MetLife 2007 Annual Report Download - page 53

Download and view the complete annual report

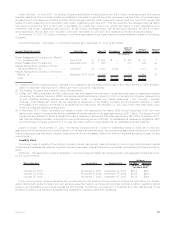

Please find page 53 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Junior subordinated debt bears interest at fixed interest rates through their respective redemption dates. Interest was computed using

the stated rate on the obligation through the scheduled redemption date as it is the Company’s expectation that the debt will be

redeemed at that time. Inclusion of interest payments on junior subordinated debt through the final maturity date would increase the

contractual obligation by $6.2 billion.

Shares subject to mandatory redemption bear interest at fixed interest rates through their respective mandatory redemption dates.

Interest on shares subject to mandatory redemption was computed using the stated fixed rate on the obligation through maturity.

Long-term debt also includes payments under capital lease obligations of $13 million, $15 million, $3 million and $24 million, in the less

than one year, one to three years, three to five years and more than five years categories, respectively.

(5) The Company has accepted cash collateral in connection with securities lending and derivative transactions. As the securities lending

transactions expire within the next year or the timing of the return of the collateral is uncertain, the return of the collateral has been

included in the less than one year category in the table above. The Company also holds non-cash collateral, which is not reflected as a

liability in the consolidated balance sheet, of $718 million as of December 31, 2007.

(6) The Company commits to lend funds under mortgage loans, partnerships, bank credit facilities, bridge loans and private corporate

bond investments. In the table above, the timing of the funding of mortgage loans and private corporate bond investments is based on

the expiration date of the commitment. As it relates to commitments to lend funds to partnerships and under bank credit facilities, the

Company anticipates that these amounts could be invested any time over the next five years; however, as the timing of the fulfillment of

the obligation cannot be predicted, such obligations are presentedinthelessthanoneyearcategoryinthetableabove.Commitments

to fund bridge loans are short-term obligations and, as a result, are presented in the less than one year category in the table above. See

“— Off-Balance Sheet Arrangements.”

(7) As a lessee, the Company has various operating leases, primarily for office space. Contractual provisions exist that could increase or

accelerate those leases obligations presented, including various leases with early buyouts and/or escalation clauses. However, the

impact of any such transactions would not be material to the Company’s financial position or results of operations. See “— Off-Balance

Sheet Arrangements.”

(8) Other includes those other liability balances which represent contractual obligations, as well as other miscellaneous contractual

obligations of $32 million not included elsewhere in the table above. Other liabilities presented in the table above is principally

comprised of amounts due under reinsurance arrangements, payables related to securities purchased but not yet settled, securities

sold short, accrued interest on debt obligations, fair value of derivative obligations, deferred compensation arrangements, guaranty

liabilities, the fair value of forward stock purchase contracts, as well as general accruals and accounts payable due under contractual

obligations. If the timing of any of the other liabilities is sufficiently uncertain, the amounts are included within the less than one year

category.

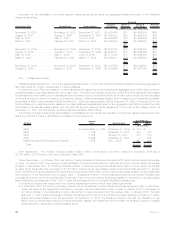

The other liabilities presented in the table above differs from the amount presented in the consolidated balance sheet by $6.1 billion

due primarily to the exclusion of items such as minority interests, legal liabilities, pension and postretirement benefit obligations, taxes

due other than income tax, unrecognized tax benefits and related accrued interest, accrued severance and employee incentive

compensation and other liabilities such as deferred gains and losses. Such items have been excluded from the table above as they

represent accounting conventions or are not liabilities due under contractual obligations.

The net funded status of the Company’s pension and other postretirement liabilities included within other liabilities has been excluded

from the amounts presented in the table above. Rather, the amounts presented represent the discretionary contributions of $150 million

to be made by the Company to the pension plan in 2008 and the discretionary contributions of $116 million, based on the next year’s

expected gross benefit payments to participants, to be made by the Company to the postretirement benefit plans during 2008. Virtually

all contributions to the pension and postretirement benefit plans are made by the insurance subsidiaries of the Holding Company with

little impact on the Holding Company’s cash flows.

Excluded from the table above are deferred income tax liabilities, unrecognized tax benefits, and accrued interest of $2.5 billion,

$1.0 billion, and $252 million, respectively, for which the Company cannot reliably determine the timing of payment. Current income tax

payable is also excluded from the table.

See also “— Off-Balance Sheet Arrangements.”

Separate account liabilities are excluded from the table above. Separate account liabilities represent the fair market value of the funds

that are separately administered by the Company. Generally, the separate account owner, rather than the Company, bears the investment

risk of these funds. The separate account liabilities are legally segregated and are not subject to the claims that arise out of any other

business of the Company. Net deposits, net investment income and realized and unrealized capital gains and losses on the separate

accounts are not reflected in the consolidated statements of income. The separate account liabilities will be fully funded by cash flows from

theseparateaccountassets.

The Company also enters into agreements to purchase goods and services in the normal course of business; however, these purchase

obligations are not material to its consolidated results of operations or financial position as of December 31, 2007.

Additionally, the Company has agreements in place for services it conducts, generally at cost, between subsidiaries relating to

insurance, reinsurance, loans, and capitalization. Intercompany transactions have appropriately been eliminated in consolidation. Inter-

company transactions among insurance subsidiaries and affiliates have been approved by the appropriate departments of insurance as

required.

Support Agreements. The Holding Company and several of its subsidiaries (each, an “Obligor”) are parties to various capital support

commitments, guarantees and contingent reinsurance agreements with certain subsidiaries of the Holding Company and a corporation in

which the Holding Company owns 50% of the equity. Under these arrangements, each Obligor, with respect to the applicable entity, has

agreed to cause such entity to meet specified capital and surplus levels, has guaranteed certain contractual obligations or has agreed to

provide, upon the occurrence of certain contingencies, reinsurance for such entity’s insurance liabilities or for certain policies reinsured by

such entity. Management does not anticipate that these arrangements will place any significant demands upon the Company’s liquidity

resources.

49MetLife, Inc.