MetLife 2007 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

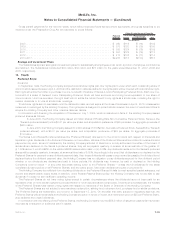

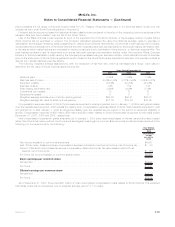

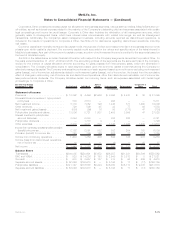

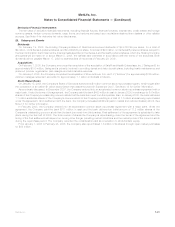

21. Quarterly Results of Operations (Unaudited)

The unaudited quarterly results of operations for 2007 and 2006 are summarized in the table below:

March 31, June 30, September 30, December 31,

Three Months Ended

(In millions, except per share data)

2007

Totalrevenues ............................................. $12,908 $13,216 $13,053 $13,830

Totalexpenses............................................. $11,469 $11,586 $11,668 $12,245

Incomefromcontinuingoperations................................ $ 1,024 $ 1,154 $ 984 $ 1,118

Income (loss) from discontinued operations, net of income tax . . . . . . . . . . . . . . $ (7) $ 9 $ 35 $ —

Netincome ............................................... $ 1,017 $ 1,163 $ 1,019 $ 1,118

Netincomeavailabletocommonshareholders ........................ $ 983 $ 1,129 $ 985 $ 1,083

Basic earnings per share:

Income from continuing operations available to common shareholders . . . . . . . . $ 1.32 $ 1.50 $ 1.28 $ 1.47

Income from discontinued operations, net of income tax, per common share . . . $ (0.01) $ 0.01 $ 0.05 $ —

Netincome.............................................. $ 1.35 $ 1.56 $ 1.37 $ 1.52

Net income available to common shareholders, per common share . . . . . . . . . . $ 1.31 $ 1.52 $ 1.32 $ 1.47

Diluted earnings per share:

Income from continuing operations available to common shareholders . . . . . . . . $ 1.29 $ 1.47 $ 1.25 $ 1.44

Income from discontinued operations, net of income tax, per common share . . . $ (0.01) $ 0.01 $ 0.05 $ —

Netincome.............................................. $ 1.32 $ 1.52 $ 1.34 $ 1.48

Net income available to common shareholders, per common share . . . . . . . . . . $ 1.28 $ 1.48 $ 1.29 $ 1.44

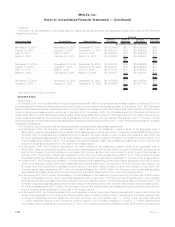

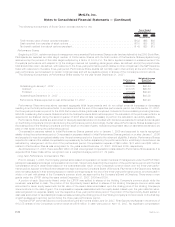

2006

Totalrevenues ............................................. $11,528 $11,350 $12,525 $12,851

Totalexpenses............................................. $10,518 $10,553 $11,212 $11,803

Incomefromcontinuingoperations................................ $ 727 $ 592 $ 958 $ 794

Incomefromdiscontinuedoperations,netofincometax.................. $ 20 $ 58 $ 75 $ 3,069

Netincome ............................................... $ 747 $ 650 $ 1,033 $ 3,863

Netincomeavailabletocommonshareholders ........................ $ 714 $ 617 $ 999 $ 3,829

Basic earnings per share:

Income from continuing operations available to common shareholders . . . . . . . . $ 0.91 $ 0.73 $ 1.21 $ 1.00

Income from discontinued operations, net of income tax, per common share . . . $ 0.03 $ 0.08 $ 0.10 $ 4.03

Netincome.............................................. $ 0.98 $ 0.85 $ 1.35 $ 5.09

Net income available to common shareholders, per common share . . . . . . . . . . $ 0.94 $ 0.81 $ 1.31 $ 5.04

Diluted earnings per share:

Income from continuing operations available to common shareholders . . . . . . . . $ 0.90 $ 0.73 $ 1.19 $ 0.99

Income from discontinued operations, net of income tax, per common share . . . $ 0.03 $ 0.08 $ 0.10 $ 3.98

Netincome.............................................. $ 0.97 $ 0.84 $ 1.34 $ 5.00

Net income available to common shareholders, per common share . . . . . . . . . . $ 0.93 $ 0.80 $ 1.29 $ 4.95

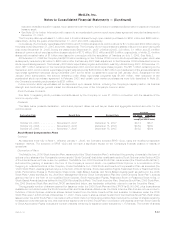

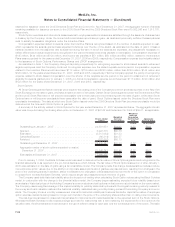

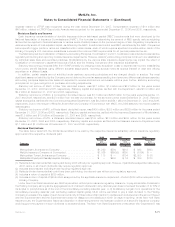

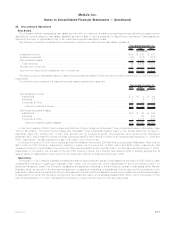

22. Business Segment Information

The Company is a leading provider of insurance and other financial services with operations throughout the United States and the

regions of Latin America, Europe, and Asia Pacific. The Company’s business is divided into five operating segments: Institutional,

Individual, Auto & Home, International and Reinsurance, as well as Corporate & Other. These segments are managed separately because

they either provide different products and services, require different strategies or have different technology requirements.

Institutional offers a broad range of group insurance and retirement & savings products and services, including group life insurance,

non-medical health insurance, such as short and long-term disability, long-term care, and dental insurance, and other insurance products

and services. Individual offers a wide variety of protection and asset accumulation products, including life insurance, annuities and mutual

funds. Auto & Home provides personal lines property and casualty insurance, including private passenger automobile, homeowners and

personal excess liability insurance. International provides life insurance, accident and health insurance, annuities and retirement & savings

products to both individuals and groups. Through the Company’s majority-owned subsidiary, RGA, the Reinsurance segment provides

reinsurance of life and annuity policies in North America and various international markets. Additionally, reinsurance of critical illness

policies is provided in select international markets.

F-74 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)