MetLife 2007 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

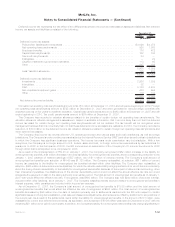

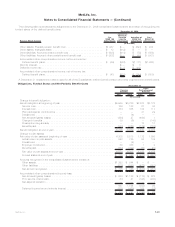

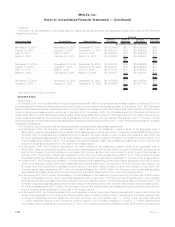

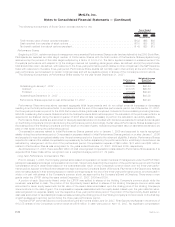

The following table summarizes the adjustments to the December 31, 2006 consolidated balance sheet as a result of recognizing the

funded status of the defined benefit plans:

Balance Sheet Caption

Pre

SFAS 158

Adjustments

Additional

Minimum

Pension

Liability

Adjustment

Adoption of

SFAS 158

Adjustment

Post

SFAS 158

Adjustments

December 31, 2006

(In millions)

Otherassets:Prepaidpensionbenefitcost....................... $1,937 $— $ (993) $ 944

Otherassets:Intangibleasset ............................... $ 12 $(12) $ — $ —

Otherliabilities:Accruedpensionbenefitcost ..................... $ (505) $(14) $ (79) $ (598)

Other liabilities: Accrued other postretirement benefit cost . . . . . . . . . . . . . $ (802) $ — $ (99) $ (901)

Accumulated other comprehensive income, before income tax:

Definedbenefitplans.................................... $ (66) $(26) $(1,171) $(1,263)

Minorityinterest......................................... $— $ 8

Deferredincometax...................................... $ 8 $ 419

Accumulated other comprehensive income, net of income tax:

Definedbenefitplans.................................... $ (41) $(18) $ (744) $ (803)

A December 31 measurement date is used for all of the Subsidiaries’ defined benefit pension and other postretirement benefit plans.

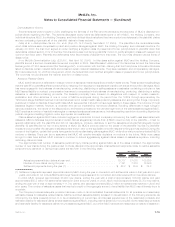

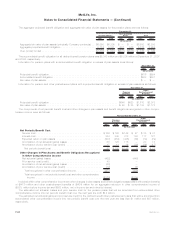

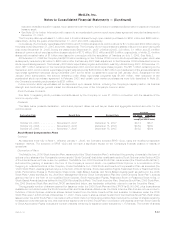

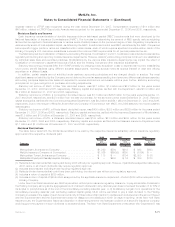

Obligations, Funded Status and Net Periodic Benefit Costs

2007 2006 2007 2006

Pension

Benefits

Other

Postretirement

Benefits

December 31,

(In millions)

Change in benefit obligation:

Benefitobligationatbeginningofyear................................. $5,959 $5,766 $2,073 $2,176

Servicecost................................................ 166 163 27 35

Interestcost................................................ 354 335 104 117

Planparticipants’contributions.................................... — — 31 29

Divestitures ................................................ — (4) — —

Netactuarial(gains)losses ...................................... (390) 27 (464) 1

Changeinbenefits............................................ 39 (6) — (143)

Prescriptiondrugsubsidy ....................................... — — 13 10

Benefitspaid................................................ (353) (322) (174) (152)

Benefitobligationatendofyear..................................... 5,775 5,959 1,610 2,073

Change in plan assets:

Fairvalueofplanassetsatbeginningofyear ............................ 6,305 5,518 1,172 1,093

Actualreturnonplanassets...................................... 548 725 58 104

Divestitures ................................................ — (4) — —

Employercontribution.......................................... 50 388 1 2

Benefitspaid................................................ (353) (322) (48) (27)

Fairvalueofplanassetsatendofyear............................... 6,550 6,305 1,183 1,172

Fundedstatusatendofyear ..................................... $ 775 $ 346 $ (427) $ (901)

Amounts recognized in the consolidated balance sheet consist of:

Otherassets................................................ $1,393 $ 944 $ — $ —

Otherliabilities .............................................. (618) (598) (427) (901)

Netamountrecognized......................................... $ 775 $ 346 $ (427) $ (901)

Accumulated other comprehensive (income) loss:

Netactuarial(gains)losses ...................................... $ 623 $1,123 $ (112) $ 328

Priorservicecost(credit)........................................ 64 41 (193) (230)

Netassetattransition.......................................... — — — 1

687 1,164 (305) 99

Deferredincometaxandminorityinterest ............................. (251) (423) 109 (37)

$ 436 $ 741 $ (196) $ 62

F-61MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)