MetLife 2007 Annual Report Download - page 58

Download and view the complete annual report

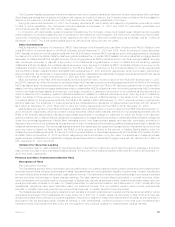

Please find page 58 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company has no obligation to pay dividends accrued for that dividend period whether or not dividends are declared and paid in future

periods. No dividends may, however, be paid or declared on the Holding Company’s common stock — or any other securities ranking

junior to the Preferred Shares — unless the full dividends for the latest completed dividend period on all Preferred Shares, and any parity

stock, have been declared and paid or provided for.

The Holding Company is prohibited from declaring dividends on the Preferred Shares if it fails to meet specified capital adequacy, net

income and shareholders’ equity levels. In addition, under Federal Reserve Board policy, the Holding Company may not be able to pay

dividends if it does not earn sufficient operating income.

The Preferred Shares do not have voting rights except in certain circumstances where the dividends have not been paid for an

equivalent of six or more dividend payment periods whether or not those periods are consecutive. Under such circumstances, the holders

of the Preferred Shares have certain voting rights with respect to members of the Board of Directors of the Holding Company.

The Preferred Shares are not subject to any mandatory redemption, sinking fund, retirement fund, purchase fund or similar provisions.

The Preferred Shares are redeemable, but not prior to September 15, 2010. On and after that date, subject to regulatory approval, the

Preferred Shares will be redeemable at the Holding Company’s option in whole or in part, at a redemption price of $25 per Preferred Share,

plus declared and unpaid dividends.

See “— Liquidity and Capital Resources — The Holding Company — Liquidity Uses — Dividends” for dividends paid on the Company’s

preferred stock.

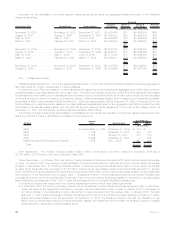

Common Equity Units. In connection with financing the acquisition of Travelers on July 1, 2005, the Holding Company distributed and

sold 82.8 million 6.375% common equity units for $2,070 million in proceeds in a registered public offering on June 21, 2005.

Each common equity unit has an initial stated amount of $25 per unit and consists of:

• a 1/80, or 1.25% ($12.50), undivided beneficial ownership interest in a series A trust preferred security of MetLife Capital Trust II

(“Series A Trust”), with an initial liquidation amount of $1,000.

• a 1/80, or 1.25% ($12.50), undivided beneficial ownership interest in a series B trust preferred security of MetLife Capital Trust III

(“Series B Trust” and, together with the Series A Trust, the “Capital Trusts”), with an initial liquidation amount of $1,000.

• a stock purchase contract under which the holder of the common equity unit will purchase and the Holding Company will sell, on

each of the initial stock purchase date and the subsequent stock purchase date, a variable number of shares of the Holding

Company’s common stock, par value $0.01 per share, for a purchase price of $12.50.

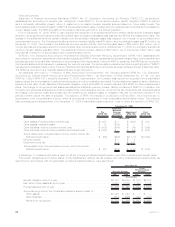

The Holding Company issued $1,067 million 4.82% Series A and $1,067 million 4.91% Series B junior subordinated debt securities due

no later than February 15, 2039 and February 15, 2040, respectively, for a total of $2,134 million, in exchange for $2,070 million in

aggregate proceeds from the sale of the trust preferred securities by the Capital Trusts and $64 million in trust common securities issued

equally by the Capital Trusts. The common and preferred securities of the Capital Trusts, totaling $2,134 million, represent undivided

beneficial ownership interests in the assets of the Capital Trusts, have no stated maturity and must be redeemed upon maturity of the

corresponding series of junior subordinated debt securities — the sole assets of the respective Capital Trusts. The Series A Trust and

Series B Trust will each make quarterly distributions on the common and preferred securities at an annual rate of 4.82% and 4.91%,

respectively.

The Holding Company has directly guaranteed the repayment of the trust preferred securities to the holders thereof to the extent that

there are funds available in the Capital Trusts. The guarantee will remain in place until the full redemption of the trust preferred securities.

The trust preferred securities held by the common equity unit holders are pledged to the Holding Company to collateralize the obligation of

the common equity unit holders under the related stock purchase contracts. The common equity unit holder may substitute certain zero

coupon treasury securities in place of the trust preferred securities as collateral under the stock purchase contract.

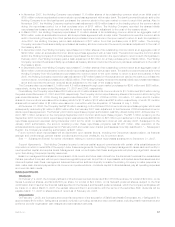

The trust preferred securities have remarketing dates which correspond with the initial and subsequent stock purchase dates to provide

the holders of the common equity units with the proceeds to exercise the stock purchase contracts. The initial stock purchase date is

expected to be August 15, 2008, but could be deferred for quarterly periods until February 15, 2009, and the subsequent stock purchase

date is expected to be February 15, 2009, but could be deferred for quarterly periods until February 15, 2010. At the remarketing date, the

remarketing agent will have the ability to reset the interest rate on the trust preferred securities to generate sufficient remarketing proceeds

to satisfy the common equity unit holder’s obligation under the stock purchase contract, subject to a reset cap for each of the first two

attempted remarketings of each series. The interest rate on the supporting junior subordinated debt securities issued by the Holding

Company will be reset at a commensurate rate. If the initial remarketing is unsuccessful, the remarketing agent will attempt to remarket the

trust preferred securities, as necessary, in subsequent quarters through February 15, 2009 for the Series A trust preferred securities and

through February 15, 2010 for the Series B trust preferred securities. The final attempt at remarketing will not be subject to the reset cap. If

all remarketing attempts are unsuccessful, the Holding Company has the right, as a secured party, to apply the liquidation amount on the

trust preferred securities to the common equity unit holders obligation under the stock purchase contract and to deliver to the common

equity unit holder a junior subordinated debt security payable on August 15, 2010 at an annual rate of 4.82% and 4.91% on the Series A

and Series B trust preferred securities, respectively, in payment of any accrued and unpaid distributions.

Each stock purchase contract requires (i) the Holding Company to pay the holder of the common equity unit quarterly contract

payments on the stock purchase contracts at the annual rate of 1.510% on the stated amount of $25 per stock purchase contract until the

initial stock purchase date and at the annual rate of 1.465% on the remaining stated amount of $12.50 per stock purchase contract

thereafter; and (ii) the holder of the common equity unit to purchase, and the Holding Company to sell, for $12.50, on each of the initial

stock purchase date and the subsequent stock purchase date, a number of newly issued or treasury shares of the Holding Company’s

common stock, par value $0.01 per share, equal to the applicable settlement rate. The settlement rate at the respective stock purchase

date will be calculated based on the closing price of the common stock during a specified 20-day period immediately preceding the

applicable stock purchase date. Accordingly, upon settlement in the aggregate, the Holding Company will receive proceeds of $2,070 mil-

lion and issue between 39.0 million and 47.8 million shares of its common stock. The stock purchase contract may be exercised at the

option of the holder at any time prior to the settlement date. However, upon early settlement, the holder will receive the minimum settlement

rate.

54 MetLife, Inc.