, respectively) . . . . . . . . . . . . . . . . . . . . . 779 759

Mortgageandconsumerloans.................................................... 47,030 42,239

Policyloans................................................................ 10,419 10,228

Realestateandrealestatejointventuresheld-for-investment................................ 6,597 4,802

Realestateheld-for-sale........................................................ 172 184

Otherlimitedpartnershipinterests.................................................. 6,155 4,781

Short-terminvestments ........................................................ 2,648 2,709

Otherinvestedassets ......................................................... 12,642 10,428

Total investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 334,734 323,152

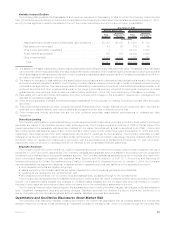

Cashandcashequivalents ....................................................... 10,368 7,107

Accruedinvestmentincome....................................................... 3,630 3,347

Premiumsandotherreceivables .................................................... 14,607 14,490

Deferredpolicyacquisitioncostsandvalueofbusinessacquired............................... 21,521 20,838

Currentincometaxrecoverable..................................................... 303 —

Goodwill.................................................................... 4,910 4,897

Assetsofsubsidiariesheld-for-sale .................................................. — 1,563

Otherassets................................................................. 8,330 7,956

Separate account assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160,159 144,365

Totalassets............................................................ $558,562 $527,715

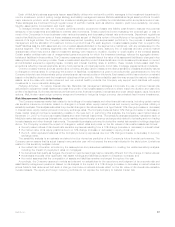

Liabilities and Stockholders’ Equity

Liabilities:

Futurepolicybenefits.......................................................... $132,262 $127,489

Policyholder account balances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 137,349 131,948

Otherpolicyholderfunds........................................................ 10,176 9,139

Policyholderdividendspayable.................................................... 994 960

Policyholderdividendobligation................................................... 789 1,063

Short-termdebt ............................................................. 667 1,449

Long-termdebt.............................................................. 9,628 9,129

Collateralfinancingarrangements.................................................. 5,732 850

Juniorsubordinateddebtsecurities................................................. 4,474 3,780

Sharessubjecttomandatoryredemption............................................. 159 278

Liabilitiesofsubsidiariesheld-for-sale ............................................... — 1,595

Currentincometaxpayable...................................................... — 1,465

Deferredincometaxliability...................................................... 2,457 2,278

Payablesforcollateralundersecuritiesloanedandothertransactions .......................... 44,136 45,846

Otherliabilities .............................................................. 14,401 12,283

Separate account liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160,159 144,365

Total liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 523,383 493,917

Contingencies, Commitments and Guarantees (Note 16)

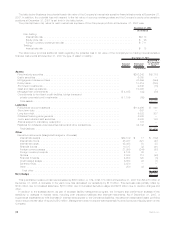

Stockholders’ Equity:

Preferred stock, par value $0.01 per share; 200,000,000 shares authorized; 84,000,000 shares issued and

outstanding;$2,100aggregateliquidationpreference..................................... 1 1

Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 786,766,664 shares issued;

729,223,440 and 751,984,799 shares outstanding at December 31, 2007 and 2006, respectively. . . . . . . . 8 8

Additionalpaid-incapital......................................................... 17,098 17,454

Retainedearnings ............................................................. 19,884 16,574

Treasury stock, at cost; 57,543,224 shares and 34,781,865 shares at December 31, 2007 and 2006,

respectively................................................................ (2,890) (1,357)

Accumulatedothercomprehensiveincome ............................................. 1,078 1,118

Totalstockholders’equity...................................................... 35,179 33,798

Totalliabilitiesandstockholders’equity............................................. $558,562 $527,715

See accompanying notes to consolidated financial statements.

F-2 MetLife, Inc.