MetLife 2007 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

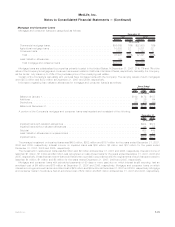

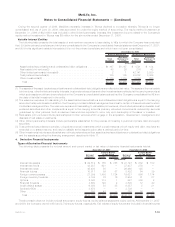

The amortized cost and estimated fair value of fixed maturity securities, by contractual maturity date (excluding scheduled sinking

funds), are as follows:

Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value

2007 2006

December 31,

(In millions)

Dueinoneyearorless.................................... $ 4,537 $ 4,628 $ 6,923 $ 7,011

Due after one year through five years . . . . . . . . . . . . . . . . . . . . . . . . . . 42,453 43,167 45,331 45,928

Due after five years through ten years . . . . . . . . . . . . . . . . . . . . . . . . . . 40,783 41,046 39,571 40,200

Dueaftertenyears ...................................... 65,496 68,143 63,023 66,728

Subtotal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 153,269 156,984 154,848 159,867

Mortgage-backed and asset-backed securities . . . . . . . . . . . . . . . . . . . . 85,492 85,258 81,920 82,061

Totalfixedmaturitysecurities .............................. $238,761 $242,242 $236,768 $241,928

Fixed maturity securities not due at a single maturity date have been included in the above table in the year of final contractual maturity.

Actual maturities may differ from contractual maturities due to the exercise of prepayment options.

Sales or disposals of fixed maturity and equity securities classified as available-for-sale are as follows:

2007 2006 2005

Years Ended December 31,

(In millions)

Proceeds....................................................... $80,685 $89,869 $127,709

Grossinvestmentgains ............................................. $ 831 $ 580 $ 704

Grossinvestmentlosses............................................. $(1,183) $(1,533) $ (1,391)

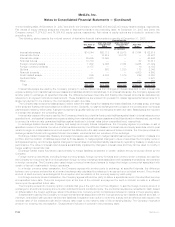

Unrealized Loss for Fixed Maturity and Equity Securities Available-for-Sale

The following tables present the estimated fair value and gross unrealized loss of the Company’s fixed maturity (aggregated by sector)

and equity securities in an unrealized loss position, aggregated by length of time that the securities have been in a continuous unrealized

loss position at:

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Less than 12 months Equal to or Greater than

12 months Total

December 31, 2007

(In millions, except number of securities)

U.S.corporatesecurities......................... $29,237 $1,431 $12,119 $ 743 $ 41,356 $2,174

Residential mortgage-backed securities . . . . . . . . . . . . . . . . 14,404 279 6,195 110 20,599 389

Foreign corporate securities . . . . . . . . . . . . . . . . . . . . . . . 11,189 484 6,321 310 17,510 794

U.S.Treasury/agencysecurities..................... 432 3 625 10 1,057 13

Commercial mortgage-backed securities . . . . . . . . . . . . . . . 2,518 102 3,797 97 6,315 199

Foreigngovernmentsecurities...................... 3,593 161 515 27 4,108 188

Asset-backedsecurities.......................... 7,627 442 1,271 107 8,898 549

State and political subdivision securities . . . . . . . . . . . . . . . 1,334 81 476 34 1,810 115

Otherfixedmaturitysecurities...................... 91 30 1 — 92 30

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . $70,425 $3,013 $31,320 $1,438 $101,745 $4,451

Equitysecurities............................... $ 2,771 $ 398 $ 543 $ 72 $ 3,314 $ 470

Total number of securities in an unrealized loss position . . . . . 8,395 3,063

F-26 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)