MetLife 2007 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other Limited Partnership Interests

The carrying value of other limited partnership interests (which primarily represent ownership interests in pooled investment funds that

make private equity investments in companies in the United States and overseas) was $6.2 billion and $4.8 billion at December 31, 2007

and 2006, respectively. Included within other limited partnership interests at December 31, 2007 and 2006 are $1.6 billion and $1.2 billion,

respectively, of hedge funds. For the years ended December 31, 2007, 2006 and 2005, net investment income from other limited

partnership interests included $89 million, $98 million and $24 million respectively, related to hedge funds.

Funds Withheld at Interest

Funds withheld at interest, included in other invested assets, were $4.5 billion and $4.0 billion at December 31, 2007 and 2006,

respectively.

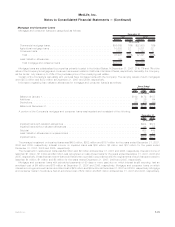

Net Investment Income

The components of net investment income are as follows:

2007 2006 2005

Years Ended December 31,

(In millions)

Fixedmaturitysecurities.............................................. $15,150 $14,049 $11,349

Equitysecurities................................................... 279 122 79

Mortgageandconsumerloans.......................................... 2,863 2,534 2,302

Policyloans...................................................... 637 603 572

Realestateandrealestatejointventures................................... 913 746 510

Otherlimitedpartnershipinterests ....................................... 1,309 945 709

Cash,cashequivalentsandshort-terminvestments............................ 503 519 400

Other.......................................................... 631 530 472

Totalinvestmentincome ............................................ 22,285 20,048 16,393

Less:Investmentexpenses............................................ 3,279 2,966 1,637

Netinvestmentincome ............................................. $19,006 $17,082 $14,756

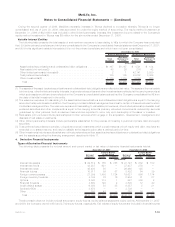

Net Investment Gains (Losses)

The components of net investment gains (losses) are as follows:

2007 2006 2005

Years Ended December 31,

(In millions)

Fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(622) $(1,119) $(868)

Equitysecurities....................................................... 164 84 117

Mortgageandconsumerloans.............................................. 2 (8) 17

Realestateandrealestatejointventures....................................... 44 102 14

Otherlimitedpartnershipinterests ........................................... 16 1 42

Salesofbusinesses .................................................... — — 8

Derivatives........................................................... (414) (201) 391

Other.............................................................. 72 (241) 193

Net investment gains (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(738) $(1,382) $ (86)

The Company periodically disposes of fixed maturity and equity securities at a loss. Generally, such losses are insignificant in amount or

in relation to the cost basis of the investment, are attributable to declines in fair value occurring in the period of the disposition or are as a

result of management’s decision to sell securities based on current conditions or the Company’s need to shift the portfolio to maintain its

portfolio management objectives.

Losses from fixed maturity and equity securities deemed other-than-temporarily impaired, included within net investment gains (losses),

were $106 million, $82 million and $64 million for the years ended December 31, 2007, 2006 and 2005, respectively.

F-31MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)