MetLife 2007 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

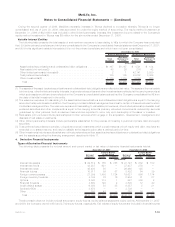

Secondary

Guarantees Paid-Up

Guarantees Secondary

Guarantees Paid-Up

Guarantees

2007 2006

December 31,

(In millions)

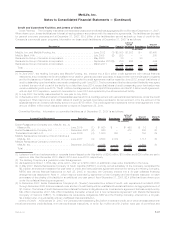

Universal and Variable Life Contracts(1)

Accountvalue(generalandseparateaccount).................... $ 9,347 $ 4,302 $ 8,357 $ 4,468

Net amount at risk(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $141,840(3) $ 33,855(3) $131,808(3) $ 36,447(3)

Averageattainedageofpolicyholders ......................... 49years 55years 49years 54years

(1) The Company’s annuity and life contracts with guarantees may offer more than one type of guarantee in each contract. Therefore, the

amounts listed above may not be mutually exclusive.

(2) The net amount at risk is based on the direct amount at risk (excluding reinsurance).

(3) The net amount at risk for guarantees of amounts in the event of death is defined as the current guaranteed minimum death benefit in

excess of the current account balance at the balance sheet date.

(4) The net amount at risk for guarantees of amounts at annuitization is defined as the present value of the minimum guaranteed annuity

payments available to the contractholder determined in accordance with the terms of the contract in excess of the current account

balance.

(5) The net amount at risk for two tier annuities is based on the excess of the upper tier, adjusted for a profit margin, less the lower tier.

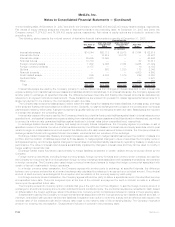

Information regarding the liabilities for guarantees (excluding base policy liabilities) relating to annuity and universal and variable life

contracts is as follows:

Guaranteed

Death

Benefits

Guaranteed

Annuitization

Benefits Secondary

Guarantees

Paid

Up

Guarantees Total

Annuity Contracts Universal and Variable

Life Contracts

(In millions)

Balance at January 1, 2005 . . . . . . . . . . . . . . . . . . . . . . . . . $24 $19 $ 6 $29 $ 78

Incurredguaranteedbenefits......................... 22 10 10 10 52

Paidguaranteedbenefits........................... (5) — (1) — (6)

Balance at December 31, 2005 . . . . . . . . . . . . . . . . . . . . . . . 41 29 15 39 124

Incurredguaranteedbenefits......................... 17 7 29 1 54

Paidguaranteedbenefits........................... (6) — — — (6)

Balance at December 31, 2006 . . . . . . . . . . . . . . . . . . . . . . . 52 36 44 40 172

Incurredguaranteedbenefits......................... 28 38 53 6 125

Paidguaranteedbenefits........................... (8) — — — (8)

Balance at December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . $72 $74 $97 $46 $289

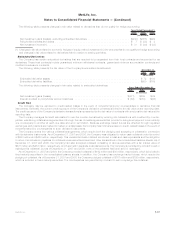

Account balances of contracts with insurance guarantees are invested in separate account asset classes as follows:

2007 2006

December 31,

(In millions)

Mutual Fund Groupings

Equity................................................................ $69,477 $70,187

Bond ................................................................ 6,284 6,139

Balanced.............................................................. 15,977 4,403

MoneyMarket........................................................... 1,775 1,302

Specialty.............................................................. 870 1,088

Total ............................................................... $94,383 $83,119

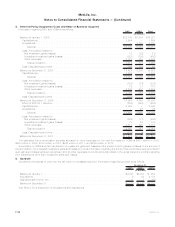

8. Reinsurance

The Company’s life insurance operations participate in reinsurance activities in order to limit losses, minimize exposure to large risks,

and provide additional capacity for future growth. The Company has historically reinsured the mortality risk on new individual life insurance

policies primarily on an excess of retention basis or a quota share basis. Until 2005, the Company reinsured up to 90% of the mortality risk

for all new individual life insurance policies that it wrote through its various franchises. This practice was initiated by the different franchises

for different products starting at various points in time between 1992 and 2000. During 2005, the Company changed its retention practices

for certain individual life insurance. Amounts reinsured in prior years remain reinsured under the original reinsurance; however, under the

new retention guidelines, the Company reinsures up to 90% of the mortality risk in excess of $1 million for most new individual life insurance

policies that it writes through its various franchises and for certain individual life policies the retention limits remained unchanged. On a

case by case basis, the Company may retain up to $20 million per life and reinsure 100% of amounts in excess of the Company’s retention

limits. The Company evaluates its reinsurance programs routinely and may increase or decrease its retention at any time. In addition, the

Company reinsures a significant portion of the mortality risk on its individual universal life policies issued since 1983. Placement of

reinsuranceisdoneprimarilyonanautomaticbasisandalsoonafacultative basis for risks with specific characteristics.

F-42 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)