MetLife 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Acquisition costs are generally expensed as incurred; restructuring costs associated with a business combination are generally

expensed as incurred subsequent to the acquisition date.

• The fair value of the purchase price, including the issuance of equity securities, is determined on the acquisition date.

• Certain acquired contingent liabilities are recorded at fair value at the acquisition date and subsequently measured at either the higher

of such amount or the amount determined under existing guidance for non-acquired contingencies.

• Changes in deferred tax asset valuation allowances and income tax uncertainties after the acquisition date generally affect income

tax expense.

• Noncontrolling interests (formerly known as “minority interests”) are valued at fair value at the acquisition date and are presented as

equity rather than liabilities.

• When control is attained on previously noncontrolling interests, the previously held equity interests are remeasured at fair value and a

gain or loss is recognized.

• Purchases or sales of equity interests that do not result in a change in control are accounted for as equity transactions.

• When control is lost in a partial disposition, realized gains or losses are recorded on equity ownership sold and the remaining

ownership interest is remeasured and holding gains or losses are recognized.

The pronouncements are effective for fiscal years beginning on or after December 15, 2008 and apply prospectively to business

combinations. Presentation and disclosure requirements related to noncontrolling interests must be retrospectively applied. The Company

is currently evaluating the impact of SFAS 141(r) on its accounting for future acquisitions and the impact of SFAS 160 on its consolidated

financial statements.

Other

In February 2008, the FASB issued FSP No. FAS 140-3, Accounting for Transfers of Financial Assets and Repurchase Financing

Transactions (“FSP 140-3”). FSP 140-3 provides guidance for evaluating whether to account for a transfer of a financial asset and

repurchase financing as a single transaction or as two separate transactions. FSP 140-3 is effective prospectively for financial statements

issued for fiscal years beginning after November 15, 2008. The Company is currently evaluating the impact of FSP FAS 140-3 on its

consolidated financial statements.

In January 2008, the FASB cleared SFAS 133 Implementation Issue E23, Clarification of the Application of the Shortcut Method (“Issue

E23”). Issue E23 amends SFAS 133 by permitting interest rate swaps to have a non-zero fair value at inception, as long as the difference

between the transaction price (zero) and the fair value (exit price), as defined by SFAS 157, is solely attributable to a bid-ask spread. In

addition, entities would not be precluded from assuming no ineffectiveness in a hedging relationship of interest rate risk involving an

interest bearing asset or liability in situations where the hedged item is not recognized for accounting purposes until settlement date as long

as the period between trade date and settlement date of the hedged item is consistent with generally established conventions in the

marketplace. Issue E23 is effective for hedging relationships designated on or after January 1, 2008. The Company does not expect the

adoption of Issue E23 to have a material impact on its consolidated financial statements.

In December 2007, the FASB ratified as final the consensus on EITF Issue No. 07-6, Accounting for the Sale of Real Estate When the

Agreement Includes a Buy-Sell Clause (“EITF 07-6”). EITF 07-6 addresses whether the existence of a buy-sell arrangement would preclude

partial sales treatment when real estate is sold to a jointly owned entity. The consensus concludes that the existence of a buy-sell clause

does not necessarily preclude partial sale treatment under current guidance. EITF 07-6 applies prospectively to new arrangements entered

into and assessments on existing transactions performed in fiscal years beginning after December 15, 2008. The Company does not

expect the adoption of EITF 07-6 to have a material impact on its consolidated financial statements.

In November 2007, the SEC issued SAB No. 109, Written Loan Commitments Recorded at Fair Value through Earnings (“SAB 109”),

which amends SAB No. 105, Application of Accounting Principles to Loan Commitments. SAB 109 provides guidance on (i) incorporating

expected net future cash flows when related to the associated servicing of a loan when measuring fair value; and (ii) broadening the SEC

staff’s view that internally-developed intangible assets should not be recorded as part of the fair value of a derivative loan commitment or to

written loan commitments that are accounted for at fair value through earnings. Internally-developed intangible assets are not considered a

component of the related instruments. SAB 109 is effective for derivative loan commitments issued or modified in fiscal quarters beginning

after December 15, 2007. The adoption of SAB 109 will not have an impact on the Company’s consolidated financial statements.

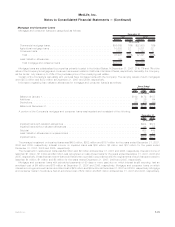

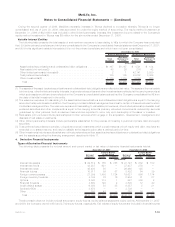

2. Acquisitions and Dispositions

Travelers

On July 1, 2005, the Company completed the acquisition of Travelers for $12.1 billion. The results of Travelers’ operations were

included in the Company’s financial statements beginning July 1, 2005. As a result of the acquisition, management of the Company

increased significantly the size and scale of the Company’s core insurance and annuity products and expanded the Company’s presence in

both the retirement & savings’ domestic and international markets. The distribution agreements executed with Citigroup as part of the

acquisition provide the Company with one of the broadest distribution networks in the industry.

The initial consideration paid in 2005 by the Company for the acquisition consisted of $10.9 billion in cash and 22,436,617 shares of

the Company’s common stock with a market value of $1.0 billion to Citigroup and $100 million in other transaction costs. The Company

revised the purchase price as a result of the finalization by both parties of their review of the June 30, 2005 financial statements and final

resolution as to the interpretation of the provisions of the acquisition agreement which resulted in a payment of additional consideration of

$115 million by the Company to Citigroup in 2006. In addition to cash on-hand, the purchase price was financed through the issuance of

common stock as described previously, debt securities as described in Note 10, common equity units as described in Note 13 and

preferred stock as described in Note 18.

The acquisition was accounted for using the purchase method of accounting, which requires that the assets and liabilities of Travelers

be measured at their fair values. The net fair value of assets acquired and liabilities assumed totaled $7.8 billion, resulting in goodwill of

F-23MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)