MetLife 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

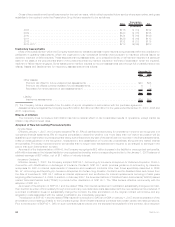

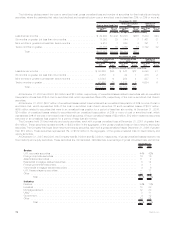

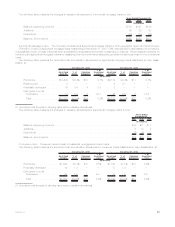

The following tables present the cost or amortized cost, gross unrealized loss and number of securities for fixed maturity and equity

securities, where the estimated fair value had declined and remained below cost or amortized cost by less than 20%, or 20% or more at:

Less than

20% 20% or

more Less than

20% 20% or

more Less than

20% 20% or

more

Cost or Amortized Cost Gross Unrealized

Loss Number of

Securities

December 31, 2007

(In millions, except number of securities)

Lessthansixmonths ................................... $ 49,463 $1,943 $1,670 $555 6,339 644

Sixmonthsorgreaterbutlessthanninemonths.................. 17,353 23 844 7 1,461 31

Ninemonthsorgreaterbutlessthantwelvemonths ............... 9,410 7 568 2 791 1

Twelvemonthsorgreater................................. 31,731 50 1,262 13 3,192 32

Total ........................................ $107,957 $2,023 $4,344 $577

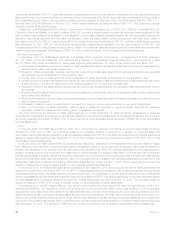

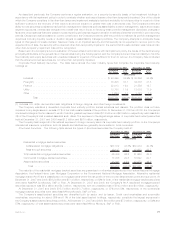

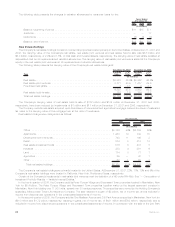

Less than

20% 20% or

more Less than

20% 20% or

more Less than

20% 20% or

more

Cost or Amortized

Cost Gross Unrealized

Loss Number of

Securities

December 31, 2006

(In millions, except number of securities)

Lessthansixmonths .................................. $ 52,222 $35 $ 547 $12 9,093 81

Sixmonthsorgreaterbutlessthanninemonths................. 2,682 3 42 1 415 2

Ninemonthsorgreaterbutlessthantwelvemonths .............. 12,049 14 204 4 937 1

Twelvemonthsorgreater................................ 47,462 29 1,511 7 4,634 6

Total........................................ $114,415 $81 $2,304 $24

At December 31, 2007 and 2006, $4.3 billion and $2.3 billion, respectively, of unrealized losses related to securities with an unrealized

loss position of less than 20% of cost or amortized cost, which represented 4% and 2%, respectively, of the cost or amortized cost of such

securities.

At December 31, 2007, $577 million of unrealized losses related to securities with an unrealized loss position of 20% or more of cost or

amortized cost, which represented 29% of the cost or amortized cost of such securities. Of such unrealized losses of $577 million,

$555 million related to securities that were in an unrealized loss position for a period of less than six months. At December 31, 2006,

$24 million of unrealized losses related to securities with an unrealized loss position of 20% or more of cost or amortized cost, which

represented 30% of the cost or amortized cost of such securities. Of such unrealized losses of $24 million, $12 million related to securities

that were in an unrealized loss position for a period of less than six months.

The Company held 30 fixed maturity and equity securities, each with a gross unrealized loss at December 31, 2007 of greater than

$10 million. These securities represented 9%, or $459 million in the aggregate, of the gross unrealized loss on fixed maturity and equity

securities. The Company held eight fixed maturity and equity securities, each with a gross unrealized loss at December 31, 2006 of greater

than $10 million. These securities represented 7%, or $169 million in the aggregate, of the gross unrealized loss on fixed maturity and

equity securities.

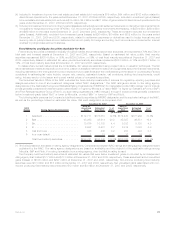

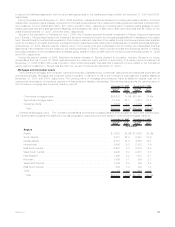

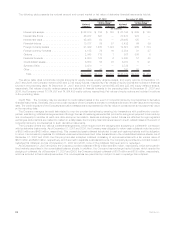

At December 31, 2007 and 2006, the Company had $4.9 billion and $2.3 billion, respectively, of gross unrealized losses related to its

fixed maturity and equity securities. These securities are concentrated, calculated as a percentage of gross unrealized loss, as follows:

2007 2006

December 31,

Sector:

U.S.corporatesecurities ..................................................... 44% 42%

Foreigncorporatesecurities ................................................... 16 16

Asset-backedsecurities...................................................... 11 2

Residentialmortgage-backedsecurities............................................ 8 14

Foreigngovernmentsecurities.................................................. 4 1

Commercialmortgage-backedsecurities ........................................... 4 6

U.S.Treasury/agencysecurities................................................. — 11

Other.................................................................. 13 8

Total............................................................. 100% 100%

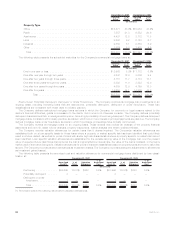

Industry:

Finance................................................................. 34% 10%

Industrial................................................................ 18 23

Mortgage-backed.......................................................... 12 20

Utility .................................................................. 8 11

Government.............................................................. 4 12

Other.................................................................. 24 24

Total............................................................. 100% 100%

76 MetLife, Inc.