MetLife 2007 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Senior Notes

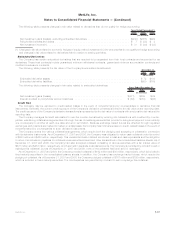

In March 2007, RGA issued $300 million of 10-year senior notes with a fixed rate of 5.625%, payable semiannually. RGA used

$50 million of the net proceeds of the offering to repay existing debt during the year ended December 31, 2007.

The Holding Company repaid a $500 million 5.25% senior note which matured in December 2006 and a $1,006 million 3.911% senior

note which matured in May 2005. RGA repaid a $100 million 7.25% senior note which matured in April 2006.

In connection with financing the acquisition of Travelers on July 1, 2005, which is described in Note 2, the Holding Company issued the

following debt:

In June 2005, the Holding Company issued $1,000 million aggregate principal amount of 5.00% senior notes due June 15, 2015 at a

discount of $2.7 million ($997.3 million) and $1,000 million aggregate principal amount of 5.70% senior notes due June 15, 2035 at a

discount of $2.4 million ($997.6 million). In connection with the offering, the Holding Company incurred $12.4 million of issuance costs

which have been capitalized and included in other assets. These costs are being amortized using the effective interest method over the

respective term of the related senior notes.

In June 2005, the Holding Company issued 400 million pounds sterling ($729.2 million at issuance) aggregate principal amount of

5.25% senior notes due June 29, 2020 at a discount of 4.5 million pounds sterling ($8.1 million at issuance), for aggregate proceeds of

395.5 million pounds sterling ($721.1 million at issuance). The senior notes were initially offered and sold outside the United States in

reliance upon Regulation S under the Securities Act of 1933, as amended (the “Securities Act”). In connection with the offering, the Holding

Company incurred $3.7 million of issuance costs which have been capitalized and included in other assets. These costs are being

amortized using the effective interest method over the term of the related senior notes.

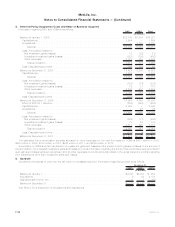

Repurchase Agreements with Federal Home Loan Bank

MetLife Bank, National Association (“MetLife Bank”) is a member of the FHLB of NY and holds $64 million and $54 million of common

stock of the FHLB of NY at December 31, 2007 and 2006, respectively, which is included in equity securities. MetLife Bank has also

entered into repurchase agreements with the FHLB of NY whereby MetLife Bank has issued repurchase agreements in exchange for cash

and for which the FHLB of NY has been granted a blanket lien on MetLife Bank’s residential mortgages and mortgage-backed securities to

collateralize MetLife Bank’s obligations under the repurchase agreements. MetLife Bank maintains control over these pledged assets, and

may use, commingle, encumber or dispose of any portion of the collateral as long as there is no event of default and the remaining qualified

collateral is sufficient to satisfy the collateral maintenance level. The repurchase agreements and the related security agreement

represented by this blanket lien provide that upon any event of default by MetLife Bank, the FHLB of NY’s recovery is limited to the

amount of MetLife Bank’s liability under the outstanding repurchase agreements. During the years ended December 31, 2007, 2006 and

2005, MetLife Bank received advances totaling $390 million, $260 million and $775 million, respectively, from the FHLB of NY. MetLife

Bank also made repayments of $175 million, $117 million and $25 million, respectively, for the years ended December 31, 2007, 2006 and

2005. The amount of the Company’s liability for repurchase agreements with the FHLB of NY was $1.2 billion and $998 million at

December 31, 2007 and 2006, respectively, which is included in long-term debt. The advances on these repurchase agreements are

collateralized by residential mortgage-backed securities and residential mortgage loans with fair values of $1.3 billion at both December 31,

2007 and 2006.

Surplus Notes

MLIC repaid a $250 million 7% surplus note which matured on November 1, 2005.

Short-term Debt

During the years ended December 31, 2007, 2006 and 2005, the Company’s short-term debt consisted of commercial paper with a

weighted average interest rate of 5.0%, 5.2% and 3.4%, respectively. During the years ended December 31, 2007, 2006 and 2005, the

commercial paper’s average daily balance was $1.6 billion, $1.9 billion and $1.0 billion, respectively, and was outstanding for an average

of 30 days, 39 days and 53 days, respectively.

Interest Expense

Interest expense related to the Company’s indebtedness included in other expenses was $633 million, $664 million and $529 million for

the years ended December 31, 2007, 2006 and 2005, respectively, and does not include interest expense on collateral financing

arrangements, junior subordinated debt securities, common equity units or shares subject to mandatory redemption. See Notes 11, 12, 13

and 14.

F-46 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)