MetLife 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

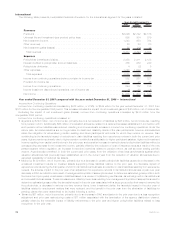

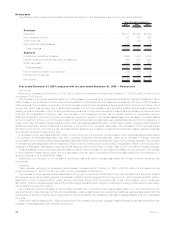

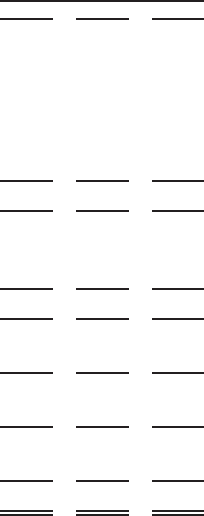

Corporate & Other

The following table presents consolidated financial information for Corporate & Other for the years indicated:

2007 2006 2005

Years Ended December 31,

(In millions)

Revenues

Premiums ..................................................... $ 35 $ 35 $ 22

Universallifeandinvestment-typeproductpolicyfees......................... — — 1

Netinvestmentincome............................................. 1,460 1,046 699

Otherrevenues.................................................. 63 34 30

Netinvestmentgains(losses) ........................................ 47 (154) (48)

Totalrevenues................................................. 1,605 961 704

Expenses

Policyholderbenefitsandclaims....................................... 47 37 (15)

Otherexpenses ................................................. 1,400 1,349 955

Totalexpenses ................................................ 1,447 1,386 940

Income (loss) from continuing operations before provision (benefit) for income tax. . . . . . . 158 (425) (236)

Incometaxbenefit................................................ (114) (419) (215)

Income(loss)fromcontinuingoperations................................. 272 (6) (21)

Incomefromdiscontinuedoperations,netofincometax....................... 35 3,134 1,167

Netincome.................................................... 307 3,128 1,146

Preferredstockdividends........................................... 137 134 63

Netincomeavailabletocommonshareholders ............................. $ 170 $2,994 $1,083

Year ended December 31, 2007 compared with the year ended December 31, 2006 — Corporate & Other

Income from Continuing Operations

Income from continuing operations increased by $278 million, to a gain of $272 million for the year ended December 31, 2007 from a

loss of $6 million for the comparable 2006 period. Included in this increase were lower net investment losses of $132 million, net of income

tax, resulting in a net investment gain. Excluding the impact of net investment gains (losses), income from continuing operations increased

by $146 million.

The increase in income from continuing operations was primarily attributable to higher net investment income, lower corporate

expenses, higher other revenues, integration costs incurred in the prior year, and lower legal cost of $269 million, $56 million, $19 million,

$17 million, and $7 million, respectively, each of which were net of income tax. This was partially offset by higher interest expense on debt,

higher interest on tax contingencies, and higher interest credited to bankholder deposits of $86 million, $23 million, and $3 million

respectively, each of which were net of income tax. Tax benefits decreased by $103 million over the comparable 2006 period due to the

Company’s implementation of FIN 48, the difference of finalizing the Company’s 2006 tax return in 2007 when compared to finalizing the

Company’s 2005 tax return in 2006 and the difference between the actual and the estimated tax rate allocated to the various segments.

Revenues

Total revenues, excluding net investment gains (losses), increased by $443 million, or 40%, to $1,558 million for the year ended

December 31, 2007 from $1,115 million for the comparable 2006 period. This increase was primarily due to increased net investment

income of $414 million, mainly on fixed maturity securities, driven by a higher asset base related to the reinvestment of proceeds from the

sale of the Peter Cooper Village and Stuyvesant Town properties during the fourth quarter of 2006 and the investment of proceeds from

issuances of junior subordinated debt in December 2006 and December 2007 and collateral financing arrangements to support statutory

reserves in May 2007 and December 2007. Net investment income also increased on other limited partnerships, real estate and real estate

joint ventures, and mortgage loans. Other revenues increased by $29 million primarily related to the resolution of an indemnification claim

associated with the 2000 acquisition of GALIC, offset by an adjustment of surrender values on corporate-owned life insurance policies.

Also included as a component of total revenues was the elimination of intersegment amounts which was offset within total expenses.

Expenses

Total expenses increased by $61 million, or 4%, to $1,447 million for the year ended December 31, 2007 from $1,386 million for the

comparable 2006 period. Interest expense was higher by $133 million due to the issuances of junior subordinated debt in December 2006

and December 2007 and collateral financing arrangements in May 2007 and December 2007, respectively, and from settlement fees on

the prepayment of shares subject to mandatory redemption in October 2007, partially offset by the maturity of senior notes in December

2006 and the reduction of commercial paper outstanding. Interest on tax contingencies was higher by $35 million as a result of an increase

in published Internal Revenue Service (“IRS”) interest rates and a change in the method of estimating interest expense on tax contingencies

associated with the Company’s implementation of FIN 48. As a result of higher interest rates, interest credited on bank deposits increased

by $5 million at MetLife Bank. Corporate expenses are lower by $86 million primarily due to lower corporate support expenses of

$63 million, which included advertising, start-up costs for new products and information technology costs, and lower costs from

reductions of MetLife Foundation contributions of $23 million. Integration costs incurred in 2006 period were $25 million. Legal costs

werelowerby$11millionprimarilyduetoareductioninthecurrentyear of $35 million of legal liabilities resulting from the settlement of

41MetLife, Inc.