MetLife 2007 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

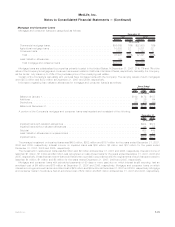

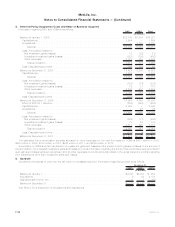

7. Insurance

Insurance Liabilities

Insurance liabilities are as follows:

2007 2006 2007 2006 2007 2006

Future Policy

Benefits Policyholder Account

Balances Other Policyholder

Funds

December 31,

(In millions)

Institutional

Grouplife............................. $ 3,326 $ 3,252 $ 13,997 $ 13,567 $ 2,364 $2,259

Retirement & savings . . . . . . . . . . . . . . . . . . . . . 37,947 37,908 51,585 46,127 213 21

Non-medical health & other . . . . . . . . . . . . . . . . . 10,617 9,540 501 — 597 531

Individual

Traditionallife.......................... 52,493 51,715 1 1 1,479 1,429

Universal variable life . . . . . . . . . . . . . . . . . . . . . 985 894 14,898 14,544 1,572 1,367

Annuities............................. 3,063 3,186 37,807 40,251 76 43

Other ............................... — — 2,410 2,412 1 1

Auto&Home............................ 3,273 3,392 — — 51 61

International ............................ 9,826 8,123 4,961 4,198 1,296 1,223

Reinsurance ............................ 6,159 5,140 6,657 6,212 2,297 1,980

CorporateandOther....................... 4,573 4,339 4,532 4,636 230 224

Total................................ $132,262 $127,489 $137,349 $131,948 $10,176 $9,139

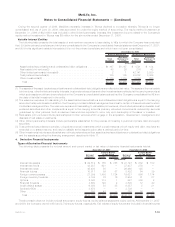

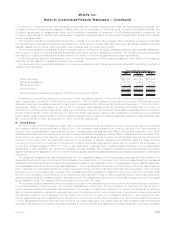

Value of Distribution Agreements and Customer Relationships Acquired

Information regarding the VODA and VOCRA, which are reported in other assets, is as follows:

2007 2006 2005

Years Ended

December 31,

(In millions)

BalanceatJanuary1,...................................................... $708 $715 $ —

Acquisitions ............................................................ 11 — 716

Amortization ............................................................ (16) (6) (1)

Other................................................................. 3 (1) —

BalanceatDecember31, ................................................... $706 $708 $715

The estimated future amortization expense allocated to other expenses for the next five years for VODA and VOCRA is $23 million in

2008, $28 million in 2009, $34 million in 2010, $37 million in 2011 and $42 million in 2012. See Note 2 for a description of acquisitions and

dispositions.

Sales Inducements

Information regarding deferred sales inducements, which are reported in other assets, is as follows:

2007 2006 2005

Years Ended

December 31,

(In millions)

BalanceatJanuary1,...................................................... $578 $414 $294

Capitalization ........................................................... 181 194 140

Amortization ............................................................ (82) (30) (20)

BalanceatDecember31, ................................................... $677 $578 $414

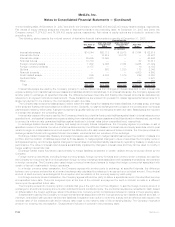

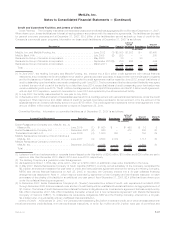

Separate Accounts

Separate account assets and liabilities include two categories of account types: pass-through separate accounts totaling $141.8 billion

and $127.9 billion at December 31, 2007 and 2006, respectively, for which the policyholder assumes all investment risk, and separate

accounts with a minimum return or account value for which the Company contractually guarantees either a minimum return or account

value to the policyholder which totaled $18.4 billion and $16.5 billion at December 31, 2007 and 2006, respectively. The latter category

consisted primarily of Met Managed GICs and participating close-out contracts. The average interest rate credited on these contracts was

4.73% and 4.63% at December 31, 2007 and 2006, respectively.

Fees charged to the separate accounts by the Company (including mortality charges, policy administration fees and surrender charges)

are reflected in the Company’s revenues as universal life and investment-type product policy fees and totaled $2.8 billion, $2.4 billion and

$1.7 billion for the years ended December 31, 2007, 2006 and 2005, respectively.

F-39MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)