MetLife 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

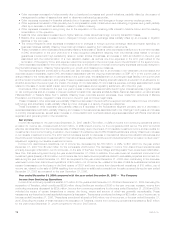

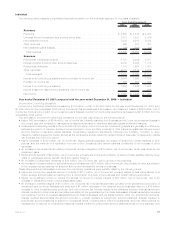

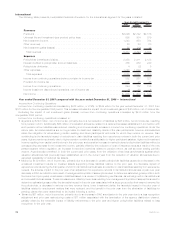

Individual

The following table presents consolidated financial information for the Individual segment for the years indicated:

2007 2006 2005

Years Ended December 31,

(In millions)

Revenues

Premiums................................................... $ 4,496 $ 4,516 $ 4,485

Universallifeandinvestment-typeproductpolicyfees...................... 3,513 3,201 2,476

Netinvestmentincome.......................................... 7,052 6,912 6,534

Otherrevenues............................................... 599 527 477

Netinvestmentgains(losses)...................................... (99) (598) (50)

Totalrevenues .............................................. 15,561 14,558 13,922

Expenses

Policyholderbenefitsandclaims.................................... 5,721 5,409 5,417

Interestcreditedtopolicyholderaccountbalances ........................ 2,030 2,035 1,775

Policyholderdividends .......................................... 1,718 1,697 1,670

Otherexpenses............................................... 4,031 3,519 3,264

Totalexpenses.............................................. 13,500 12,660 12,126

Incomefromcontinuingoperationsbeforeprovisionforincometax.............. 2,061 1,898 1,796

Provisionforincometax ......................................... 705 652 594

Incomefromcontinuingoperations .................................. 1,356 1,246 1,202

Income(loss)fromdiscontinuedoperations,netofincometax................. 1 18 296

Netincome.................................................. $ 1,357 $ 1,264 $ 1,498

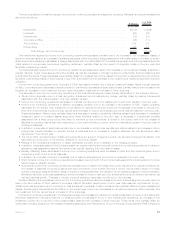

Year ended December 31, 2007 compared with the year ended December 31, 2006 — Individual

Income from Continuing Operations

Income from continuing operations increased by $110 million, or 9%, to $1,356 million for the year ended December 31, 2007 from

$1,246 million for the comparable 2006 period. Included in this increase was a decrease in net investment losses of $324 million, net of

income tax. Excluding the impact of net investment gains (losses), income from continuing operations decreased by $214 million from the

comparable 2006 period.

Thedecreaseinincomefromcontinuingoperationsfortheyearwasdrivenbythefollowingitems:

• Higher DAC amortization of $204 million, net of income tax, primarily resulting from business growth, lower net investment losses in

the current year and revisions to management’s assumptions used to determine estimated gross profits and margins.

• Unfavorable underwriting results in life products of $134 million, net of income tax. Underwriting results are generally the difference

between the portion of premium and fee income intended to cover mortality, morbidity or other insurance costs less claims incurred

and the change in insurance-related liabilities. Underwriting results are significantly influenced by mortality, morbidity, or other

insurance-related experience trends, as well as the reinsurance activity related to certain blocks of business. Consequently, results

can fluctuate from period to period.

• Higher expenses of $129 million, net of income tax. Higher general expenses, the impact of revisions to certain liabilities in both

periods, and the write-off of a receivable from one of the Company’s joint venture partners contributed to the increase in other

expenses.

• An increase in the closed block-related policyholder dividend obligation of $75 million, net of income tax, which was driven by net

investment gains.

• Higher annuity benefits of $24 million, net of income tax, primarily due to higher amortization of deferred costs, partially offset by lower

costs of guaranteed annuity benefit riders and related hedging.

• An increase in policyholder dividends of $14 million, net of income tax, due to growth in the business.

• An increase in interest credited to policyholder account balances of $13 million, net of income tax, due primarily to lower amortization

of the excess interest reserves on acquired annuity and universal life blocks of business.

These aforementioned decreases in income from continuing operations were partially offset by the following items:

• Higher fee income from separate account products of $271 million, net of income tax, primarily related to fees being earned on a

higher average account balance resulting from a combination of growth in the business and overall market performance.

• Higher net investment income on blocks of business not driven by interest margins of $85 million, net of income tax, due to an

increase in yields and growth in the average asset base.

• An increase in interest margins of $18 million, net of income tax. Interest margins relate primarily to the general account portion of

investment-type products. Management attributed a $1 million decrease to the deferred annuity business offset by a $19 million

increase to other investment-type products, both net of income tax. Interest margin is the difference between interest earned and

interest credited to policyholder account balances related to the general account on these businesses. Interest earned approximates

net investment income on invested assets attributed to these businesses with net adjustments for other non-policyholder elements.

Interest credited approximates the amount recorded in interest credited to policyholder account balances. Interest credited to

policyholder account balances is subject to contractual terms, including some minimum guarantees, and may reflect actions by

management to respond to competitive pressures. Interest credited to policyholder account balances tends to move gradually over

27MetLife, Inc.