MetLife 2007 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

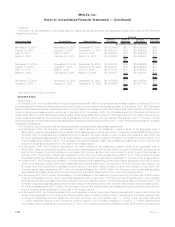

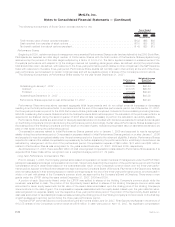

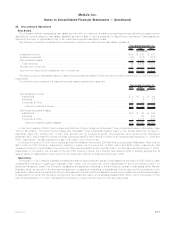

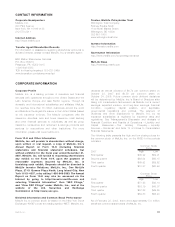

For the Year Ended

December 31, 2006 Institutional Individual Auto &

Home International Reinsurance Corporate &

Other Total

(In millions)

Statement of Income:

Premiums ....................... $ 11,867 $ 4,516 $2,924 $ 2,722 $ 4,348 $ 35 $ 26,412

Universal life and investment- type product

policyfees ..................... 775 3,201 — 804 — — 4,780

Net investment income . . . . . . . . . . . . . . . 7,265 6,912 177 950 732 1,046 17,082

Otherrevenues.................... 685 527 22 28 66 34 1,362

Net investment gains (losses) . . . . . . . . . . . (631) (598) 4 (10) 7 (154) (1,382)

Policyholder benefits and claims . . . . . . . . . 13,367 5,409 1,717 2,411 3,490 37 26,431

Interest credited to policyholder

account balances . . . . . . . . . . . . . . . . . 2,593 2,035 — 289 254 — 5,171

Policyholderdividends ............... — 1,697 6 (2) — — 1,701

Other expenses. . . . . . . . . . . . . . . . . . . . 2,314 3,519 845 1,529 1,227 1,349 10,783

Income (loss) from continuing operations before

provision (benefit) for income tax . . . . . . . . . . 1,687 1,898 559 267 182 (425) 4,168

Provision (benefit) for income tax. . . . . . . . . 562 652 143 95 64 (419) 1,097

Income (loss) from continuing operations . . . 1,125 1,246 416 172 118 (6) 3,071

Income from discontinued operations, net of

incometax ..................... 42 18 — 28 — 3,134 3,222

Netincome ...................... $ 1,167 $ 1,264 $ 416 $ 200 $ 118 $ 3,128 $ 6,293

Balance Sheet:

Total assets . . . . . . . . . . . . . . . . . . . . . . $190,963 $243,604 $5,467 $22,724 $18,818 $46,139 $527,715

DAC and VOBA . . . . . . . . . . . . . . . . . . . . $ 1,370 $ 13,996 $ 190 $ 2,117 $ 3,152 $ 13 $ 20,838

Goodwill ........................ $ 977 $ 2,957 $ 157 $ 301 $ 96 $ 409 $ 4,897

Separate account assets. . . . . . . . . . . . . . $ 47,047 $ 94,124 $ — $ 3,178 $ 16 $ — $144,365

Policyholder liabilities . . . . . . . . . . . . . . . . $113,205 $117,866 $3,453 $13,544 $13,332 $ 9,199 $270,599

Separate account liabilities . . . . . . . . . . . . $ 47,047 $ 94,124 $ — $ 3,178 $ 16 $ — $144,365

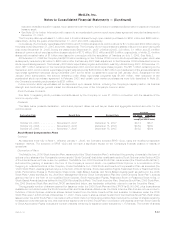

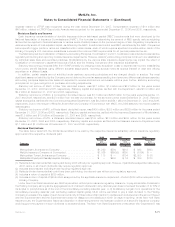

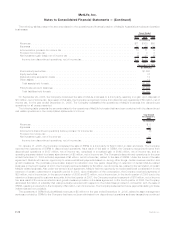

For the Year Ended

December 31, 2005 Institutional Individual Auto &

Home International Reinsurance Corporate &

Other Total

(In millions)

Statement of Income:

Premiums ......................... $11,387 $4,485 $2,911 $2,186 $3,869 $ 22 $24,860

Universal life and investment- type product

policyfees....................... 772 2,476 — 579 — 1 3,828

Net investment income. . . . . . . . . . . . . . . . . 5,942 6,534 181 794 606 699 14,756

Otherrevenues...................... 653 477 33 20 58 30 1,271

Netinvestmentgains(losses) ............ (10) (50) (12) 12 22 (48) (86)

Policyholder benefits and claims . . . . . . . . . . 12,776 5,417 1,994 2,128 3,206 (15) 25,506

Interest credited to policyholder

accountbalances................... 1,652 1,775 — 240 220 — 3,887

Policyholderdividends................. 1 1,670 3 5 — — 1,679

Other expenses . . . . . . . . . . . . . . . . . . . . . 2,229 3,264 828 997 991 955 9,264

Income (loss) from continuing operations before

provision (benefit) for income tax . . . . . . . . . . . . 2,086 1,796 288 221 138 (236) 4,293

Provision (benefit) for income tax . . . . . . . . . . 698 594 64 35 46 (215) 1,222

Income (loss) from continuing operations . . . . . 1,388 1,202 224 186 92 (21) 3,071

Income from discontinued operations, net of

incometax....................... 174 296 — 6 — 1,167 1,643

Netincome........................ $ 1,562 $1,498 $ 224 $ 192 $ 92 $1,146 $ 4,714

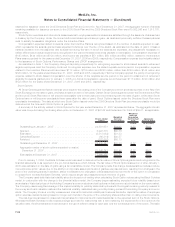

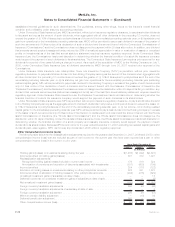

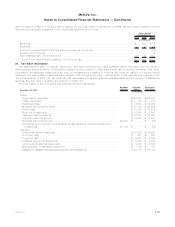

Net investment income and net investment gains (losses) are based upon the actual results of each segment’s specifically identifiable

asset portfolio adjusted for allocated equity. Other costs are allocated to each of the segments based upon: (i) a review of the nature of

such costs; (ii) time studies analyzing the amount of employee compensation costs incurred by each segment; and (iii) cost estimates

included in the Company’s product pricing.

Revenues derived from any customer did not exceed 10% of consolidated revenues for the years ended December 31, 2007, 2006 and

2005. Revenues from U.S. operations were $45.4 billion, $41.9 billion and $39.5 billion for the years ended December 31, 2007, 2006 and

2005, respectively, which represented 86%, 87% and 89%, respectively, of consolidated revenues.

F-76 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)