MetLife 2007 Annual Report Download - page 26

Download and view the complete annual report

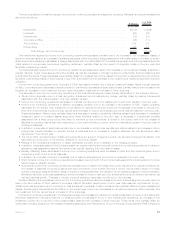

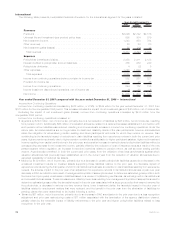

Please find page 26 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Auto & Home segment contributed to the year over year increase primarily due to expenditures related to information technology,

advertising and compensation costs.

Partially offsetting the increases in other expenses was a decrease in the Individual segment. This decrease was primarily due to lower

DAC amortization, partially offset by higher general spending in the current year, despite higher corporate incentives. In addition, the impact

of revisions to certain expenses, premium tax, policyholder liabilities and pension and postretirement liabilities, in both periods, increased

other expenses in the current year period.

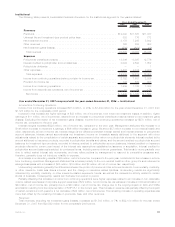

Net Income

Income tax expense for the year ended December 31, 2006 was $1,097 million, or 26% of income from continuing operations before

provision for income tax, compared with $1,222 million, or 28%, of such income, for the comparable 2005 period. Excluding the impact of

the acquisition of Travelers, which contributed $118 million during the first six months of 2006, income tax expense was $979 million, or

26%, of income from continuing operations before provision for income tax, compared with $1,222 million, or 28%, of such income, for the

comparable 2005 period. The 2006 and 2005 effective tax rates differ from the corporate tax rate of 35% primarily due to the impact of non-

taxable investment income and tax credits for investments in low income housing. The 2006 effective tax rate also includes an adjustment

of a benefit of $33 million consisting primarily of a revision in the estimate of income tax for 2005, and the 2005 effective tax rate also

includes a tax benefit of $27 million related to the repatriation of foreign earnings pursuant to Internal Revenue Code Section 965 for which

a U.S. deferred tax provision had previously been recorded and an adjustment of a benefit of $31 million consisting primarily of a revision in

theestimateofincometaxfor2004.

Income from discontinued operations consisted of net investment income and net investment gains related to real estate properties that

the Company had classified as available-for-sale or had sold and, for the years ended December 31, 2006 and 2005, the operations and

gain upon disposal from the sale of SSRM on January 31, 2005 and for the year ended December 31, 2005, the operations of MetLife

Indonesia which was sold on September 29, 2005. Income from discontinued operations, net of income tax, increased by $1,579 million,

or 96%, to $3,222 million for the year ended December 31, 2006 from $1,643 million for the comparable 2005 period. This increase is

primarily due to a gain of $3 billion, net of income tax, on the sale of the Peter Cooper Village and Stuyvesant Town properties in Manhattan,

New York, as well as a gain of $32 million, net of income tax, related to the sale of SSRM during the year ended December 31, 2006. This

increase was partially offset by gains during the year ended December 31, 2005 including $1,193 million, net of income tax, on the sales of

the One Madison Avenue and 200 Park Avenue properties in Manhattan, New York, as well as gains on the sales of SSRM and MetLife

Indonesia of $177 million and $10 million, respectively, both net of income tax. In addition, there was lower net investment income and net

investment gains from discontinued operations related to real estate properties sold or held-for-sale during the year ended December 31,

2006 compared to the year ended December 31, 2005.

Dividends on the Holding Company’s Preferred Shares issued in connection with financing the acquisition of Travelers increased by

$71 million, to $134 million for the year ended December 31, 2006, from $63 million for the comparable 2005 period, as the preferred

stock was issued in June 2005.

22 MetLife, Inc.