MetLife 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.iv) the application of the consolidation rules to certain investments;

v) the fair value of and accounting for derivatives;

vi) the capitalization and amortization of DAC and the establishment and amortization of VOBA;

vii) the measurement of goodwill and related impairment, if any;

viii) the liability for future policyholder benefits;

ix) accounting for income taxes and the valuation of deferred tax assets;

x) accounting for reinsurance transactions;

xi) accounting for employee benefit plans; and

xii) the liability for litigation and regulatory matters.

The application of purchase accounting requires the use of estimation techniques in determining the fair values of assets acquired and

liabilities assumed — the most significant of which relate to the aforementioned critical estimates. In applying these policies, management

makes subjective and complex judgments that frequently require estimates about matters that are inherently uncertain. Many of these

policies, estimates and related judgments are common in the insurance and financial services industries; others are specific to the

Company’s businesses and operations. Actual results could differ from these estimates.

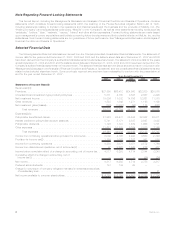

Investments

The Company’s principal investments are in fixed maturity and equity securities, mortgage and consumer loans, policy loans, real

estate, real estate joint ventures and other limited partnerships, short-term investments, and other invested assets. The Company’s

investments are exposed to three primary sources of risk: credit, interest rate and market valuation. The financial statement risks, stemming

from such investment risks, are those associated with the determination of fair values, the recognition of impairments, the recognition of

income on certain investments, and the potential consolidation of previously unconsolidated subsidiaries.

The Company’s investments in fixed maturity and equity securities are classified as available-for-sale, except for trading securities, and

are reported at their estimated fair value. The fair values for public fixed maturity securities and public equity securities are based on quoted

market prices or estimates from independent pricing services. However, in cases where quoted market prices are not available, such as for

private fixed maturities, fair values are estimated using present value or valuation techniques. The determination of fair values in the

absence of quoted market prices is based on: (i) valuation methodologies; (ii) securities the Company deems to be comparable; and

(iii) assumptions deemed appropriate given the circumstances. The fair value estimates are made at a specific point in time, based on

available market information and judgments about financial instruments, including estimates of the timing and amounts of expected future

cash flows and the credit standing of the issuer or counterparty. Factors considered in estimating fair value include: coupon rate, maturity,

estimated duration, call provisions, sinking fund requirements, credit rating, industry sector of the issuer, and quoted market prices of

comparable securities. The use of different methodologies and assumptions may have a material effect on the estimated fair value

amounts.

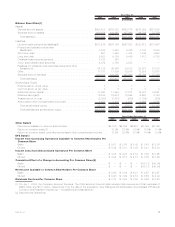

One of the significant estimates related to available-for-sale securities is the evaluation of investments for other-than-temporary

impairments. The assessment of whether impairments have occurred is based on management’s case-by-case evaluation of the

underlying reasons for the decline in fair value. The Company’s review of its fixed maturity and equity securities for impairments includes

an analysis of the total gross unrealized losses by three categories of securities: (i) securities where the estimated fair value had declined

and remained below cost or amortized cost by less than 20%; (ii) securities where the estimated fair value had declined and remained

below cost or amortized cost by 20% or more for less than six months; and (iii) securities where the estimated fair value had declined and

remained below cost or amortized cost by 20% or more for six months or greater. Additionally, management considers a wide range of

factors about the security issuer and uses its best judgment in evaluating the cause of the decline in the estimated fair value of the security

and in assessing the prospects for near-term recovery. Inherent in management’s evaluation of the security are assumptions and estimates

about the operations of the issuer and its future earnings potential. Considerations used by the Company in the impairment evaluation

process include, but are not limited to:

i) the length of time and the extent to which the market value has been below cost or amortized cost;

ii) the potential for impairments of securities when the issuer is experiencing significant financial difficulties;

iii) the potential for impairments in an entire industry sector or sub-sector;

iv) the potential for impairments in certain economically depressed geographic locations;

v) the potential for impairments of securities where the issuer, series of issuers or industry has suffered a catastrophic type of

loss or has exhausted natural resources;

vi) the Company’s ability and intent to hold the security for a period of time sufficient to allow for the recovery of its value to an

amount equal to or greater than cost or amortized cost;

vii) unfavorable changes in forecasted cash flows on mortgage-backed and asset-backed securities; and

viii) other subjective factors, including concentrations and information obtained from regulators and rating agencies.

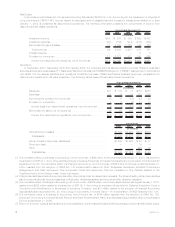

The cost of fixed maturity and equity securities is adjusted for impairments in value deemed to be other-than-temporary in the period in

which the determination is made. These impairments are included within net investment gains (losses) and the cost basis of the fixed

maturity and equity securities is reduced accordingly. The Company does not change the revised cost basis for subsequent recoveries in

value.

The determination of the amount of allowances and impairments on other invested asset classes is highly subjective and is based upon

the Company’s periodic evaluation and assessment of known and inherent risks associated with the respective asset class. Such

evaluations and assessments are revised as conditions change and new information becomes available. Management updates its

evaluations regularly and reflects changes in allowances and impairments in operations as such evaluations are revised.

The recognition of income on certain investments (e.g. loan-backed securities, including mortgage-backed and asset-backed

securities, certain investment transactions, trading securities, etc.) is dependent upon market conditions, which could result in prepay-

ments and changes in amounts to be earned.

Additionally, when the Company enters into certain structured investment transactions, real estate joint ventures and other limited

partnerships for which the Company may be deemed to be the primary beneficiary under Financial Accounting Standards Board (“FASB”)

Interpretation (“FIN”) No. 46(r), Consolidation of Variable Interest Entities — An Interpretation of ARB No. 51, it may be required to

9MetLife, Inc.