MetLife 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$4.3 billion, of which $1.6 billion is deductible for income tax purposes. Further information on goodwill is described in Note 6. See Note 5

for the VOBA acquired as part of the acquisition and Note 7 for the value of distribution agreements (“VODA”) and the value of customer

relationships acquired (“VOCRA”).

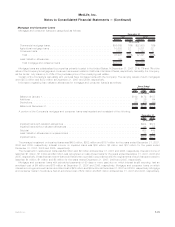

As part of the integration of Travelers’ operations, management approved and initiated plans to reduce approximately 1,000 domestic

and international Travelers positions, which was completed in December 2006. MetLife initially recorded restructuring costs, including

severance, relocation and outplacement services of Travelers’ employees, as liabilities assumed in the purchase business combination of

$49 million. For the years ended December 31, 2006 and 2005, the liability for restructuring costs was reduced by $4 million and $1 million,

respectively, due to a reduction in the estimate of severance benefits to be paid to Travelers employees. The restructuring costs associated

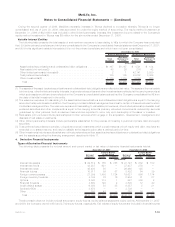

with the Travelers acquisition were as follows:

2006 2005

Years Ended December 31,

(In millions)

BalanceatJanuary1,................................................... $28 $—

Acquisition.......................................................... — 49

Cashpayments....................................................... (24) (20)

Otherreductions ...................................................... (4) (1)

BalanceatDecember31, ................................................ $— $28

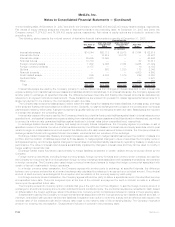

Other Acquisitions and Dispositions

On June 28, 2007, the Company acquired the remaining 50% interest in a joint venture in Hong Kong, MetLife Fubon Limited (“MetLife

Fubon”),for$56millionincash,resultinginMetLifeFubonbecoming a consolidated subsidiary of the Company. The transaction was

treated as a step acquisition, and at June 30, 2007, total assets and liabilities of MetLife Fubon of $839 million and $735 million,

respectively, were included in the Company’s consolidated balance sheet. The Company’s investment for the initial 50% interest in MetLife

Fubon was $48 million. The Company used the equity method of accounting for such investment in MetLife Fubon. The Company’s share

of the joint venture’s results for the six months ended June 30, 2007, was a loss of $3 million. The fair value of the assets acquired and the

liabilities assumed in the step acquisition at June 30, 2007, was $427 million and $371 million, respectively. No additional goodwill was

recorded as a part of the step acquisition. As a result of this acquisition, additional VOBA and VODA of $45 million and $5 million,

respectively, were recorded and both have a weighted average amortization period of 16 years. Further information on VOBA and VODA is

described in Note 5 and Note 7, respectively.

On June 1, 2007, the Company completed the sale of its Bermuda insurance subsidiary, MetLife International Insurance, Ltd. (“MLII”), to

athirdpartyfor$33millionincashconsideration,resultinginagainupondisposalof$3million,netofincometax.ThenetassetsofMLIIat

disposal were $27 million. A liability of $1 million was recorded with respect to a guarantee provided in connection with this disposition.

Further information on guarantees is described in Note 16.

On September 1, 2005, the Company completed the acquisition of CitiStreet Associates, a division of CitiStreet LLC, which is primarily

involved in the distribution of annuity products and retirement plans to the education, healthcare, and not-for-profit markets, for $56 million,

of which $2 million was allocated to goodwill and $54 million to other identifiable intangibles, specifically the value of customer relationships

acquired, which have a weighted average amortization period of 16 years. CitiStreet Associates was integrated with MetLife Resources, a

focused distribution channel of MetLife, which is dedicated to provide retirement plans and financial services to the same markets. Further

information on goodwill and VOCRA is described in Note 6 and Note 7, respectively.

See Note 23 for information on the disposition of the annuities and pension businesses of MetLife Insurance Limited (“MetLife

Australia”), P.T. Sejahtera (“MetLife Indonesia”) and SSRM Holdings, Inc. (“SSRM”).

See Note 25 for information on the Company’s acquisitions subsequent to December 31, 2007.

F-24 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)