MetLife 2007 Annual Report Download - page 61

Download and view the complete annual report

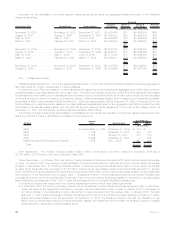

Please find page 61 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• In November 2007, the Holding Company repurchased 11.6 million shares of its outstanding common stock at an initial cost of

$750 million under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the stock sold to the

Holding Company from third parties and purchased the common stock in the open market to return to such third parties. Also, in

November 2007, the Holding Company received a cash adjustment of $19 million based on the trading price of the common stock

during the repurchase period, for a final purchase price of $731 million. The Holding Company recorded the shares initially

repurchased as treasury stock and recorded the amount received as an adjustment to the cost of the treasury stock.

• In March 2007, the Holding Company repurchased 11.9 million shares of its outstanding common stock at an aggregate cost of

$750 million under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the common stock

sold to the Holding Company from third parties and purchased common stock in the open market to return to such third parties. In

June 2007, the Holding Company paid a cash adjustment of $17 million for a final purchase price of $767 million. The Holding

Company recorded the shares initially repurchased as treasury stock and recorded the amount paid as an adjustment to the cost of

the treasury stock.

• In December 2006, the Holding Company repurchased 4.0 million shares of its outstanding common stock at an aggregate cost of

$232 million under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the common stock

sold to the Holding Company from third parties and purchased the common stock in the open market to return to such third parties. In

February 2007, the Holding Company paid a cash adjustment of $8 million for a final purchase price of $240 million. The Holding

Company recorded the shares initially repurchased as treasury stock and recorded the amount paid as an adjustment to the cost of

the treasury stock.

• In December 2004, the Holding Company repurchased 7.3 million shares of its outstanding common stock at an aggregate cost of

$300 million under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the stock sold to the

Holding Company from third parties and purchased the common stock in the open market to return to such third parties. In April

2005, the Holding Company received a cash adjustment of $7 million based on the actual amount paid by the bank to purchase the

common stock, for a final purchase price of $293 million. The Holding Company recorded the shares initially repurchased as treasury

stock and recorded the amount received as an adjustment to the cost of the treasury stock.

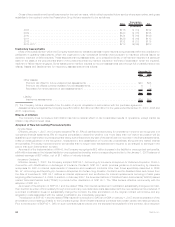

The Company also repurchased 3.1 million and 4.6 million shares through open market purchases for $200 million and $268 million,

respectively, during the years ended December 31, 2007 and 2006, respectively.

Cumulatively, the Company repurchased 26.6 million and 8.6 million shares of its common stock for $1.7 billion and $500 million during

the years ended December 31, 2007 and 2006, respectively. The Company did not repurchase any shares of its common stock during the

year ended December 31, 2005. During the years ended December 31, 2007, 2006 and 2005, 3.9 million, 3.1 million and 25.0 million

shares of common stock were issued from treasury stock for $172 million, $102 million and $819 million, respectively, of which 22.4 million

shares with a market value of $1 billion were issued in connection with the acquisition of Travelers of July 1, 2005.

At December 31, 2006, the Company had $216 million remaining on the October 2004 common stock repurchase program which was

subsequently reduced by $8 million to $208 million after the February 2007 cash adjustment to the December 2006 accelerated common

stock repurchase agreement. The February 2007 stock repurchase program authorization was fully utilized during 2007. At December 31,

2007, $511 million remained on the Company’s September 2007 common stock repurchase program. The $511 million remaining on the

September 2007 common stock repurchase program was reduced by $450 million to $61 million upon settlement of the accelerated stock

repurchase agreement executed during December 2007 but for which no settlement occurred until January 2008. Subsequent to the

January 2008 authorization, the amount remaining under these repurchase programs was $1,061 million. After execution of the

accelerated stock repurchase agreement in February 2008 and certain open market purchases as more fully described in “— Subsequent

Events”, the Company’s remaining authorization is $261 million.

Future common stock repurchases will be dependent upon several factors, including the Company’s capital position, its financial

strength and credit ratings, general market conditions and the price of MetLife, Inc.’s common stock.

See “— Subsequent Events” for further information relating to common stock repurchases subsequent to December 31, 2007.

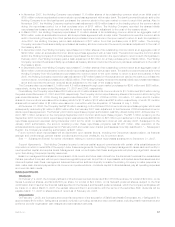

Support Agreements. The Holding Company is party to various capital support commitments with certain of its subsidiaries and a

corporation in which it owns 50% of the equity. Under these arrangements, the Holding Company has agreed to cause each such entity to

meet specified capital and surplus levels. Management does not anticipate that these arrangements will place any significant demands

upon the Holding Company’s liquidity resources.

Based on management’s analysis and comparison of its current and future cash inflows from the dividends it receives from subsidiaries

that are permitted to be paid without prior insurance regulatory approval, its portfolio of liquid assets, anticipated securities issuances and

other anticipated cash flows, management believes there will be sufficient liquidity to enable the Holding Company to make payments on

debt, make cash dividend payments on its common and preferred stock, contribute capital to its subsidiaries, pay all operating expenses

and meet its cash needs.

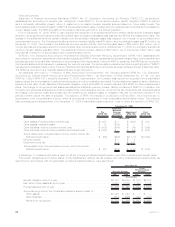

Subsequent Events

Dividends

On February 19, 2008, the Company’s Board of Directors announced dividends of $0.3785745 per share, for a total of $9 million, on its

Series A preferred shares, and $0.4062500 per share, for a total of $24 million, on its Series B preferred shares, subject to the final

confirmation that it has met the financial tests specified in the Series A and Series B preferred shares, which the Company anticipates will

be made on or about March 5, 2008, the earliest date permitted in accordance with the terms of the securities. Both dividends will be

payable March 17, 2008 to shareholders of record as of February 29, 2008.

Acquisitions

On February 1, 2008, the Company announced its completion of the acquisition of SafeGuard Health Enterprises, Inc. (“Safeguard”) for

approximately $190 million. Safeguard is primarily involved in providing dental and vision benefit plans, including health maintenance and

preferred provider organization plan designs and administrative services.

57MetLife, Inc.