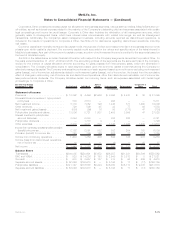

MetLife 2007 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

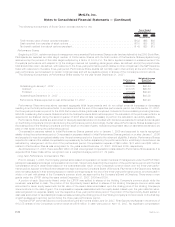

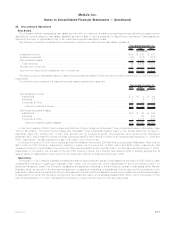

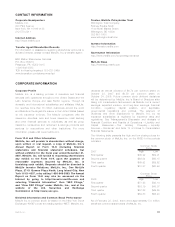

December 31, 2006

Notional

Amount Carrying

Value Estimated

Fair Value

(In millions)

Assets:

Fixedmaturitysecurities ........................................... $241,928 $241,928

Tradingsecurities................................................ $ 759 $ 759

Equitysecurities................................................. $ 5,094 $ 5,094

Mortgageandconsumerloans ....................................... $ 42,239 $ 42,451

Policyloans ................................................... $ 10,228 $ 10,228

Short-terminvestments............................................ $ 2,709 $ 2,709

Cashandcashequivalents ......................................... $ 7,107 $ 7,107

Accruedinvestmentincome......................................... $ 3,347 $ 3,347

Mortgageloancommitments......................................... $4,022 $ — $ 4

Commitments to fund bank credit facilities, bridge loans and private corporate bond

investments.................................................. $1,908 $ — $ —

Liabilities:

Policyholderaccountbalances ....................................... $112,438 $108,318

Short-termdebt................................................. $ 1,449 $ 1,449

Long-termdebt................................................. $ 9,129 $ 9,299

Collateralfinancingarrangements ..................................... $ 850 $ 850

Juniorsubordinateddebtsecurities.................................... $ 3,780 $ 3,759

Sharessubjecttomandatoryredemption................................. $ 278 $ 357

Payables for collateral under securities loaned and other transactions. . . . . . . . . . . . . . . . . . . . . $ 45,846 $ 45,846

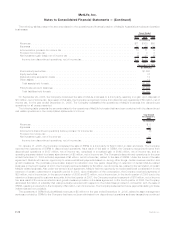

The methods and assumptions used to estimate the fair value of financial instruments are summarized as follows:

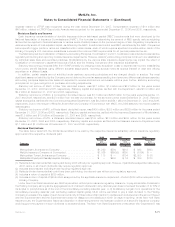

Fixed Maturity Securities, Trading Securities and Equity Securities

The fair values of publicly held fixed maturity securities and publicly held equity securities are based on quoted market prices or

estimates from independent pricing services. However, in cases where quoted market prices are not available, such as for private fixed

maturity securities, fair values are estimated using present value or valuation techniques. The determination of fair values is based on:

(i) valuation methodologies; (ii) securities the Company deems to be comparable; and (iii) assumptions deemed appropriate given the

circumstances. The fair value estimates based on available market information and judgments about financial instruments, including

estimates of the timing and amounts of expected future cash flows and the credit standing of the issuer or counterparty. Factors

considered in estimating fair value include; coupon rate, maturity, estimated duration, call provisions, sinking fund requirements, credit

rating, industry sector of the issuer, and quoted market prices of comparable securities.

Mortgage and Consumer Loans, Mortgage Loan Commitments and Commitments to Fund Bank Credit Facilities,

Bridge Loans, and Private Corporate Bond Investments

Fair values for mortgage and consumer loans are estimated by discounting expected future cash flows, using current interest rates for

similar loans with similar credit risk. For mortgage loan commitments and commitments to fund bank credit facilities, bridge loans, and

private corporate bond investments the estimated fair value is the net premium or discount of the commitments.

Policy Loans

The carrying values for policy loans approximate fair value.

Cash and Cash Equivalents and Short-term Investments

The carrying values for cash and cash equivalents and short-term investments approximate fair values due to the short-term maturities

of these instruments.

Accrued Investment Income

The carrying value for accrued investment income approximates fair value.

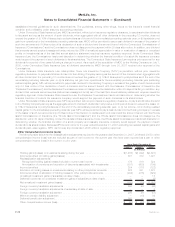

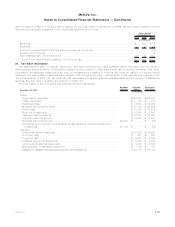

Policyholder Account Balances

The fair value of policyholder account balances which have final contractual maturities are estimated by discounting expected future

cash flows based upon interest rates currently being offered for similar contracts with maturities consistent with those remaining for the

agreements being valued. The fair value of policyholder account balances without final contractual maturities are assumed to equal their

current net surrender value.

Short-term and Long-term Debt, Collateral Financing Arrangements, Junior Subordinated Debt Securities and Shares

Subject to Mandatory Redemption

The fair values of short-term and long-term debt, collateral financing arrangements, junior subordinated debt securities,and shares

subject to mandatory redemption are determined by discounting expected future cash flows using risk rates currently available for debt with

similar terms and remaining maturities.

Payables for Collateral Under Securities Loaned and Other Transactions

The carrying value for payables for collateral under securities loaned and other transactions approximate fair value.

F-80 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)