MetLife 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Summary

Statement of Financial Accounting Standards (“SFAS”) No. 87, Employers’ Accounting for Pensions (“SFAS 87”), as amended,

establishes the accounting for pension plan obligations. Under SFAS 87, the projected pension benefit obligation (“PBO”) is defined

as the actuarially calculated present value of vested and non-vested pension benefits accrued based on future salary levels. The

accumulated pension benefit obligation (“ABO”) is the actuarial present value of vested and non-vested pension benefits accrued based on

current salary levels. The PBO and ABO of the pension plans are set forth in the following section.

Prior to December 31, 2006, SFAS 87 also required the recognition of an additional minimum pension liability and an intangible asset

(limited to unrecognized prior service cost) if the market value of pension plan assets was less than the ABO at the measurement date. The

excess of the additional minimum pension liability over the allowable intangible asset was charged, net of taxes, to accumulated other

comprehensive income. The Company’s additional minimum pension liability was $78 million, and the intangible asset was $12 million, at

December 31, 2005. The excess of the additional minimum pension liability over the intangible asset of $66 million ($41 million, net of

income tax) was recorded as a reduction of accumulated other comprehensive income. At December 31, 2006, the Company’s additional

minimum pension liability was $92 million. The additional minimum pension liability of $59 million, net of income tax of $33 million, was

recorded as a reduction of accumulated other comprehensive income.

SFAS No. 106, Employers Accounting for Postretirement Benefits Other than Pensions, as amended, (“SFAS 106”), establishes the

accounting for expected postretirement plan benefit obligations (“EPBO”) which represents the actuarial present value of all postretirement

benefits expected to be paid after retirement to employees and their dependents. Unlike the PBO for pensions, the EPBO is not recorded in

the financial statements but is used in measuring the periodic expense. The accumulated postretirement plan benefit obligation (“APBO”)

represents the actuarial present value of future postretirement benefits attributed to employee services rendered through a particular date.

The APBO is recorded in the financial statements and is set forth below.

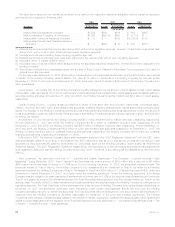

As described more fully in “— Adoption of New Accounting Pronouncements”, the Company adopted SFAS No. 158, Employers’

Accounting for Defined Benefit Pension and Other Postretirement Plans —an amendment of FASB Statements No. 87, 88, 106, and

SFAS No. 132(r) (“SFAS 158”), effective December 31, 2006. Upon adoption, the Company was required to recognize in the consolidated

balance sheet the funded status of defined benefit pension and other postretirement plans. Funded status is measured as the difference

between the fair value of plan assets and the benefit obligation, which is the PBO for pension plans and the APBO for other postretirement

plans. The change to recognize funded status eliminated the additional minimum pension liability provisions of SFAS 87. In addition, the

Company recognized as an adjustment to accumulated other comprehensive income, net of income tax, those amounts of actuarial gains

and losses, prior service costs and credits, and the remaining net transition asset or obligation that had not yet been included in net

periodic benefit cost at the date of adoption. The adoption of SFAS 158 resulted in a reduction of $744 million, net of income tax, to

accumulated other comprehensive income, which is included as a component of total consolidated stockholders’ equity. The following

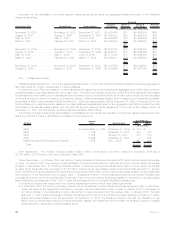

table summarizes the adjustments to the December 31, 2006 consolidated balance sheet in order to effect the adoption of SFAS 158.

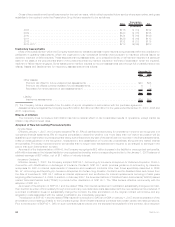

Balance Sheet Caption

Pre

SFAS 158

Adjustments

Additional

Minimum

Pension

Liability

Adjustment

Adoption of

SFAS 158

Adjustment

Post

SFAS 158

Adjustments

December 31, 2006

(In millions)

Otherassets:Prepaidpensionbenefitcost................ $1,937 $— $ (993) $ 944

Otherassets:Intangibleasset ........................ $ 12 $(12) $ — $ —

Other liabilities: Accrued pension benefit cost . . . . . . . . . . . . . . $ (505) $(14) $ (79) $ (598)

Other liabilities: Accrued other postretirement benefit cost . . . . . . $ (802) $ — $ (99) $ (901)

Accumulated other comprehensive income, before income tax:

Definedbenefitplans............................. $ (66) $(26) $(1,171) $(1,263)

Minorityinterest.................................. $— $ 8

Deferredincometax............................... $ 8 $ 419

Accumulated other comprehensive income, net of income tax:

Definedbenefitplans............................. $ (41) $(18) $ (744) $ (803)

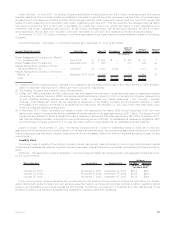

A December 31 measurement date is used for all the Company’s defined benefit pension and other postretirement benefit plans.

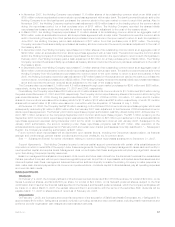

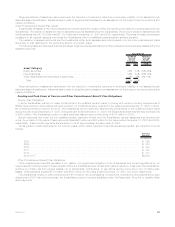

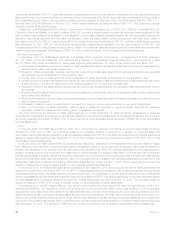

The benefit obligations and funded status of the Subsidiaries’ defined benefit pension and other postretirement benefit plans, as

determined in accordance with the applicable provisions described above, were as follows:

2007 2006 2007 2006

Pension Benefits

Other

Postretirement

Benefits

December 31,

(In millions)

Benefitobligationatendofyear ................................ $5,775 $5,959 $1,610 $2,073

Fairvalueofplanassetsatendofyear............................ 6,550 6,305 1,183 1,172

Fundedstatusatendofyear .................................. $ 775 $ 346 $ (427) $ (901)

Amounts recognized in the consolidated balance sheet consist of:

Otherassets........................................... $1,393 $ 944 $ — $ —

Otherliabilities.......................................... (618) (598) (427) (901)

Netamountrecognized .................................... $ 775 $ 346 $ (427) $ (901)

60 MetLife, Inc.