MetLife 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for general corporate purposes and at December 31, 2007, $3.0 billion of the facilities also served as back-up lines of credit for the

Company’s commercial paper programs.

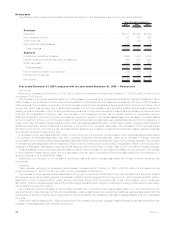

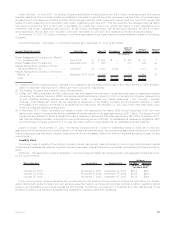

Information on these credit facilities as of December 31, 2007 is as follows:

Borrower(s) Expiration Capacity

Letter of

Credit

Issuances Drawdowns Unused

Commitments

(In millions)

MetLife, Inc. and MetLife Funding, Inc. . . . . . . June 2012 (1) $3,000 $1,532 $— $1,468

MetLifeBank,N.A. ................... July2008 (2) 200 — — 200

Reinsurance Group of America, Incorporated . . May 2008 30 — 30 —

Reinsurance Group of America, Incorporated . . September 2012(3) 750 406 — 344

Reinsurance Group of America, Incorporated . . March 2011 44 — — 44

Total........................... $4,024 $1,938 $30 $2,056

(1) In June 2007, the Holding Company and MetLife Funding entered into a $3.0 billion credit agreement with various financial institutions,

the proceeds of which are available to be used for general corporate purposes, to support their commercial paper programs and for the

issuance of letters of credit. All borrowings under the credit agreement must be repaid by June 2012, except that letters of credit

outstanding upon termination may remain outstanding until June 2013. The borrowers and the lenders under this facility may agree to

extend the term of all or part of the facility to no later than June 2014, except that letters of credit outstanding upon termination may

remain outstanding until June 2015. The $1.5 billion credit agreement, with an April 2009 expiration, and the $1.5 billion credit

agreement, with an April 2010 expiration, were both terminated in June 2007 and replaced by the aforementioned facility.

(2) In July 2007, the facility was extended for one year to July 2008.

(3) In September 2007, RGA and certain of its subsidiaries entered into a credit agreement with various financial institutions. Under the

credit agreement, RGA may borrow and obtain letters of credit for general corporate purposes for its own account or for the account of

its subsidiaries with an overall credit facility amount of up to $750 million. The credit agreement replaced a former credit agreement in

the amount of $600 million which was scheduled to expire on September 29, 2010.

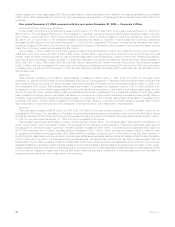

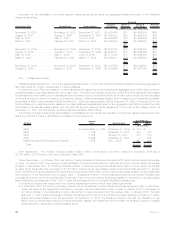

Committed Facilities. Information on committed facilities as of December 31, 2007 is as follows:

Account Party/Borrower(s) Expiration Capacity Drawdowns

Letter of

Credit

Issuances Unused

Commitments Maturity

(Years)

(In millions)

Exeter Reassurance Company Ltd.,

MetLife, Inc., & Missouri Re . . . . . . . . . . . . . June 2016 (1) $ 500 $ — $ 490 $ 10 8

Exeter Reassurance Company Ltd. . . . . . . . . . December 2027 (2) 650 — 410 240 20

Timberlake Financial L.L.C. . . . . . . . . . . . . . . June 2036 (3) 1,000 850 — 150 29

MetLife Reinsurance Company of

South Carolina & MetLife, Inc. . . . . . . . . . . . June 2037 (4) 3,500 2,382 — 1,118 30

MetLife Reinsurance Company of

Vermont & MetLife, Inc. . . . . . . . . . . . . . . . December 2037 (2),(5) 2,896 — 1,235 1,661 30

Total ............................ $8,546 $3,232 $2,135 $3,179

(1) Letters of credit and replacements or renewals thereof issued under this facility of $280 million, $10 million and $200 million are set to

expire no later than December 2015, March 2016 and June 2016, respectively.

(2) The Holding Company is a guarantor under this agreement.

(3) As described under “— Liquidity and Capital Resources — The Company — Liquidity Sources — Debt Issuances”, RGA may, at its

option, offer up to $150 million of additional notes under this facility in the future.

(4) In May 2007, MRSC terminated the $2.0 billion amended and restated five-year letter of credit and reimbursement agreement entered

into among the Holding Company, MRSC and various financial institutions on April 25, 2005. In its place the Company entered into a

30-year collateral financing arrangement as described under “Liquidity Sources — Debt Issuances”, which may be extended by

agreementoftheCompanyandthefinancialinstitutiononeachanniversaryoftheclosingofthefacilityforanadditionalone-year

period. At December 31, 2007, $2.4 billion had been drawn upon under the collateral financing arrangement.

(5) In December 2007, Exeter Reassurance Company Ltd. (“Exeter”) terminated four letters of credit, with expirations from March 2025

through December 2026, that were issued under a letter of credit facility with an unaffiliated financial institution in an aggregate amount

of $1.7 billion. The letters of credit had served as collateral for Exeter’s obligations under a reinsurance agreement that was recaptured

by MetLife Investors USA Insurance Company (“MLI-USA”) in December 2007. MLI-USA immediately thereafter entered into a new

reinsurance agreement with MetLife Reinsurance Company of Vermont (“MRV”). To collateralize its reinsurance obligations, MRV and

the Holding Company entered into a 30-year, $2.9 billion letter of credit facility with an unaffiliated financial institution.

Letters of Credit. At December 31, 2007, the Company had outstanding $4.2 billion in letters of credit, all of which are associated with

the aforementioned credit facilities, from various financial institutions, of which $2.1 billion and $1.9 billion were part of committed and

credit facilities, respectively. As commitments associated with letters of credit and financing arrangements may expire unused, these

amounts do not necessarily reflect the Company’s actual future cash funding requirements.

46 MetLife, Inc.