MetLife 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

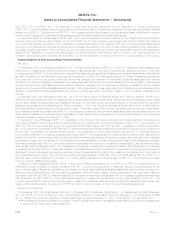

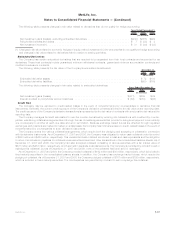

Net Unrealized Investment Gains (Losses)

The components of net unrealized investment gains (losses), included in accumulated other comprehensive income, are as follows:

2007 2006 2005

Years Ended December 31,

(In millions)

Fixedmaturitysecurities ............................................... $3,378 $5,075 $6,132

Equitysecurities .................................................... 157 541 247

Derivatives........................................................ (270) (208) (142)

Minorityinterest..................................................... (150) (159) (171)

Other ........................................................... 3 9 (102)

Subtotal........................................................ 3,118 5,258 5,964

Amounts allocated from:

Insuranceliabilitylossrecognition........................................ (608) (1,149) (1,410)

DACandVOBA ................................................... (327) (189) (79)

Policyholderdividendobligation......................................... (789) (1,062) (1,492)

Subtotal....................................................... (1,724) (2,400) (2,981)

Deferredincometax.................................................. (423) (994) (1,041)

Subtotal........................................................ (2,147) (3,394) (4,022)

Netunrealizedinvestmentgains(losses)..................................... $ 971 $1,864 $1,942

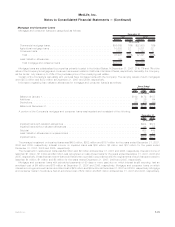

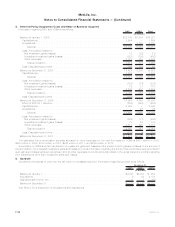

The changes in net unrealized investment gains (losses) are as follows:

2007 2006 2005

Years Ended December 31,

(In millions)

Balance,January1, .................................................. $1,864 $1,942 $2,994

Unrealizedinvestmentgains(losses)duringtheyear ............................. (2,140) (706) (3,372)

Unrealizedinvestmentgainsofsubsidiariesatthedateofsale....................... — — 15

Unrealized investment gains (losses) relating to:

Insuranceliabilitygain(loss)recognition.................................... 541 261 581

DACandVOBA.................................................... (138) (110) 462

Policyholderdividendobligation ......................................... 273 430 627

Deferredincometax................................................. 571 47 635

Balance,December31,................................................ $ 971 $1,864 $1,942

Netchangeinunrealizedinvestmentgains(losses) .............................. $ (893) $ (78) $(1,052)

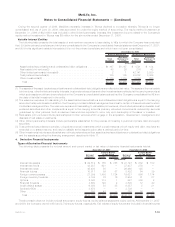

Trading Securities

The Company has a trading securities portfolio to support investment strategies that involve the active and frequent purchase and sale

of securities, the execution of short sale agreements and asset and liability matching strategies for certain insurance products. Trading

securities and short sale agreement liabilities are recorded at fair value with subsequent changes in fair value recognized in net investment

income related to fixed maturity securities.

At December 31, 2007 and 2006, trading securities were $779 million and $759 million, respectively, and liabilities associated with the

short sale agreements in the trading securities portfolio, which were included in other liabilities, were $107 million and $387 million,

respectively. The Company had pledged $407 million and $614 million of its assets, primarily consisting of trading securities, as collateral

to secure the liabilities associated with the short sale agreements in the trading securities portfolio at December 31, 2007 and 2006,

respectively.

During the years ended December 31, 2007, 2006 and 2005, interest and dividends earned on trading securities in addition to the net

realized and unrealized gains (losses) recognized on the trading securities and the related short sale agreement liabilities included within

net investment income totaled $50 million, $71 million and $14 million, respectively. Included within unrealized gains (losses) on such

trading securities and short sale agreement liabilities, are changes in fair value of ($4) million, $26 million and less than $1 million for the

years ended December 31, 2007, 2006 and 2005, respectively.

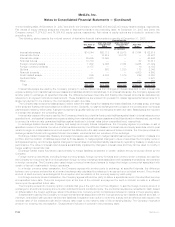

As part of the acquisition of Travelers on July 1, 2005, the Company acquired Travelers’ investment in Tribeca Citigroup Investments

Ltd. (“Tribeca”). Tribeca was a feeder fund investment structure whereby the feeder fund invests substantially all of its assets in the master

fund, Tribeca Global Convertible Instruments Ltd. The primary investment objective of the master fund is to achieve enhanced risk-adjusted

return by investing in domestic and foreign equities and equity-related securities utilizing such strategies as convertible securities arbitrage.

At December 31, 2005, MetLife was the majority owner of the feeder fund and consolidated the fund within its consolidated financial

statements. Net investment income related to the trading activities of Tribeca, which included interest and dividends earned on trading

securities in addition to the net realized and unrealized gains (losses), was $12 million and $6 million for the six months ended June 30,

2006 and the year ended December 31, 2005, respectively.

F-32 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)