MetLife 2007 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

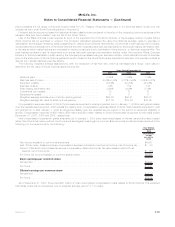

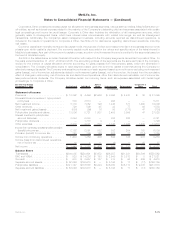

after the sale of SSRM. The following table presents the amounts relatedtooperationsofSSRMthathavebeencombinedwiththe

discontinued real estate operations in the consolidated statements of income:

2007 2006 2005

Years Ended

December 31,

(In millions)

Revenues............................................................... $— $— $ 19

Expenses ............................................................... — — 38

Incomefromdiscontinuedoperationsbeforeprovisionforincometax......................... — — (19)

Provisionforincometax...................................................... — — (5)

Netinvestmentgain,netofincometax ............................................ 14 32 177

Incomefromdiscontinuedoperations,netofincometax................................ $14 $32 $163

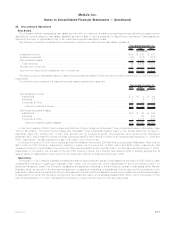

24. Fair Value Information

The estimated fair value of financial instruments have been determined by using available market information and the valuation

methodologies described below. Considerable judgment is often required in interpreting market data to develop estimates of fair value.

Accordingly, the estimates presented herein may not necessarily be indicative of amounts that could be realized in a current market

exchange. The use of different assumptions or valuation methodologies may have a material effect on the estimated fair value amounts.

The implementation of SFAS 157 may impact the fair value assumptions and methodologies associated with the valuation of assets and

liabilities. See also Note 1 regarding the adoption of SFAS 157.

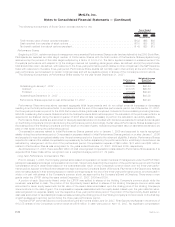

Amounts related to the Company’s financial instruments are as follows:

December 31, 2007

Notional

Amount Carrying

Value Estimated

Fair Value

(In millions)

Assets:

Fixedmaturitysecurities ........................................... $242,242 $242,242

Tradingsecurities................................................ $ 779 $ 779

Equitysecurities................................................. $ 6,050 $ 6,050

Mortgageandconsumerloans ....................................... $ 47,030 $ 47,599

Policyloans ................................................... $ 10,419 $ 10,419

Short-terminvestments............................................ $ 2,648 $ 2,648

Cashandcashequivalents ......................................... $ 10,368 $ 10,368

Accruedinvestmentincome......................................... $ 3,630 $ 3,630

Mortgageloancommitments......................................... $4,035 $ — $ (43)

Commitments to fund bank credit facilities, bridge loans and private corporate bond

investments.................................................. $1,196 $ — $ (59)

Liabilities:

Policyholderaccountbalances ....................................... $115,385 $114,466

Short-termdebt................................................. $ 667 $ 667

Long-termdebt................................................. $ 9,628 $ 9,532

Collateralfinancingarrangements ..................................... $ 5,732 $ 5,365

Juniorsubordinateddebtsecurities.................................... $ 4,474 $ 4,338

Sharessubjecttomandatoryredemption................................. $ 159 $ 178

Payables for collateral under securities loaned and other transactions . . . . . . . . . . . . . . . . . . . $ 44,136 $ 44,136

F-79MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)