MetLife 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

For purposes of this discussion, “MetLife” or the “Company” refers to MetLife, Inc., a Delaware corporation incorporated in 1999 (the

“Holding Company”), and its subsidiaries, including Metropolitan Life Insurance Company (“MLIC”). Following this summary is a discussion

addressing the consolidated results of operations and financial condition of the Company for the periods indicated. This discussion should

be read in conjunction with the forward-looking statement information included below, “Risk Factors” contained in MetLife Inc.’s Annual

Report on Form 10-K for the year ended December 31, 2007, “Selected Financial Data” and the Company’s consolidated financial

statements included elsewhere herein.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains statements which constitute

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to

trends in the operations and financial results and the business and the products of MetLife, Inc. and its subsidiaries, as well as other

statements including words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend” and other similar expressions. Forward-

looking statements are made based upon management’s current expectations and beliefs concerning future developments and their

potential effects on the Company. Such forward-looking statements are not guarantees of future performance.

Actual results may differ materially from those included in the forward-looking statements as a result of risks and uncertainties including,

but not limited to, the following: (i) changes in general economic conditions, including the performance of financial markets and interest

rates, which may affect the Company’s ability to raise capital; (ii) heightened competition, including with respect to pricing, entry of new

competitors, the development of new products by new and existing competitors and for personnel; (iii) investment losses and defaults, and

changes to investment valuations; (iv) unanticipated changes in industry trends; (v) catastrophe losses; (vi) ineffectiveness of risk

management policies and procedures; (vii) changes in accounting standards, practices and/or policies; (viii) changes in assumptions

related to deferred policy acquisition costs (“DAC”), value of business acquired (“VOBA”) or goodwill; (ix) discrepancies between actual

claims experience and assumptions used in setting prices for the Company’s products and establishing the liabilities for the Company’s

obligations for future policy benefits and claims; (x) discrepancies between actual experience and assumptions used in establishing

liabilities related to other contingencies or obligations; (xi) adverse results or other consequences from litigation, arbitration or regulatory

investigations; (xii) downgrades in the Company’s and its affiliates’ claims paying ability, financial strength or credit ratings; (xiii) regulatory,

legislative or tax changes that may affect the cost of, or demand for, the Company’s products or services; (xiv) MetLife, Inc.’s primary

reliance, as a holding company, on dividends from its subsidiaries to meet debt payment obligations and the applicable regulatory

restrictions on the ability of the subsidiaries to pay such dividends; (xv) deterioration in the experience of the “closed block” established in

connection with the reorganization of MLIC; (xvi) economic, political, currency and other risks relating to the Company’s international

operations; (xvii) the effects of business disruption or economic contraction due to terrorism or other hostilities; (xviii) the Company’s ability

to identify and consummate on successful terms any future acquisitions, and to successfully integrate acquired businesses with minimal

disruption; and (xix) other risks and uncertainties described from time to time in MetLife’s filings with the U.S. Securities and Exchange

Commission (“SEC”).

The Company specifically disclaims any obligation to update or revise any forward-looking statement, whether as a result of new

information, future developments or otherwise.

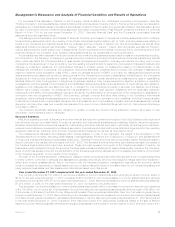

Executive Summary

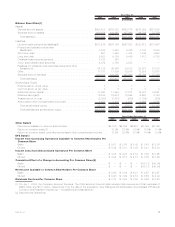

MetLife is a leading provider of insurance and other financial services with operations throughout the United States and the regions of

Latin America, Europe, and Asia Pacific. Through its domestic and international subsidiaries and affiliates, MetLife offers life insurance,

annuities, automobile and homeowners insurance, retail banking and other financial services to individuals, as well as group insurance,

reinsurance and retirement & savings products and services to corporations and other institutions. MetLife is organized into five operating

segments: Institutional, Individual, Auto & Home, International and Reinsurance, as well as Corporate & Other.

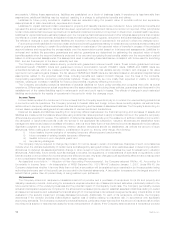

The management’s discussion and analysis which follows isolates, in order to be meaningful, the results of the acquisition of The

Travelers Insurance Company, excluding certain assets, most significantly, Primerica, from Citigroup Inc. (“Citigroup”), and substantially all

of Citigroup’s international insurance businesses (collectively, “Travelers”) in the period over period comparison as the Travelers acquisition

was not included in the results of the Company until July 1, 2005. The Travelers’ amounts which have been isolated represent the results of

the Travelers legal entities which have been acquired. These amounts represent the impact of the Travelers acquisition; however, as

business currently transacted through the acquired Travelers legal entities is transitioned to legal entities already owned by the Company,

some of which has already occurred, the identification of the Travelers legal entity business will not necessarily be indicative of the impact

of the Travelers acquisition on the results of the Company.

As a part of the Travelers acquisition, management realigned certain products and services within several of the Company’s segments

to better conform to the way it manages and assesses its business. Accordingly, all prior period segment results have been adjusted to

reflect such product reclassifications. Also in connection with the Travelers acquisition, management has utilized its economic capital

model to evaluate the deployment of capital based upon the unique and specific nature of the risks inherent in the Company’s existing and

newly acquired businesses and has adjusted such allocations based upon this model.

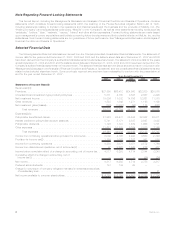

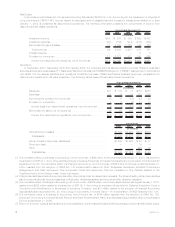

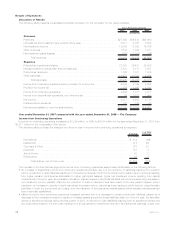

Year ended December 31, 2007 compared with the year ended December 31, 2006

The Company reported $4,180 million in net income available to common shareholders and earnings per diluted common share of

$5.48 for the year ended December 31, 2007 compared to $6,159 million in net income available to common shareholders and earnings

per diluted common share of $7.99 for the year ended December 31, 2006. Net income available to common shareholders decreased by

$1,979 million, or 32%, for the year ended December 31, 2007 compared to the 2006 period.

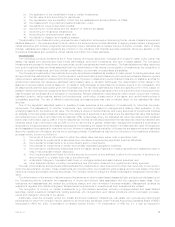

The decrease in net income available to common shareholders was primarily due to a decrease in income from discontinued operations

of $3,185 million, net of income tax. This decrease in income from discontinued operations was principally driven by a gain of $3 billion, net

of income tax, on the sale of the Peter Cooper Village and Stuyvesant Town properties in Manhattan, New York, that was recognized during

the year ended December 31, 2006. Also contributing to the decrease was lower net investment income and net investment gains (losses)

from discontinued operations related to real estate properties sold or held-for-sale during the year ended December 31, 2007 as compared

to the year ended December 31, 2006. In addition, there was lower income from discontinued operations related to the sale of MetLife

Insurance Limited (“MetLife Australia”) annuities and pension businesses to a third party in the third quarter of 2007 and lower income from

5MetLife, Inc.