MetLife 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

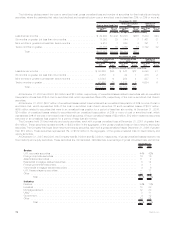

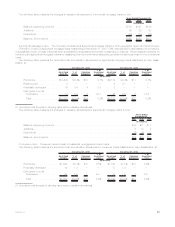

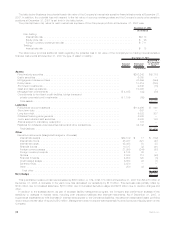

Variable Interest Entities

The following table presents the total assets of and maximum exposure to loss relating to VIEs for which the Company has concluded

that: (i) it is the primary beneficiary and which are consolidated in the Company’s consolidated financial statements at December 31, 2007;

and (ii) it holds significant variable interests but it is not the primary beneficiary and which have not been consolidated:

Total

Assets(1)

Maximum

Exposure to

Loss(2) Total

Assets(1)

Maximum

Exposure to

Loss(2)

Primary Beneficiary Not Primary Beneficiary

December 31, 2007

(In millions)

Asset-backed securitizations and collateralized debt obligations . . . . . $1,167 $1,167 $ 1,591 $ 184

Realestatejointventures(3)............................. 48 26 276 42

Otherlimitedpartnershipinterests(4) ....................... 2 1 42,141 2,080

Trustpreferredsecurities(5)............................. 105 105 48,232 3,369

Otherinvestments(6) ................................. 1,119 1,119 3,258 260

Total........................................... $2,441 $2,418 $95,498 $5,935

(1) The assets of the asset-backed securitizations and collateralized debt obligations are reflected at fair value. The assets of the real estate

joint ventures, other limited partnership interests, trust preferred securities and other investments are reflected at the carrying amounts at

which such assets would have been reflected on the Company’s consolidated balance sheet had the Company consolidated the VIE from

the date of its initial investment in the entity.

(2) The maximum exposure to loss relating to the asset-backed securitizations and collateralized debt obligations is equal to the carrying

amounts of retained interests. In addition, the Company provides collateral management services for certain of these structures for which

it collects a management fee. The maximum exposure to loss relating to real estate joint ventures, other limited partnership interests, trust

preferred securities and other investments is equal to the carrying amounts plus any unfunded commitments, reduced by amounts

guaranteed by other partners. Such a maximum loss would be expected to occur only upon bankruptcy of the issuer or investee.

(3) Real estate joint ventures include partnerships and other ventures which engage in the acquisition, development, management and

disposal of real estate investments.

(4) Other limited partnership interests include partnerships established for the purpose of investing in public and private debt and equity

securities.

(5) Trust preferred securities are complex, uniquely structured investments which contain features of both equity and debt, may have an

extended or no stated maturity, and may be callable at the issuer’s option after a defined period of time.

(6) Other investments include securities that are not trust preferred securities, asset-backed securitizations or collateralized debt

obligations.

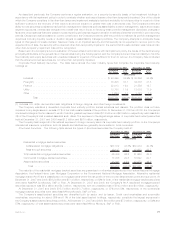

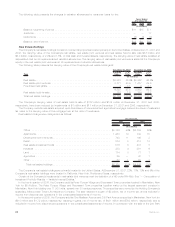

Securities Lending

The Company participates in a securities lending program whereby blocks of securities, which are included in fixed maturity and equity

securities, are loaned to third parties, primarily major brokerage firms. The Company requires a minimum of 102% of the fair value of the

loaned securities to be separately maintained as collateral for the loans. Securities with a cost or amortized cost of $41.1 billion and

$43.3 billion and an estimated fair value of $42.1 billion and $44.1 billion were on loan under the program at December 31, 2007 and 2006,

respectively. Securities loaned under such transactions may be sold or repledged by the transferee. The Company was liable for cash

collateral under its control of $43.3 billion and $45.4 billion at December 31, 2007 and 2006, respectively. Security collateral of $40 million

and $100 million on deposit from customers in connection with the securities lending transactions at December 31, 2007 and 2006,

respectively, may not be sold or repledged and is not reflected in the consolidated financial statements.

Separate Accounts

The Company held $160.2 billion and $144.4 billion in separate accounts, for which the Company does not bear investment risk, as of

December 31, 2007 and 2006, respectively. The Company manages each separate account’s assets in accordance with the prescribed

investment policy that applies to that specific separate account. The Company establishes separate accounts on a single client and multi-

client commingled basis in compliance with insurance laws. Effective with the adoption of SOP 03-1, Accounting and Reporting by

Insurance Enterprises for Certain Nontraditional Long-Duration Contracts and for Separate Accounts, on January 1, 2004, the Company

reported separately, as assets and liabilities, investments held in separate accounts and liabilities of the separate accounts if:

• such separate accounts are legally recognized;

• assets supporting the contract liabilities are legally insulated from the Company’s general account liabilities;

• investments are directed by the contractholder; and

• all investment performance, net of contract fees and assessments, is passed through to the contractholder.

The Company reports separate account assets meeting such criteria at their fair value. Investment performance (including investment

income, net investment gains (losses) and changes in unrealized gains (losses)) and the corresponding amounts credited to contrac-

tholders of such separate accounts are offset within the same line in the consolidated statements of income.

The Company’s revenues reflect fees charged to the separate accounts, including mortality charges, risk charges, policy administration

fees, investment management fees and surrender charges. Separate accounts not meeting the above criteria are combined on a

line-by-line basis with the Company’s general account assets, liabilities, revenues and expenses.

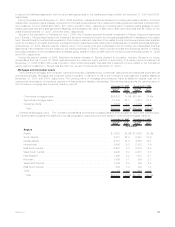

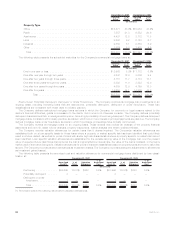

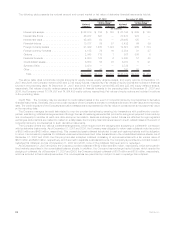

Quantitative and Qualitative Disclosures About Market Risk

The Company must effectively manage, measure and monitor the market risk associated with its invested assets and interest rate

sensitive insurance contracts. It has developed an integrated process for managing risk, which it conducts through its Corporate Risk

85MetLife, Inc.