MetLife 2007 Annual Report Download - page 91

Download and view the complete annual report

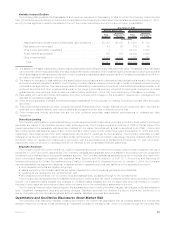

Please find page 91 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Each of MetLife’s business segments has an asset/liability officer who works with portfolio managers in the investment department to

monitor investment, product pricing, hedge strategy and liability management issues. MetLife establishes target asset portfolios for each

major insurance product, which represent the investment strategies used to profitably fund its liabilities within acceptable levels of risk.

These strategies are monitored through regular review of portfolio metrics, such as effective duration, yield curve sensitivity, convexity,

liquidity, asset sector concentration and credit quality.

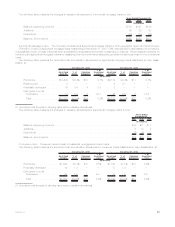

To manage interest rate risk, the Company performs periodic projections of asset and liability cash flows to evaluate the potential

sensitivity of its investments and liabilities to interest rate movements. These projections involve evaluating the potential gain or loss on

most of the Company’s in-force business under various increasing and decreasing interest rate environments. Department regulations

require that MetLife perform some of these analyses annually as part of MetLife’s review of the sufficiency of its regulatory reserves. For

several of its legal entities, the Company maintains segmented operating and surplus asset portfolios for the purpose of asset/liability

management and the allocation of investment income to product lines. For each segment, invested assets greater than or equal to the

GAAP liabilities less the DAC asset and any non-invested assets allocated to the segment are maintained, with any excess swept to the

surplus segment. The operating segments may reflect differences in legal entity, statutory line of business and any product market

characteristic which may drive a distinct investment strategy with respect to duration, liquidity or credit quality of the invested assets.

Certain smaller entities make use of unsegmented general accounts for which the investment strategy reflects the aggregate charac-

teristics of liabilities in those entities. The Company measures relative sensitivities of the value of its assets and liabilities to changes in key

assumptions utilizing Company models. These models reflect specific product characteristics and include assumptions based on current

and anticipated experience regarding lapse, mortality and interest crediting rates. In addition, these models include asset cash flow

projections reflecting interest payments, sinking fund payments, principal payments, bond calls, mortgage prepayments and defaults.

Common industry metrics, such as duration and convexity, are also used to measure the relative sensitivity of assets and liability values

to changes in interest rates. In computing the duration of liabilities, consideration is given to all policyholder guarantees and to how the

Company intends to set indeterminate policy elements such as interest credits or dividends. Each asset portfolio has a duration constraint

based on the liability duration and the investment objectives of that portfolio. Where a liability cash flow may exceed the maturity of available

assets, as is the case with certain retirement and non-medical health products, the Company may support such liabilities with equity

investments or curve mismatch strategies.

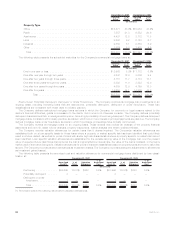

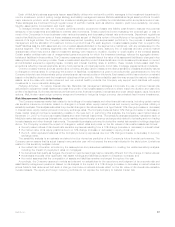

Hedging Activities. To reduce interest rate risk, MetLife’s risk management strategies incorporate the use of various interest rate

derivatives to adjust the overall duration and cash flow profile of its invested asset portfolios to better match the duration and cash flow

profile of its liabilities. Such instruments include financial futures, financial forwards, interest rate and credit default swaps, caps, floors and

options. MetLife also uses foreign currency swaps and forwards to hedge its foreign currency denominated fixed income investments.

Risk Measurement: Sensitivity Analysis

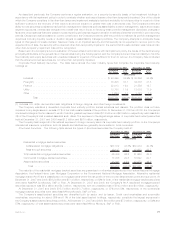

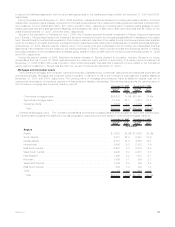

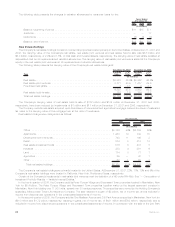

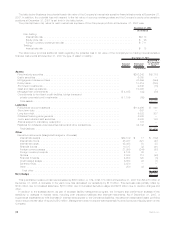

The Company measures market risk related to its holdings of invested assets and other financial instruments, including certain market

risk sensitive insurance contracts, based on changes in interest rates, equity market prices and currency exchange rates, utilizing a

sensitivity analysis. This analysis estimates the potential changes in fair value based on a hypothetical 10% change (increase or decrease)

in interest rates, equity market prices and currency exchange rates. The Company believes that a 10% change (increase or decrease) in

these market rates and prices is reasonably possible in the near-term. In performing this analysis, the Company used market rates at

December 31, 2007 to re-price its invested assets and other financial instruments. The sensitivity analysis separately calculated each of

MetLife’s market risk exposures (interest rate, equity market price and foreign currency exchange rate) related to its trading and non-trading

invested assets and other financial instruments. The sensitivity analysis performed included the market risk sensitive holdings described

above. The Company modeled the impact of changes in market rates and prices on the fair values of its invested assets as follows:

• the net present values of its interest rate sensitive exposures resulting from a 10% change (increase or decrease) in interest rates;

• the market value of its equity positions due to a 10% change (increase or decrease) in equity prices; and

• the U.S. dollar equivalent balances of the Company’s currency exposures due to a 10% change (increase or decrease) in currency

exchange rates.

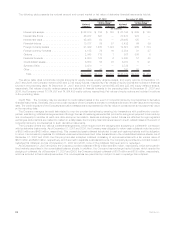

The sensitivity analysis is an estimate and should not be viewed as predictive of the Company’s future financial performance. The

Company cannot assure that its actual losses in any particular year will not exceed the amounts indicated in the table below. Limitations

related to this sensitivity analysis include:

• the market risk information is limited by the assumptions and parameters established in creating the related sensitivity analysis,

including the impact of prepayment rates on mortgages;

• for derivatives that qualify as hedges, the impact on reported earnings may be materially different from the change in market values;

• the analysis excludes other significant real estate holdings and liabilities pursuant to insurance contracts; and

• the model assumes that the composition of assets and liabilities remains unchanged throughout the year.

Accordingly, the Company uses such models as tools and not substitutes for the experience and judgment of its corporate risk and

asset/liability management personnel. Based on its analysis of the impact of a 10% change (increase or decrease) in market rates and

prices, MetLife has determined that such a change could have a material adverse effect on the fair value of its interest rate sensitive

invested assets. The equity and foreign currency portfolios do not expose the Company to material market risk.

87MetLife, Inc.