MetLife 2007 Annual Report Download - page 144

Download and view the complete annual report

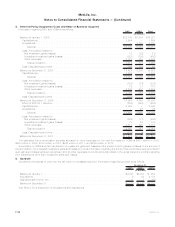

Please find page 144 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.credit facilities, respectively. As commitments associated with letters of credit and financing arrangements may expire unused, these

amounts do not necessarily reflect the Company’s actual future cash funding requirements.

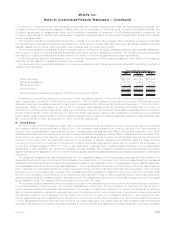

11. Collateral Financing Arrangements

Associated with the Closed Block

In December 2007, MLIC reinsured a portion of its closed block liabilities to MetLife Reinsurance Company of Charleston (“MRC”), a

wholly-owned subsidiary of the Company. In connection with this transaction, MRC issued, to investors placed by an unaffiliated financial

institution, $2.5 billion of 35-year surplus notes to provide statutory reserve support for the assumed closed block liabilities. Interest on the

surplus notes accrues at an annual rate of 3-month LIBOR plus 55 basis points, payable quarterly. The ability of MRC to make interest and

principal payments on the surplus notes is contingent upon South Carolina regulatory approval.

Simultaneous with issuing the surplus notes, the Holding Company entered into an agreement with the unaffiliated financial institution,

under which the Holding Company is entitled to the interest paid by MRC on the surplus notes of 3-month LIBOR plus 55 basis points in

exchange for the payment of 3-month LIBOR plus 112 basis points, payable quarterly. Under this agreement, the Holding Company may

also be required to make payments to the unaffiliated financial institution related to any decline in the market value of the surplus notes and

in connection with any early termination of this agreement.

A majority of the proceeds from the offering of the surplus notes were placed in trust to support MRC’s statutory obligations associated

with the assumed closed block liabilities. The trust is a VIE which is consolidated by the Company.

At December 31, 2007, the Company held assets in trust of $1.9 billion associated with the transaction. The Company’s consolidated

balance sheet includes these assets as fixed maturity securities. The Company’s consolidated statement of income includes the

investment returns on the assets held as collateral as net investment income and the interest on the collateral financing arrangement

is included as a component of other expenses.

Total interest expense was $5 million for the year ended December 31, 2007.

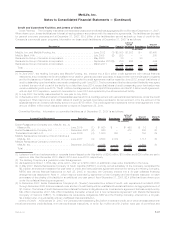

Associated with Secondary Guarantees

In May 2007, the Holding Company and MRSC entered into a 30-year collateral financing arrangement with an unaffiliated financial

institution that provides up to $3.5 billion of statutory reserve support for MRSC associated with reinsurance obligations under

intercompany reinsurance agreements. Such statutory reserves are associated with universal life secondary guarantees and are required

under U.S. Valuation of Life Policies Model Regulation (commonly referred to as Regulation A-XXX). At December 31, 2007, $2.4 billion had

been drawn upon under the collateral financing arrangement. The collateral financing arrangement may be extended by agreement of the

Holding Company and the unaffiliated financial institution on each anniversary of the closing.

Proceeds from the collateral financing arrangement were placed in trust to support MRSC’s statutory obligations associated with the

reinsurance of secondary guarantees. The trust is a VIE which is consolidated by the Company. The unaffiliated financial institution is

entitled to the return on the investment portfolio held by the trust.

Simultaneous with entering into the collateral financing arrangement, the Holding Company entered into an agreement with the same

unaffiliated financial institution under which the Holding Company is entitled to the return on the investment portfolio held by the trust

established in connection with this collateral financing arrangement in exchange for the payment of a stated rate of return to the unaffiliated

financial institution of 3-month LIBOR plus 70 basis points, payable quarterly. The Holding Company may also be required to make

payments to the unaffiliated financial institution, for deposit into the trust, related to any decline in the market value of the assets held by the

trust, as well as amounts outstanding upon maturity or early termination of the collateral financing arrangement.

At December 31, 2007, the Company held assets in trust of $2.3 billion associated with this transaction. The Company’s consolidated

balance sheet includes these assets as fixed maturity securities. The Company’s consolidated statement of income includes the

investment returns on the assets held as collateral as net investment income and the interest on the collateral financing arrangement

is included as a component of other expenses.

Transaction costs associated with the collateral financing arrangement of $5 million have been capitalized, are included in other assets,

and are amortized using the effective interest method over the period from the issuance of the collateral financing arrangement to its

expiration. Total interest expense was $84 million for the year ended December 31, 2007.

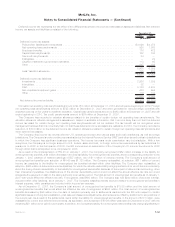

Associated with RGA

In June 2006, Timberlake Financial L.L.C., (“Timberlake Financial”), a subsidiary of RGA, completed an offering of $850 million of

Series A Floating Rate Insured Notes due June 2036 in a private placement. Interest on the notes accrues at an annual rate of 1-month

LIBOR plus 29 basis points payable monthly. The payment of interest and principal on the notes is insured through a financial guaranty

insurance policy with a third party. The notes represent senior, secured indebtedness of Timberlake Financial with no recourse to RGA or its

other subsidiaries. Up to $150 million of additional notes may be offered in the future. In order to make payments of principal and interest on

the notes, Timberlake Financial will rely upon the receipt of interest and principal payments on surplus note and dividend payments from its

wholly-owned subsidiary, Timberlake Reinsurance Company II (“Timberlake Re”), a South Carolina captive insurance company. The ability

of Timberlake Re to make interest and principal payments on the surplus note and dividend payments to Timberlake Financial is contingent

upon South Carolina regulatory approval and the performance of specified term life insurance policies with guaranteed level premiums

retroceded by RGA’s subsidiary, RGA Reinsurance Company (“RGA Reinsurance”), to Timberlake Re.

Proceeds from the offering of the notes, along with a $113 million direct investment by RGA, collateralize the notes and are not available

to satisfy the general obligations of RGA or the Company. Most of these assets were placed in a trust and provide long-term collateral as

support for statutory reserves required by U.S. Valuation of Life Policies Model Regulation (commonly referred to as Regulation XXX) on

term life insurance policies with guaranteed level premium periods reinsured by RGA Reinsurance. The trust is consolidated by Timberlake

Re which in-turn is consolidated by Timberlake Financial. Timberlake Financial is considered to be a VIE and RGA is considered to be the

primary beneficiary. As such, the results of Timberlake Financial have been consolidated by RGA and ultimately by the Company.

F-48 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)