MetLife 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.year decrease in DAC amortization resulting from management’s update of assumptions used to determine estimated gross profits in

both the current and prior years, a decrease in liabilities based on a review of outstanding remittances, and growth in its institutional

and universal life businesses. These increases in Mexico’s income from continuing operations were partially offset by lower fees

resulting from management’s update of assumptions used to determine estimated gross profits, the favorable impact in the prior year

associated with a large group policy that was not renewed, a decrease in various one-time revenue items, lower investment yields,

the favorable impact in the prior year of liabilities related to employment matters that were reduced, and the benefit in the prior year

from the elimination of liabilities for pending claims determined to be invalid.

• Taiwan’s income from continuing operations increased primarily driven by an increase due to higher DAC amortization in the prior year

resulting from a loss recognition adjustment and restructuring costs, partially offset by the favorable impact of liability refinements in

the prior year, as well as higher policyholder liabilities related to loss recognition in the fourth quarter of 2006.

• Brazil’s income from continuing operations increased due to the unfavorable impact of increases in policyholder liabilities due to

higher than expected mortality on specific blocks of business and an increase in litigation liabilities in the prior year, the unfavorable

impact of the reversal of a tax credit in the prior year, as well as growth of the in-force business.

• Ireland’s income from continuing operations increased primarily due to the utilization of net operating losses for which a valuation

allowance had been previously established, higher investment income, partially offset by higher start-up expenses and currency

transaction losses.

• Japan’s income from continuing operations increased due to improved hedge results and business growth, partially offset by the

impact of foreign currency transaction losses.

• Hong Kong’s income from continuing operations increased due to the acquisition of the remaining 50% interest in MetLife Fubon and

the resulting consolidation of the operation, as well as business growth.

• Chile’s income from continuing operations increased primarily due to growth of the in-force business, higher joint venture income and

higher returns on inflation indexed securities, partially offset by higher compensation, infrastructure and marketing expenses.

• Income from continuing operations increased in the United Kingdom due to a reduction of claim liabilities resulting from an experience

review, offset by an unearned premium calculation refinement.

• Australia’s income from continuing operations increased due to growth of the in-force business and changes in foreign currency

exchange rates.

• These increases in income from continuing operations were partially offset by a decrease in the home office due to higher economic

capital charges and investment expenses, an increase in contingent tax expenses in the current year, as well as higher spending due

to growth and initiatives, partially offset by the elimination of certain intercompany expenses previously charged to the International

segment, and a tax benefit associated with a prior year income tax expense related to a revision of an estimate.

• India’s income from continuing operations decreased primarily due to headcount increases and growth initiatives, as well as the

impact of valuation allowances established against losses in both years.

• South Korea’s income from continuing operations decreased due to a favorable impact in the prior year associated with the

implementation of a more refined reserve valuation system, as well as additional expenses in the current year associated with growth

and infrastructure initiatives, partially offset by continued growth and lower DAC amortization, both in the variable universal life

business.

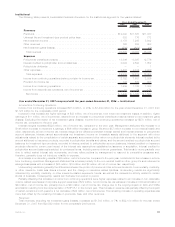

The Institutional segment’s income from continuing operations increased primarily due to lower net investment losses, an increase in

interest margins, an increase in underwriting results, the impact of revisions to certain expenses in both periods, partially offset by higher

expenses due to an increase in non-deferrable volume-related and corporate support expenses and an increase in DAC amortization

resulting from the ongoing implementation of Statement of Position (“SOP”) 05-1, Accounting by Insurance Enterprises for Deferred

Acquisition Costs in Connection with Modifications or Exchanges of Insurance Contracts (“SOP 05-1”) in the current year.

Corporate & Other’s income from continuing operations increased primarily due to higher net investment income, lower net investment

losses, lower corporate expenses, higher other revenues, integration costs incurred in the prior year, and lower legal costs, partially offset

by a decrease in tax benefits, higher interest expense on debt, higher interest on tax contingencies, and higher interest credited to

bankholder deposits.

The Individual segment’s income from continuing operations increased primarily due to a decrease in net investment losses, higher fee

income from separate account products, higher net investment income on blocks of business not driven by interest margins and an

increase in interest margins, partially offset by higher DAC amortization, unfavorable underwriting results in life products, higher general

expenses, the impact of revisions to certain liabilities in both years, the write-off of a receivable in the current year, an increase in the

closed block-related policyholder dividend obligation, higher annuity benefits, an increase in policyholder dividends and an increase in

interest credited to policyholder account balances.

The Auto & Home segment’s income from continuing operations increased primarily due to an increase in premiums and other revenues,

an increase in net investment income, an increase in net investment gains and a decrease in other expenses. These were partially offset by

losses related to higher claim frequencies, higher earned exposures, higher losses due to severity, an increase in unallocated claims

adjusting expenses and an increase from a reduction in favorable development of prior year losses, partially offset by a decrease in

catastrophe losses, which included favorable development of prior year catastrophe reserves, all of which are related to policyholder

benefits and claims. Also offsetting the increase in income from continuing operations was a decrease in average earned premium per

policy and an increase in catastrophe reinsurance costs.

The Reinsurance segment’s income from continuing operations increased primarily due to an increase in premiums due to additional

business in-force from facultative and automatic treaties and renewal premiums on existing blocks of business, an increase in net

investment income due to growth in the asset base, an increase in other revenues and a decrease in other expenses, partially offset by an

increase in net investment losses which was primarily due to a decrease in the fair value of embedded derivatives associated with the

reinsurance of annuity products on a funds withheld basis.

15MetLife, Inc.