MetLife 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

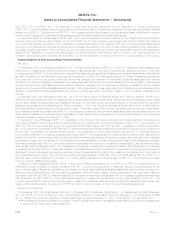

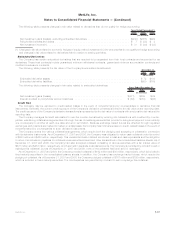

Real Estate Holdings

Real estate holdings consisted of the following:

2007 2006

December 31,

(In millions)

Realestate............................................................... $4,914 $4,326

Accumulateddepreciation..................................................... (1,088) (1,001)

Netrealestate............................................................. 3,826 3,325

Realestatejointventures...................................................... 2,771 1,477

Realestateandrealestatejointventures.......................................... 6,597 4,802

Realestateheld-for-sale...................................................... 172 184

Totalrealestateholdings .................................................... $6,769 $4,986

Related depreciation expense on real estate was $130 million, $131 million and $135 million for the years ended December 31, 2007,

2006 and 2005, respectively. These amounts include $13 million, $37 million and $62 million of depreciation expense related to

discontinued operations for the years ended December 31, 2007, 2006 and 2005, respectively.

There were no impairments recognized on real estate held-for-sale for the year ended December 31, 2007. Impairment losses

recognized on real estate held-for-sale were $8 million and $5 million for the years ended December 31, 2006 and 2005, respectively. The

carrying value of non-income producing real estate was $12 million and $8 million at December 31, 2007 and 2006, respectively. The

Company owned real estate acquired in satisfaction of debt of $3 million at both December 31, 2007 and 2006.

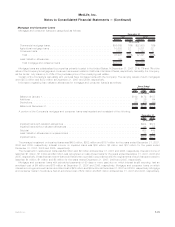

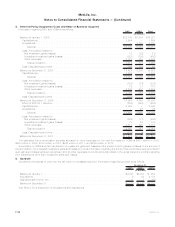

Real estate holdings were categorized as follows:

Amount Percent Amount Percent

2007 2006

December 31,

(In millions)

Office...................................................... $3,126 46% $2,709 55%

Apartments .................................................. 1,264 19 739 15

Developmentjointventures ........................................ 743 11 169 3

Retail ...................................................... 574 8 513 10

Realestateinvestmentfunds....................................... 516 8 401 8

Industrial.................................................... 283 4 291 6

Land....................................................... 174 3 71 1

Agriculture................................................... 29 — 32 1

Other ...................................................... 60 1 61 1

Totalrealestateholdings ........................................ $6,769 100% $4,986 100%

The Company’s real estate holdings are primarily located in the United States. At December 31, 2007, 22%, 11%, 10% and 9% of the

Company’s real estate holdings were located in California, New York, Florida and Texas, respectively.

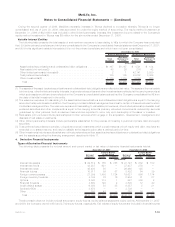

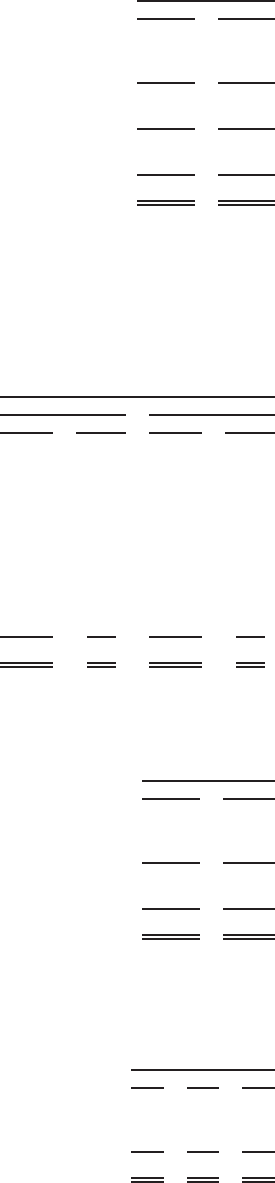

Leveraged Leases

Investment in leveraged leases, included in other invested assets, consisted of the following:

2007 2006

December 31,

(In millions)

Rentalreceivables,net........................................................ $1,491 $1,055

Estimatedresidualvalues...................................................... 1,881 887

Subtotal................................................................ 3,372 1,942

Unearnedincome........................................................... (1,313) (694)

Investmentinleveragedleases................................................. $2,059 $1,248

The Company’s deferred income tax liability related to leveraged leases was $1.0 billion and $670 million at December 31, 2007 and

2006, respectively. The rental receivables set forth above are generally due in periodic installments. The payment periods range from one

to 15 years, but in certain circumstances are as long as 30 years.

The components of net income from investment in leveraged leases are as follows:

2007 2006 2005

Years Ended

December 31,

(In millions)

Income from investment in leveraged leases (included in net investment income) . . . . . . . . . . . . . . . . . $ 67 $ 51 $ 54

Less:Incometaxexpenseonleveragedleases....................................... (24) (18) (19)

Netincomefrominvestmentinleveragedleases...................................... $43 $33 $35

F-30 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)