MetLife 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

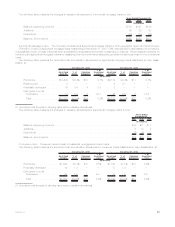

As described previously, the Company performs a regular evaluation, on a security-by-security basis, of its investment holdings in

accordance with its impairment policy in order to evaluate whether such securities are other-than-temporarily impaired. One of the criteria

which the Company considers in its other-than-temporary impairment analysis is its intent and ability to hold securities for a period of time

sufficient to allow for the recovery of their value to an amount equal to or greater than cost or amortized cost. The Company’s intent and

ability to hold securities considers broad portfolio management objectives such as asset/liability duration management, issuer and industry

segment exposures, interest rate views and the overall total return focus. In following these portfolio management objectives, changes in

facts and circumstances that were present in past reporting periods may trigger a decision to sell securities that were held in prior reporting

periods. Decisions to sell are based on current conditions or the Company’s need to shift the portfolio to maintain its portfolio management

objectives including liquidity needs or duration targets on asset/liability managed portfolios. The Company attempts to anticipate these

types of changes and if a sale decision has been made on an impaired security and that security is not expected to recover prior to the

expected time of sale, the security will be deemed other-than-temporarily impaired in the period that the sale decision was made and an

other-than-temporary impairment loss will be recognized.

Based upon the Company’s current evaluation of the securities in accordance with its impairment policy, the cause of the decline being

principally attributable to the general rise in interest rates during the holding period, and the Company’s current intent and ability to hold the

fixed maturity and equity securities with unrealized losses for a period of time sufficient for them to recover, the Company has concluded

that the aforementioned securities are not other-than-temporarily impaired.

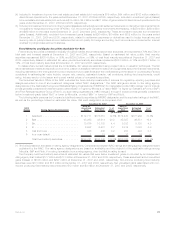

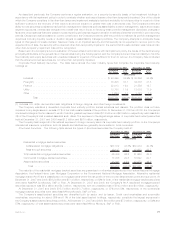

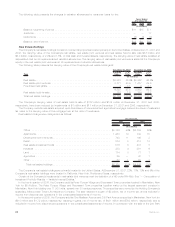

Corporate Fixed Maturity Securities. The table below shows the major industry types that comprise the corporate fixed maturity

holdings at:

Estimated

Fair Value %of

Tot al Estimated

Fair Value %of

Tot al

December 31, 2007 December 31, 2006

(In millions)

Industrial ............................................. $ 40,399 34.9% $ 39,296 35.9%

Foreign(1) ............................................ 38,305 33.1 34,338 31.5

Finance.............................................. 22,013 19.0 21,559 19.7

Utility................................................ 13,780 11.9 13,038 11.9

Other ............................................... 1,234 1.1 1,181 1.0

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $115,731 100.0% $109,412 100.0%

(1) Includes U.S. dollar-denominated debt obligations of foreign obligors, and other foreign investments.

The Company maintains a diversified corporate fixed maturity portfolio across industries and issuers. The portfolio does not have

exposure to any single issuer in excess of 1% of the total invested assets of the portfolio. At December 31, 2007 and 2006, the Company’s

combined holdings in the ten issuers to which it had the greatest exposure totaled $7.8 billion and $6.8 billion, respectively, each less than

3% of the Company’s total invested assets at such dates. The exposure to the largest single issuer of corporate fixed maturity securities

held at December 31, 2007 and 2006 was $1.2 billion and $970 million, respectively.

The Company has hedged all of its material exposure to foreign currency risk in its corporate fixed maturity portfolio. In the Company’s

international insurance operations, both its assets and liabilities are generally denominated in local currencies.

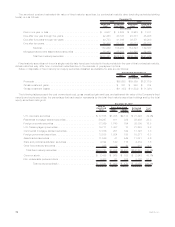

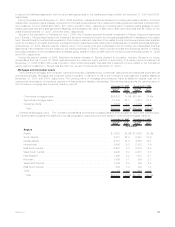

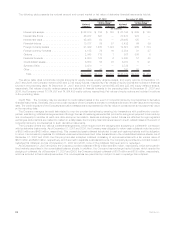

Structured Securities. The following table shows the types of structured securities the Company held at:

Estimated

Fair Value %of

Total Estimated

Fair Value %of

Tot al

December 31, 2007 December 31, 2006

(In millions)

Residential mortgage-backed securities:

Collateralizedmortgageobligations............................ $37,372 43.8% $33,034 40.3%

Pass-throughsecurities ................................... 19,117 22.4 18,632 22.7

Totalresidentialmortgage-backedsecurities ....................... 56,489 66.2 51,666 63.0

Commercialmortgage-backedsecurities.......................... 17,728 20.8 16,522 20.1

Asset-backedsecurities .................................... 11,041 13.0 13,873 16.9

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $85,258 100.0% $82,061 100.0%

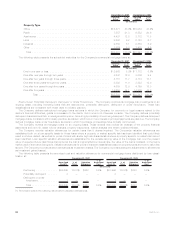

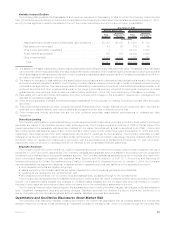

The majority of the residential mortgage-backed securities are guaranteed or otherwise supported by the Federal National Mortgage

Association, the Federal Home Loan Mortgage Corporation or the Government National Mortgage Association. Alternative residential

mortgage loans (“Alt-A”) are a classification of mortgage loans where the risk profile of the borrower falls between prime and sub-prime. At

December 31, 2007 and 2006, $56.2 billion and $51.0 billion, respectively, or 99% for both, of the residential mortgage-backed securities

were rated Aaa/AAA by Moody’s, S&P or Fitch. At December 31, 2007 and 2006, the Company’s Alt-A residential mortgage-backed

securities exposure was $6.4 billion and $4.8 billion, respectively, with an unrealized loss of $143 million and $4 million, respectively.

At December 31, 2007 and 2006, $15.5 billion and $13.7 billion, respectively, or 87% and 83%, respectively, of the commercial

mortgage-backed securities were rated Aaa/AAA by Moody’s, S&P or Fitch.

The Company’s asset-backed securities are diversified both by sector and by issuer. Credit card receivables and automobile

receivables, accounting for about 36% and 11% of the total asset-backed holdings, respectively, constitute the largest exposures in

the Company’s asset-backed securities portfolio. At December 31, 2007 and 2006, $6.0 billion and $7.9 billion, respectively, or 54% and

57%, respectively, of total asset-backed securities were rated Aaa/AAA by Moody’s, S&P or Fitch.

77MetLife, Inc.